In-Depth Research: Exploring Liquidity Fragmentation Challenges in the Layer 2 Era

Gate Ventures

Intro

Since Ethereum shifted toward a Layer 2-focused expansion model and with the rise of tools like RaaS, numerous public blockchains have emerged rapidly. Many entities are eager to build their own chains to represent unique interests and pursue higher valuations. However, the proliferation of these blockchains has created a challenge for the ecosystem, which struggles to keep pace, resulting in many projects seeing a price drop immediately after their TGE (Token Generation Event).

Leveraging the OP Stack, Coinbase launched Base, its Layer 2 network,, while Kraken released Ink; OKX utilized ZK technology to introduce XLayer; Sony released Soneium, and LINE introduced Kaia. Today, the financial and technical barriers to creating a blockchain have significantly decreased, with the operational cost for an OP Stack-based chain now averaging about $10,000 per month.

The future will undoubtedly be an era of multi-chain coexistence. Although these Layer 2 chains may adopt EVM compatibility for interoperability, achieving consensus on building applications on a single chain remains challenging, given that many of these chains are backed by Web2 entities with extensive downstream applications.

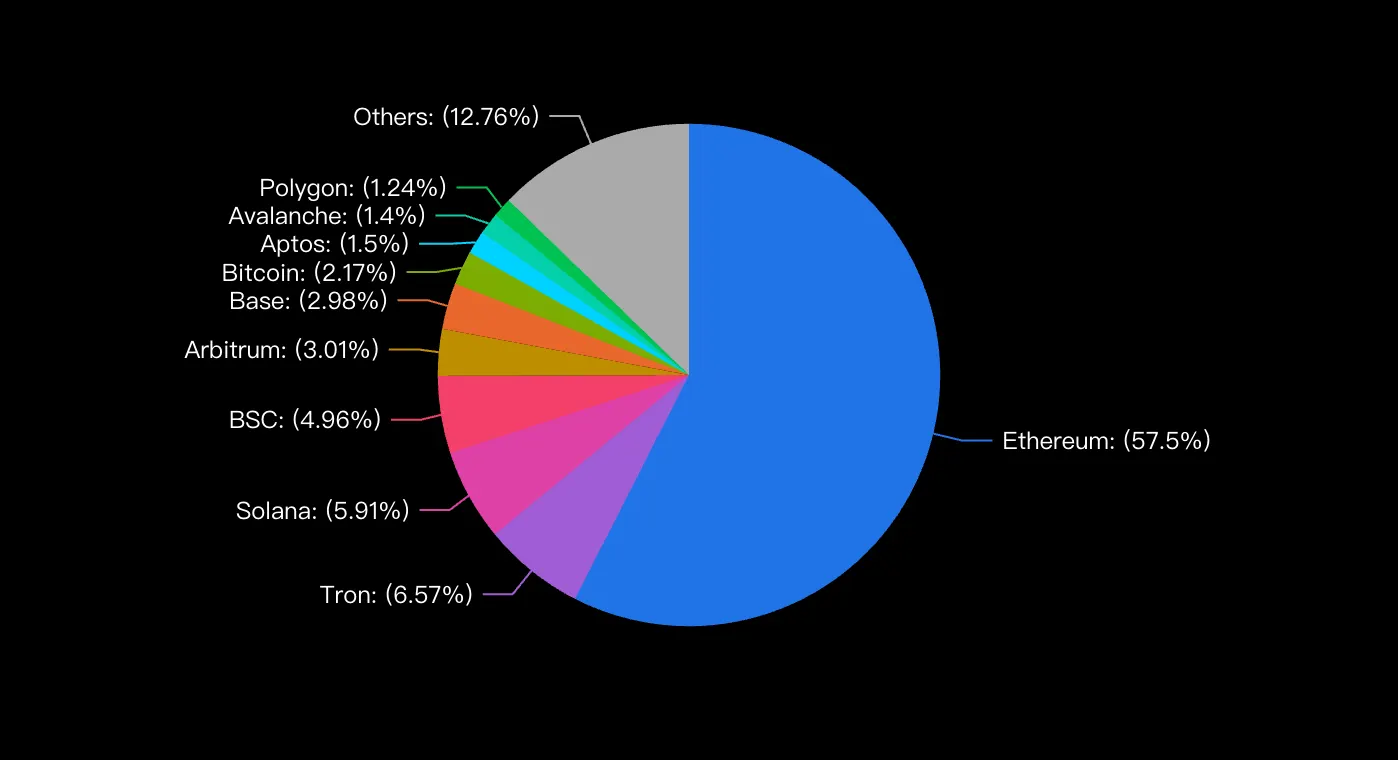

TVL Breakdown, source: Defillama

The current multi-chain landscape has led to a new challenge: liquidity and state fragmentation. Since a multi-chain environment is inevitable, interoperability has become a crucial area to explore and address. While there are numerous liquidity solutions available, such as Chain Abstraction (Particle Network, Socket, XION, INFINIT, Borsa), Intent-Based Protocols (Anoma, Khalani), Clearing Execution (Connext), Native Cross-Chain (Cross), and ZK Sharding (=nil; Foundation), they all fundamentally aim to solve the same core issues.

