2025 TUSD Price Prediction: Analyzing Stablecoin Trajectory in a Regulated Crypto Economy

Introduction: TUSD's Market Position and Investment Value

TrueUSD (TUSD) as a stablecoin platform for marking currency and real assets, has made significant strides since its inception in 2018. As of 2025, TUSD's market capitalization has reached $492,339,216, with a circulating supply of approximately 494,515,083 tokens, maintaining a price of around $0.9956. This asset, hailed as a "transparent and legally protected stablecoin," is playing an increasingly crucial role in providing reliable trading tools for consumers and businesses.

This article will comprehensively analyze TUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. TUSD Price History Review and Current Market Status

TUSD Historical Price Evolution

- 2018: Initial launch, price stabilized around $1

- 2020: Market volatility during COVID-19 pandemic, price briefly dropped to $0.88355

- 2022: Increased adoption in DeFi space, price maintained stability around $1

TUSD Current Market Situation

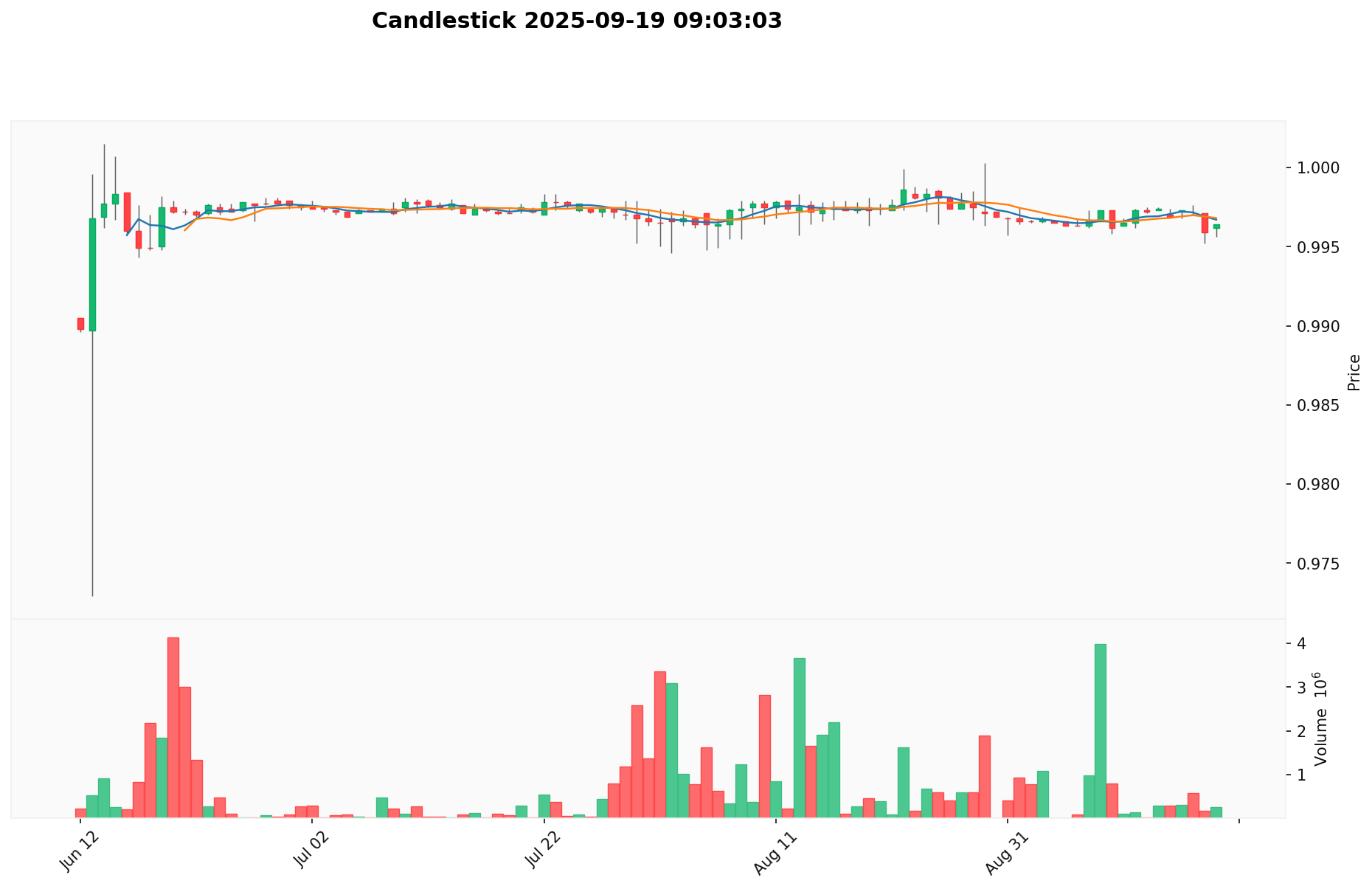

As of September 19, 2025, TUSD is trading at $0.9956, showing a slight deviation from its $1 peg. The 24-hour trading volume stands at $300,172.35, indicating moderate market activity. TUSD's market capitalization is $492,339,216.63, ranking it 169th in the overall cryptocurrency market. The circulating supply is 494,515,083 TUSD, which is very close to its total supply of 495,202,000 TUSD, suggesting high liquidity and availability in the market.

