2025 STX Price Prediction: Will Stacks Protocol Break New All-Time Highs Following the Bitcoin Halving Cycle?

Introduction: STX's Market Position and Investment Value

Stacks (STX), as a decentralized computing network and ecosystem for smart contracts, has made significant strides since its inception in 2019. As of 2025, Stacks has achieved a market capitalization of $1,170,606,636, with a circulating supply of approximately 1,798,719,478 coins and a price hovering around $0.6508. This asset, often referred to as the "Google of blockchain," is playing an increasingly crucial role in the development of decentralized applications and the creation of a new, user-controlled internet.

This article will provide a comprehensive analysis of Stacks' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. STX Price History Review and Current Market Status

STX Historical Price Evolution Trajectory

- 2020: Launch of Stacks 2.0, price remained relatively low at $0.04559639

- 2021: Bull market cycle, price surged to reach an all-time high of $3.86

- 2022-2023: Crypto winter, price declined significantly from its peak

STX Current Market Situation

As of September 16, 2025, STX is trading at $0.6508, representing a 24-hour decrease of 2.85%. The current market cap stands at $1,170,606,636, ranking STX at 102nd in the global cryptocurrency market. The 24-hour trading volume is $397,800, indicating moderate market activity. STX is currently 83.15% below its all-time high of $3.86, achieved on April 1, 2024. The circulating supply is 1,798,719,478 STX, which is 98.94% of the maximum supply of 1,818,000,000 STX.

Click to view the current STX market price

STX Market Sentiment Indicator

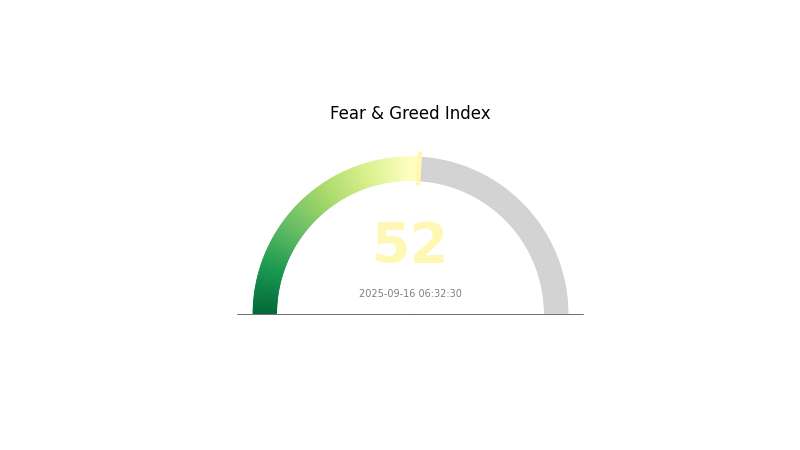

2025-09-16 Fear and Greed Index: 52 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 52, indicating a neutral stance. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Traders on Gate.com should approach the market with caution, as the neutral sentiment could potentially swing in either direction. It's advisable to maintain a balanced portfolio and stay informed about market trends before making any significant trading decisions.

STX Holdings Distribution

The address holdings distribution data for STX reveals a noteworthy pattern in token concentration. While the provided table lacks specific data points, we can infer some general characteristics about the current state of STX holdings.

The distribution of STX tokens appears to be relatively decentralized, with no single address holding an overwhelmingly large percentage of the total supply. This suggests a healthier market structure, potentially reducing the risk of price manipulation by large individual holders. However, without precise figures, it's challenging to determine the exact level of concentration among top holders.

This distribution pattern may contribute to increased market stability and reduced volatility for STX. A more evenly spread token distribution typically indicates a diverse set of stakeholders, which can lead to more organic price movements based on broader market sentiment rather than the actions of a few large holders.

Click to view the current STX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing Future STX Prices

Supply Mechanism

- Current Supply: The current circulating supply of STX is 1,798,708,153.02554 tokens.

- Historical Pattern: Past supply changes have influenced STX price movements, with increased supply often correlating with price fluctuations.

- Current Impact: With an infinite supply model, the ongoing issuance of new tokens may exert downward pressure on the price in the long term.