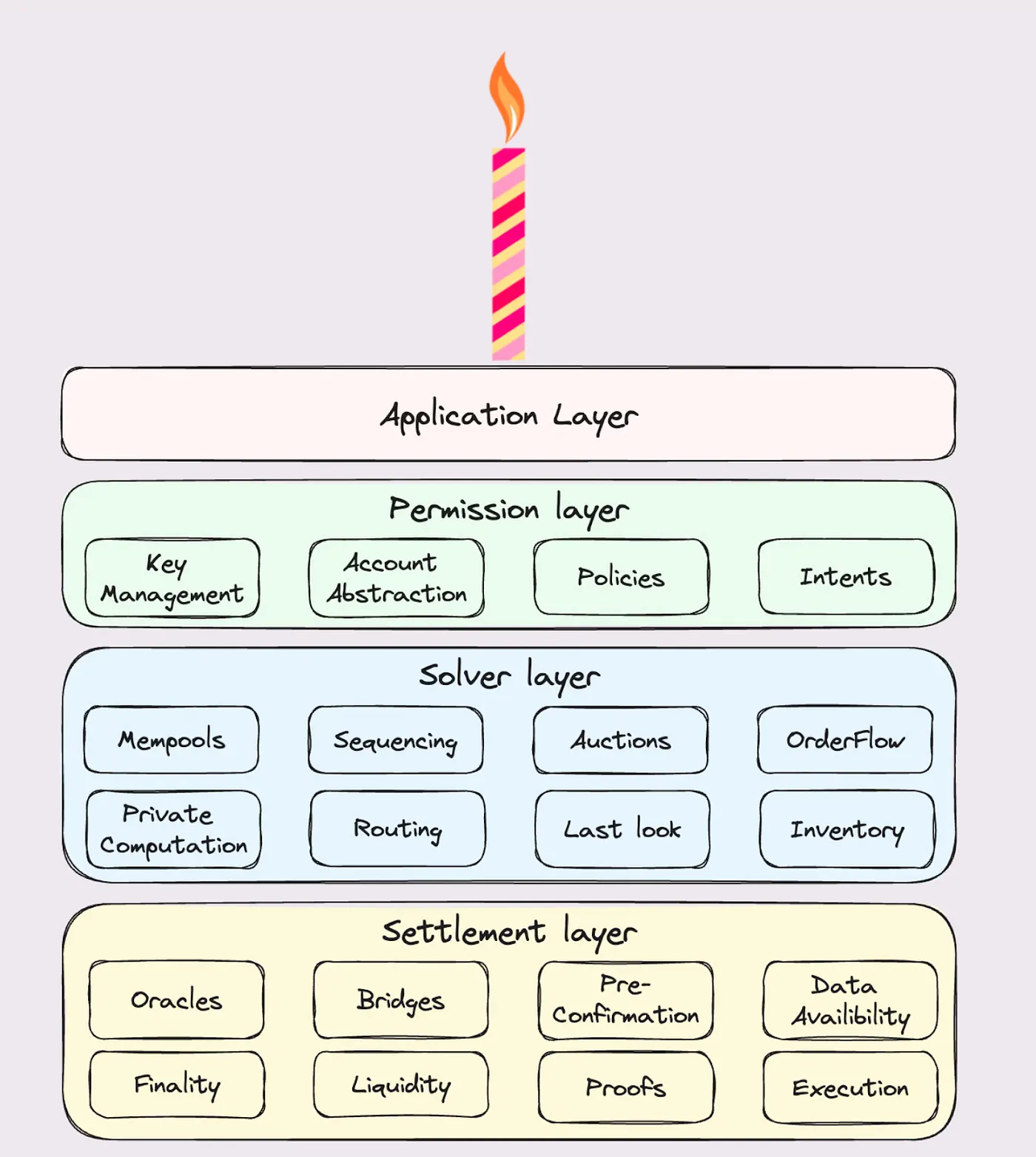

Chain Abstraction Stack, Source: Frontier Research

We use the industry-recognized Cake architecture to introduce the core components of cross-chain abstraction from top to bottom:

Application Layer

This is the layer where users directly interact, and it is the most abstract layer within liquidity solutions as it completely hides the details of liquidity conversion. At the Application Layer, users engage with the front-end interface without necessarily understanding the underlying liquidity conversion mechanisms.

Permission Layer

Located below the Application Layer, this layer allows users to connect their wallets to a dApp and request quotes to fulfill their transaction intentions. Here, “intention” refers to the user’s desired final transaction outcome (i.e., output), rather than the specific execution path the transaction will take.

Key Management and Account Abstraction Layer

Due to the multi-chain environment, a management and abstraction system is needed to handle unique account structures across different chains. For example, the object-centric account system of SUI differs entirely from EVM. OneBalance is a representative project in this area, establishing a trusted account system that does not require cross-chain consensus — only a trustworthy commitment across existing account systems. NEAR’s account model employs multi-chain wallet generation to achieve abstraction in wallet management, significantly enhancing user experience and reducing UX fragmentation. However, liquidity integration mainly focuses on existing public chains.

Solver Layer