Over the past 24 hours, TUSD has experienced a minor decrease of 0.03%. Looking at longer timeframes, we observe a 0.16% decrease over the past week and a 0.21% decline over the last month. These small fluctuations are typical for stablecoins and demonstrate TUSD's relative stability in maintaining its peg to the US dollar.

Click to view the current TUSD market price

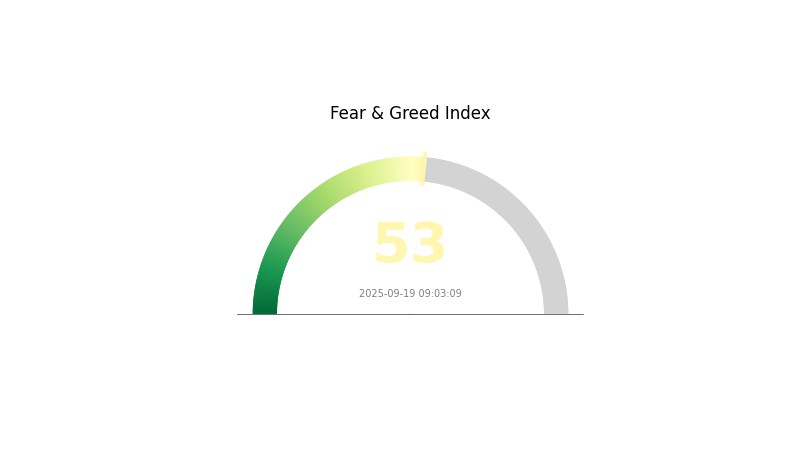

TUSD Market Sentiment Indicator

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index hovering at 53, indicating a neutral stance. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often precedes significant market movements, making it crucial for traders to stay vigilant. While the current sentiment doesn't signal immediate urgency, it's an ideal time for investors to reassess their strategies and prepare for potential shifts in market dynamics.

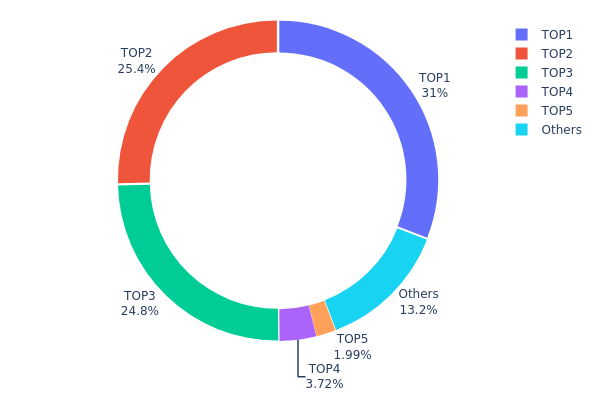

TUSD Holdings Distribution

The address holdings distribution data for TUSD reveals a highly concentrated ownership structure. The top three addresses collectively hold 81.09% of the total TUSD supply, with the largest address controlling 30.96%. This level of concentration raises concerns about the decentralization and market stability of TUSD.

Such a concentrated distribution can have significant implications for market dynamics. The large holdings by a few addresses potentially give these entities substantial influence over TUSD's price and liquidity. This concentration could lead to increased volatility if any of these major holders decide to make large transactions. Furthermore, it exposes the market to potential manipulation risks, as coordinated actions by these top holders could significantly impact the token's value and market behavior.

This distribution pattern suggests that TUSD's on-chain structure may be less stable than ideal for a stablecoin. The high concentration in a few addresses indicates a lower degree of decentralization, which could be a point of concern for investors and regulators alike. It underscores the importance of monitoring large address movements and emphasizes the need for greater distribution to enhance market resilience and reduce systemic risks.