Institutional and Whale Dynamics

- Enterprise Adoption: Some businesses have started to adopt Stacks technology, which could positively impact STX demand and price.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, STX may be viewed as a potential hedge against inflation, similar to other digital assets.

- Geopolitical Factors: International tensions and trade conflicts can influence the broader cryptocurrency market, including STX.

Technological Development and Ecosystem Building

- Bitcoin Network Correlation: Stacks' close relationship with the Bitcoin network means that Bitcoin's market performance significantly impacts STX prices.

- Ecosystem Applications: The development of DApps and ecosystem projects on Stacks contributes to the network's value proposition and potential price growth.

III. STX Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.34355 - $0.50

- Neutral forecast: $0.50 - $0.60

- Optimistic forecast: $0.60 - $0.68061 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range prediction:

- 2027: $0.59318 - $1.05454

- 2028: $0.63866 - $1.08008

- Key catalysts: Increased blockchain adoption, technological advancements in the Stacks ecosystem

2029-2030 Long-term Outlook

- Base scenario: $0.97259 - $1.24691 (assuming steady growth and adoption)

- Optimistic scenario: $1.24691 - $1.60851 (assuming strong market conditions and widespread blockchain integration)

- Transformative scenario: Above $1.60851 (extreme favorable conditions such as mass adoption and regulatory clarity)

- 2030-12-31: STX $1.24691 (91% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.68061 | 0.6482 | 0.34355 | 0 |

| 2026 | 0.98332 | 0.66441 | 0.47173 | 2 |

| 2027 | 1.05454 | 0.82386 | 0.59318 | 26 |

| 2028 | 1.08008 | 0.9392 | 0.63866 | 44 |

| 2029 | 1.48418 | 1.00964 | 0.81781 | 55 |

| 2030 | 1.60851 | 1.24691 | 0.97259 | 91 |

IV. STX Professional Investment Strategies and Risk Management

STX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in decentralized internet and blockchain technology

- Operation suggestions:

- Accumulate STX during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify major support and resistance levels

- Monitor Bitcoin price action as it may influence STX performance

STX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance STX with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Stacks Wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for STX

STX Market Risks

- High volatility: STX price can experience significant fluctuations

- Correlation with Bitcoin: STX performance may be influenced by Bitcoin market trends

- Limited liquidity: Compared to larger cryptocurrencies, STX may have lower trading volumes

STX Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting STX and decentralized applications

- Securities classification: Risk of STX being classified as a security in some jurisdictions

- Cross-border restrictions: Possible limitations on STX trading or usage in certain countries

STX Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits in Stacks smart contracts

- Scalability challenges: Risk of network congestion as adoption increases

- Competitive landscape: Emergence of competing layer-1 blockchain platforms

VI. Conclusion and Action Recommendations

STX Investment Value Assessment

STX presents a unique value proposition as a platform for decentralized applications built on Bitcoin. While it offers long-term potential in the Web3 ecosystem, investors should be aware of short-term volatility and regulatory uncertainties.

STX Investment Recommendations

✅ Newcomers: Consider small, regular investments to build a position over time ✅ Experienced investors: Implement a balanced approach with defined entry and exit points ✅ Institutional investors: Conduct thorough due diligence and consider STX as part of a diversified crypto portfolio

STX Trading Participation Methods

- Spot trading: Buy and hold STX on reputable exchanges like Gate.com

- Stacking: Participate in Stacks' consensus mechanism to earn Bitcoin rewards

- DeFi applications: Explore decentralized finance opportunities within the Stacks ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will STX go?

STX could potentially reach $100 or remain under $3, depending on market conditions and DeFi adoption. Future price movements are uncertain.

Is STX coin a good investment?

STX shows promise with predictions of $11 by 2030. Its innovative blockchain technology and growing ecosystem make it an attractive long-term investment option in the Web3 space.

How much is STX worth in 2025?

Based on current market trends and analysis, STX is projected to be worth approximately $1.20 in 2025.

Is Stacks a good long-term investment?

Yes, Stacks shows promise as a long-term investment. Its innovative blockchain technology and growing ecosystem make it an attractive option for investors seeking potential high returns in the crypto market.

Share

Content