This layer is responsible for receiving and executing user transaction intentions, with “Solver” roles competing here to deliver improved user experience, including faster transaction times and execution speed. Intent-based projects like Anoma use this layer to build intent-driven solutions. Derivatives of these intentions, such as Predicate components, can fulfill user intentions within certain rules.

Settlement Layer

This is the middleware layer that the Solver Layer utilizes to fulfill user intentions. Key components in liquidity and state fragmentation solutions include:

Oracle: Used to obtain state information from other chains.

Bridges: Facilitate cross-chain transmission of information and liquidity.

Pre-Confirmation Mechanisms: Shorten cross-chain confirmation times.

Data Availability (DA): Ensures data accessibility.

Additionally, factors like inter-chain liquidity, finality, and Layer 2 proof mechanisms are considered to ensure the efficient operation of the entire multi-chain system.

Solution

Currently, there are several solutions in the market aimed at addressing liquidity fragmentation. After reviewing numerous approaches, we identified the following main methods:

1. RaaS (Rollup-as-a-Service)-Centered Solution

Similar to OP Stack’s Rollup solution, this approach adds specific shared sequencers and cross-chain bridges to help Rollups built on OP Stack share liquidity and state. This method seeks to address liquidity and state fragmentation at a higher level. A more specialized aspect within this approach involves designing standalone shared sequencers, though this is mainly suited for Layer 2 solutions and lacks universal applicability. Examples include Astria, Espresso, and Flashbots.