Click to view the current TUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd423...a4c261 | 97585.50K | 30.96% |

| 2 | 0x7000...60ad34 | 80000.00K | 25.38% |

| 3 | 0x2bb1...95ca7d | 78000.00K | 24.75% |

| 4 | 0x9390...e6a1d1 | 11730.38K | 3.72% |

| 5 | 0x4359...def7cb | 6256.60K | 1.98% |

| - | Others | 41553.06K | 13.21% |

II. Key Factors Influencing TUSD's Future Price

Supply Mechanism

- Market Demand: TUSD's price is primarily influenced by market demand and supply dynamics.

- Historical Pattern: TUSD has historically maintained a stable price close to $1 due to its design as a stablecoin.

- Current Impact: The current supply of 494,515,083 TUSD is likely to maintain its stability around the $1 mark.

Institutional and Whale Dynamics

- Corporate Adoption: Some enterprises have adopted TUSD for cryptocurrency transactions and as a stable store of value.

- National Policies: Regulatory changes and government policies regarding stablecoins can significantly impact TUSD's adoption and usage.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, can affect the demand for stablecoins like TUSD.

- Inflation Hedging Properties: As a USD-pegged stablecoin, TUSD may be viewed as a hedge against inflation in certain economic environments.

- Geopolitical Factors: International tensions and economic sanctions can influence the global demand for USD-pegged stablecoins like TUSD.

Technical Development and Ecosystem Building

- Blockchain Integration: TUSD's availability on multiple blockchains, including Ethereum, BNB Smart Chain, Avalanche, and Tron, enhances its utility and accessibility.

- Ecosystem Applications: The integration of TUSD in various DeFi protocols and payment systems contributes to its overall adoption and usage in the cryptocurrency ecosystem.

III. TUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.98 - $1.00

- Neutral prediction: $0.99 - $1.01

- Optimistic prediction: $1.00 - $1.02 (requires increased adoption in DeFi platforms)

2027-2028 Outlook

- Market phase expectation: Stable growth with potential for minor fluctuations

- Price range forecast:

- 2027: $0.99 - $1.01

- 2028: $0.99 - $1.01

- Key catalysts: Regulatory clarity for stablecoins, integration with major payment systems

2029-2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (assuming continued market stability)

- Optimistic scenario: $1.00 - $1.02 (assuming widespread adoption in cross-border transactions)

- Transformative scenario: $1.00 - $1.03 (assuming TUSD becomes a primary stablecoin in the crypto ecosystem)

- 2030-12-31: TUSD $1.01 (steady state with minor appreciation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. TUSD Professional Investment Strategies and Risk Management

TUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operational advice:

- Accumulate TUSD during market dips

- Use dollar-cost averaging to build positions

- Store in secure wallets with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined levels

TUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Regular auditing: Monitor TUSD's backing and reserves

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable 2FA, use unique passwords, be wary of phishing attempts

V. Potential Risks and Challenges for TUSD

TUSD Market Risks

- Liquidity risk: Potential issues during high-volume trading periods

- Competition risk: Emergence of new, more attractive stablecoins

- Depegging risk: Temporary loss of 1:1 USD peg during market stress

TUSD Regulatory Risks

- Compliance challenges: Evolving regulations in different jurisdictions

- Audit scrutiny: Increased regulatory focus on stablecoin reserves

- Legal uncertainties: Potential changes in stablecoin classification and treatment

TUSD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Centralization concerns: Reliance on trust company partnerships

- Scalability issues: Potential limitations during periods of high demand

VI. Conclusion and Action Recommendations

TUSD Investment Value Assessment

TUSD offers a stable store of value with regular audits and legal protections. However, it faces competition and regulatory challenges in the evolving stablecoin landscape.

TUSD Investment Recommendations

✅ Beginners: Use TUSD as an entry point to understand stablecoins and crypto markets ✅ Experienced investors: Incorporate TUSD as part of a diversified stablecoin portfolio ✅ Institutional investors: Consider TUSD for treasury management and as a trading pair

TUSD Participation Methods

- Direct purchase: Buy TUSD on Gate.com

- Yield farming: Explore DeFi protocols offering TUSD liquidity pools

- Trading pairs: Use TUSD as a base currency for crypto trading

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for TRX 2025?

TRX could reach $0.358 by September 2025, with a potential low of $0.342, based on expert analysis.

What is the dollar price prediction for 2030?

Based on current trends, the dollar price is predicted to reach $0.000751 by 2030, representing a significant increase from current levels.

What is the top crypto price prediction in 2025?

The top crypto price prediction for 2025 is Solana (SOL) reaching $220 to $1,000. Analysts expect a potential breakout based on expert consensus.

What kind of cryptocurrency is TUSD?

TUSD is a stablecoin pegged to the US dollar at a 1:1 ratio. It's issued by TrustToken and fully backed by fiat reserves.

Share

Content