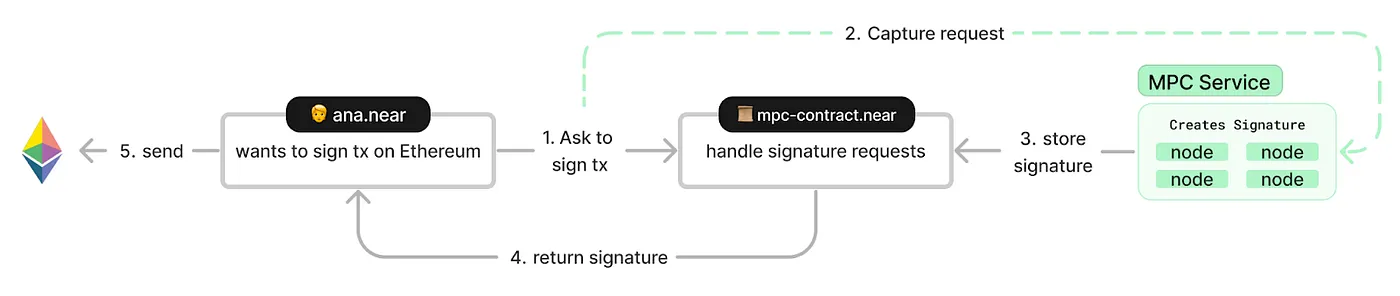

Chain Abstraction, source: NEAR

2. Account-Centric Approach

Similar to NEAR, this method builds a cross-chain account wallet, allowing transactions to be signed and executed across multiple blockchain protocols using a technology called “chain signatures.” The core component is the MPC (Multi-Party Computation) network, which signs multi-chain transactions on behalf of users. While this solution greatly reduces UX fragmentation, it involves complex backend implementations for developers and does not fundamentally resolve liquidity and state fragmentation.

3. Off-Chain Intent Network-Centered Approach

This is the “Solver Network” mentioned in our Cake architecture diagram in the introduction. Here, users send their transaction intents to the Solver Network, where Solvers compete to provide the best quote, optimizing transaction completion time and cost. These Solvers can include AI Agents, CEXs, Market Makers, or even integrated protocols like Liquorice. Projects in this space include Anoma, Khalani, Enso, Aori, and Valantis. While intent-based solutions theoretically support complex cross-chain operations, they require substantial liquidity within the Solver Network for effective execution. Additionally, in cases of off-chain needs, Solvers may pose fraud risks; introducing fraud proofs or similar mechanisms would increase implementation difficulty and raise the operational threshold for running Solvers.

4. On-Chain Liquidity Network-Centered Approach

This method specifically targets cross-chain liquidity optimization without addressing the broader issue of state fragmentation across chains. The core component is the construction of a liquidity layer, on which applications can be built to share liquidity across chains. Examples include Raye Network, INFINIT, Everclear, and Elixir.

5. Application-Centric Approach

This type of application integrates major market makers or third-party applications to build high-liquidity solutions, such as Liquorice, Socket, Radiant Capital, 1inch, and Hedgemony. However, these projects must manage complex cross-chain processes, which demands a high level of expertise from developers, making them susceptible to security risks like hacking incidents.

Solving liquidity challenges is a critical objective, as liquidity often drives everything in the financial world. The potential to build a unified liquidity platform, especially one that consolidates fragmented liquidity across all chains, holds tremendous promise, and we have examined various solutions aiming to address this issue.

In the framework we discussed above, based on the Cake structure, the Settlement Layer represents the most atomic-level solutions. This layer includes essential components like cross-chain mechanisms, oracles, and pre-confirmation schemes. Building upon these atomic solutions, more abstract layers emerge, including the Solver Layer, Permission Layer, and Application Layer. Each solution direction we outlined aligns with these layers, forming an upstream-downstream relationship. However, these solutions are still not atomic, and the complexity of liquidity fragmentation has led to a range of derivative issues, prompting an array of interoperability solutions that ultimately still rely on these foundational components.

Next, we will explore several typical projects centered around the concept of chain abstraction to examine how each one addresses liquidity fragmentation from its unique perspective.

INFINIT

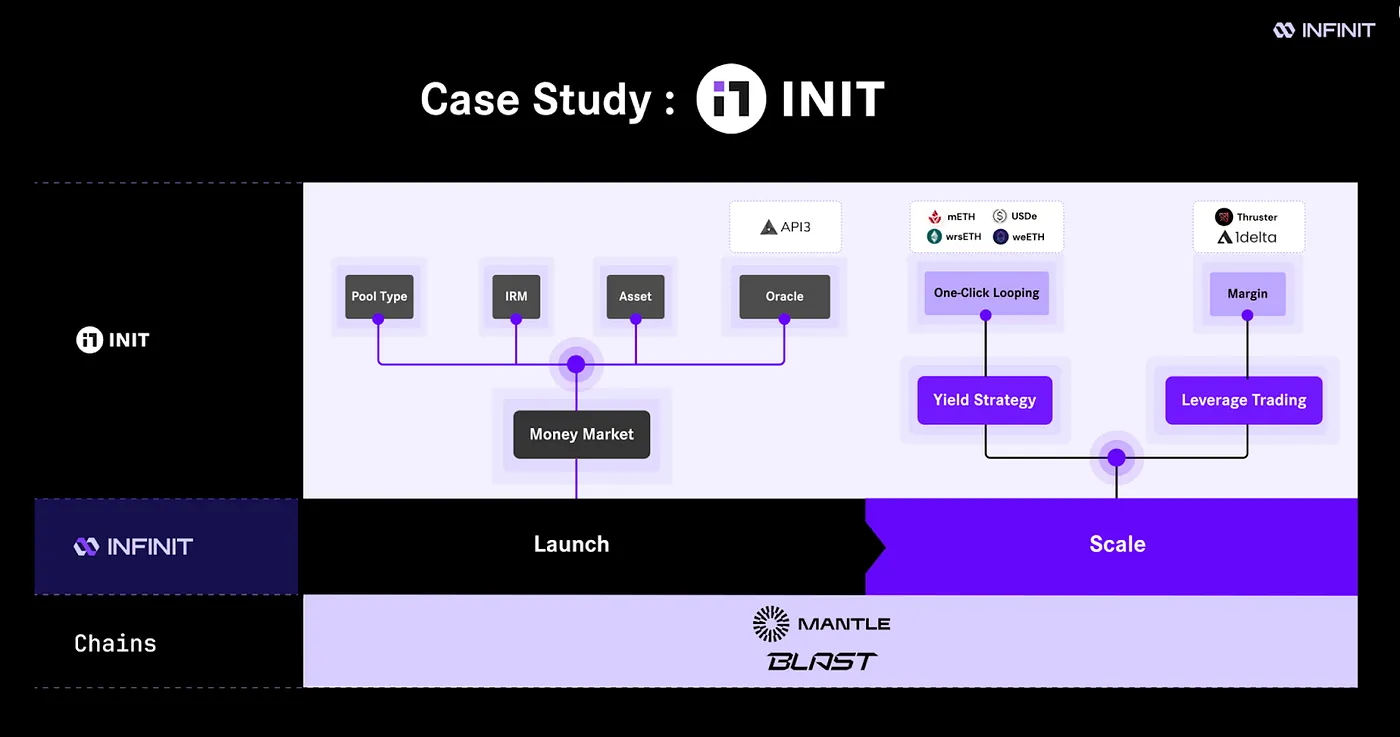

INFINIT Structure, source: Infinit

INFINIT has built a RaaS service in the DeFi sector, which can provide components needed for direct construction of DeFi protocols, such as Oracle, Pool Type, IRM, Asset, etc. It can also offer ready-to-use components like Leverage Trading and Yield Strategy. It’s equivalent to other application building ends but ultimately places liquidity on Infinit’s liquidity layer. However, its underlying working principles have not yet been disclosed. Currently, INFINIT has secured $6 million in seed funding from Robot Ventures, Electric Capital, and Maelstrom Capital.

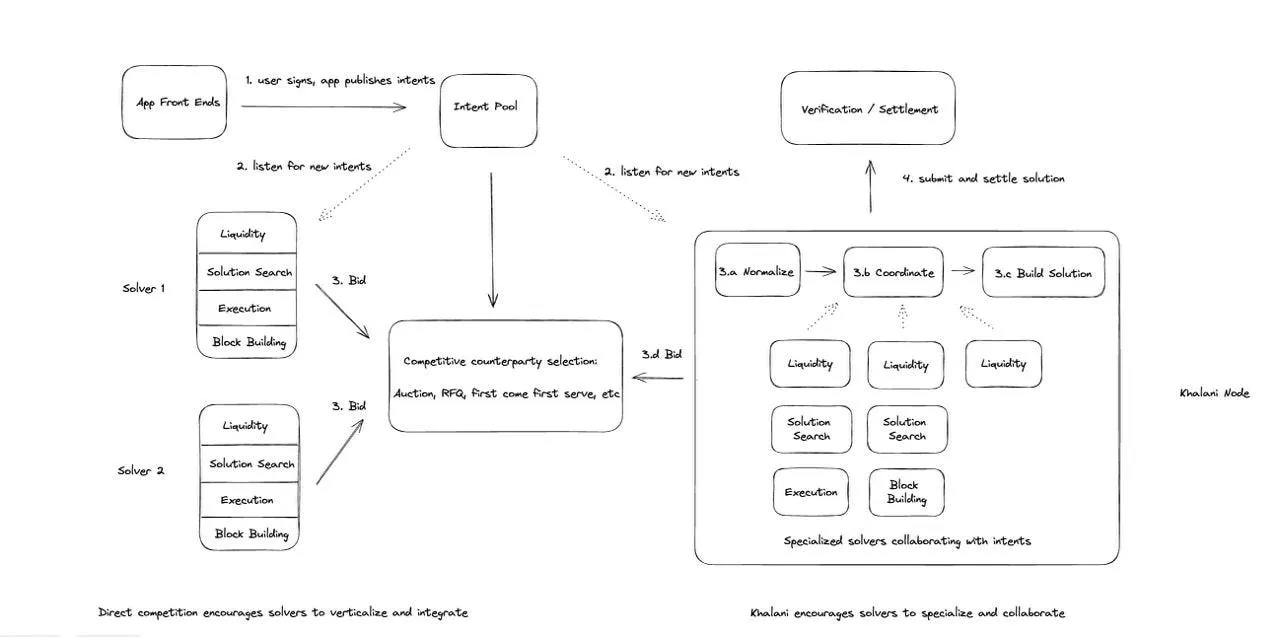

Khalani Network

Khalani Network Structure, source: Khalani Network

Khalani has built three core components: the Intent Compatibility Layer, Validity, and the Universal Settlement Layer. External applications or intent layers can publish intents to Khalani, then Khalani’s Intent Compatibility Layer can convert external intents into a format recognizable by the protocol Solver, using a standardized format called Validity language. Khalani nodes are responsible for submitting final results to the Universal Settlement Layer through cross-chain bridges and fast settlement technologies. This project is still in the construction phase, with no further work details disclosed yet. It received $2.2 million in seed funding from Ethereal Ventures, Nascent, Maelstrom Capital, etc., in August.

Liquorice

Liquorice Structure, source: Liquorice

Liquorice is a decentralized application that enables auction-based price discovery and unilateral liquidity pools. The primary mission of Liquorice is to provide efficient inventory management tools for professional trading firms and to easily connect with core DeFi protocols like 1inch and UniswapX when settling trades with intent. Meanwhile, Liquorice has created lending markets for its borrowing and lending transactions. This application focuses more on the trade itself. It is still in the development stage, having announced in July that it secured $1.2 million in pre-seed funding led by Greenfield Capital.

Xion

Xion is an upgrade from the Burnt brand. In the past, Burnt focused on consumer applications, but the team later discovered significant fragmentation issues in on-chain interactions. Therefore, they built Xion to address this problem. Xion is built on the Comet BFT consensus protocol and uses cross-chain communication based on Cosmos IBC, making it more native and secure than other cross-chain bridges. It has undergone four rounds of financing with investors, including Animoca, Multicoin, Alliance DAO, Mechanism, among others.

=nil; Foundation

The =nil; Foundation is a developer of Ethereum’s ZK computing power market, ZK coprocessor, and Layer 2, with a team possessing deep expertise in ZK technology. They proposed the zkSharding solution, which uses ZK technology to horizontally scale the Ethereum mainnet by executing shard parallel processing transactions and generating ZKP. The main shard verifies data, communicates with Ethereum, and synchronizes network state among all validators. It also manages the distribution of validators and accounts within execution shards. The consensus protocol used by the validation committee is Hotstuff, which is common in recent parallel execution projects. The =nil; L2 has embedded cross-shard communication into its protocol from the start. Cross-shard messages are verified as transactions by each shard’s validator committee.

The basic idea is to build an IBC-like embedded cross-shard communication architecture through a sharded Layer 2 architecture to solve liquidity and state dispersion issues. However, its core idea doesn’t make sense because solving liquidity dispersion addresses multi-chain problems while it constructs a single Layer 2. This means that solving it would require all chains to become shards of ZK-sharding, which is difficult to achieve.

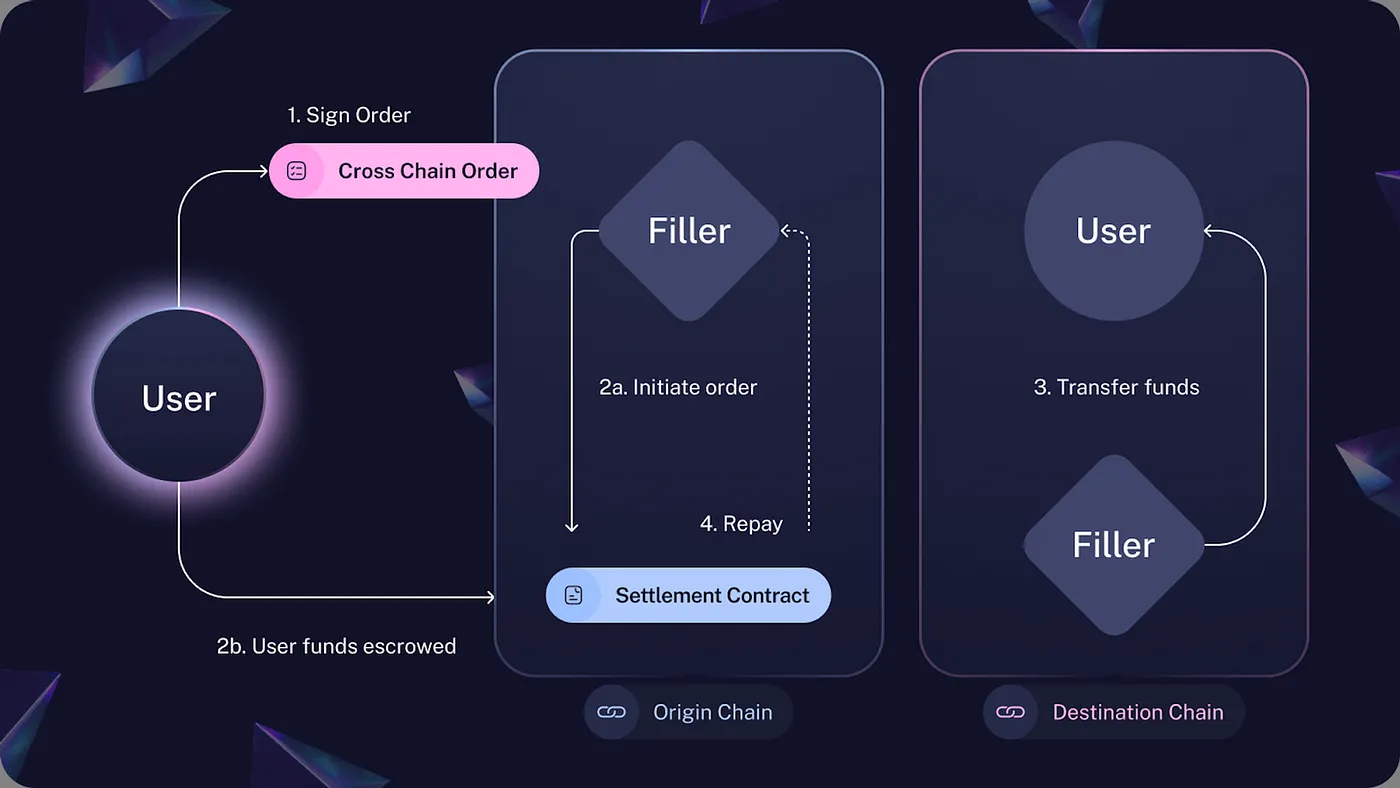

ERC-7683

ERC-7683, source: Across

Ethereum is also working on addressing the issue of cross-chain liquidity. Currently, Arbitrum, OP, and Uniswap are the first to publicly support the ERC7683 standard, which uses an Intent-based cross-chain approach. Its core goal is to establish a universal standard for cross-chain operations across L2 and sidechains, standardizing order and settlement interfaces to achieve seamless cross-chain execution. The main core is that a Filler can also be said to play the role of Solver in chain abstraction by acting as a proxy payer. This proposal was jointly developed by Uniswap and Across and is currently under review by the Cake Working Group.

OP Stack

The OP Stack, ERC-7683, and zkSharding are all Ethereum’s internal solutions to address liquidity fragmentation between Layer 2s. They tackle the issue from architectural, consensus, and application levels, respectively. The OP stack solves information transmission and Sequencer decentralization issues by designing a comprehensive multi-Layer 2 solution that automatically deploys cross-chain contracts when using the OP Stack architecture. A Supervisor is also present to challenge and prevent false cross-chain information transmission. Currently, Coinbase, Uniswap, Kraken, etc., use the OP Stack architecture.

A typical example is Unichain. Unichain mainly addresses cross-chain liquidity fragmentation through integration with the Superchain network. This setup facilitates seamless liquidity movement by providing:

- Intent-based Cross-Chain Bridge: This bridge supports fast and reliable inter-blockchain liquidity transfers allowing users to set intentions which help the system automatically select the best path for moving liquidity. This approach abstracts complexity for users making cross-chain transactions smoother and faster.

- Unichain Verification Network (UVN): This decentralized node operator network verifies cross-chain transactions providing quicker economic finality, which is crucial for ensuring efficient settlement of cross-chain transactions, thereby minimizing risks of liquidity fragmentation due to delayed settlements.

- Flashblocks and Verifiable Block Construction: By using Flashblocks, Unichain significantly reduces block time, improving efficiency for liquidity providers while achieving more synchronized cross-chain markets. Flashblocks help ensure that liquidity remains readily available, reducing negative impacts caused by block confirmation delays which could lead to fragmented liquidity.

Conclusion

In summary, solving cross-chain liquidity issues is a vast field with numerous approaches. For example, within the Layer 2 ecosystem, solutions range from Ethereum’s built-in cross-chain messaging, such as ERC-7683, to OP Stack on Optimism, which shares sequencers to facilitate liquidity. Beyond Layer 2, Layer 1 blockchains also encounter challenges with fragmented liquidity, state, and user experience. Solutions here span application-centric approaches focused on liquidity, off-chain Solver Networks, and account-centric solutions like NEAR, which also rely on off-chain Solver roles.

Cross-chain liquidity, state, and UX fragmentation represent core challenges for the entire blockchain industry. A higher-level abstraction, akin to chain abstraction, is a promising approach to address these issues holistically. This would serve as a true gateway to Web3, resolving UX fragmentation while consolidating liquidity and state seamlessly, invisible to the user. Integration methods vary, involving off-chain Solver networks or atomic cross-chain bridges, each with merits worth exploring.

Ultimately, a multi-chain future is inevitable, and addressing liquidity fragmentation is an essential step for the industry. The potential to create a unified liquidity layer across all chains represents a vast growth opportunity, possibly paving the way for the Web3 equivalent of Google.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.io, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

Thanks for your attention.

Share

Content