2025 NAM Price Prediction: Analyzing Growth Factors and Market Potential in the Emerging Digital Economy

Introduction: NAM's Market Position and Investment Value

Namada (NAM), as a composable privacy layer for the multichain ecosystem, has emerged as a promising project since its inception. As of 2025, Namada's market capitalization has reached $8,388,549, with a circulating supply of approximately 976,320,949 NAM tokens, and a price hovering around $0.008592. This asset, dubbed as the "privacy shield for cross-chain transactions," is playing an increasingly crucial role in protecting user data across various blockchain networks and decentralized applications.

This article will comprehensively analyze Namada's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price forecasts and practical investment strategies.

I. NAM Price History Review and Current Market Status

NAM Historical Price Evolution

- 2025: NAM launched, price reached an all-time high of $0.102 on June 19

- 2025: Market correction, price dropped to an all-time low of $0.006471 on September 30

- 2025: Recent recovery, price rebounded to $0.008592 as of October 9

NAM Current Market Situation

NAM is currently trading at $0.008592, showing a significant 10.11% increase in the past 24 hours. The token has also demonstrated positive momentum over longer time frames, with 9.83% and 8.35% gains over the past 7 days and 30 days, respectively. NAM's market capitalization stands at $8,388,549, ranking it 1509th in the cryptocurrency market. With a circulating supply of 976,320,949 NAM tokens, representing 97.63% of the total supply, the project maintains a relatively high circulation ratio. The 24-hour trading volume of $22,155 indicates moderate market activity for NAM.

Click to view the current NAM market price

NAM Market Sentiment Indicator

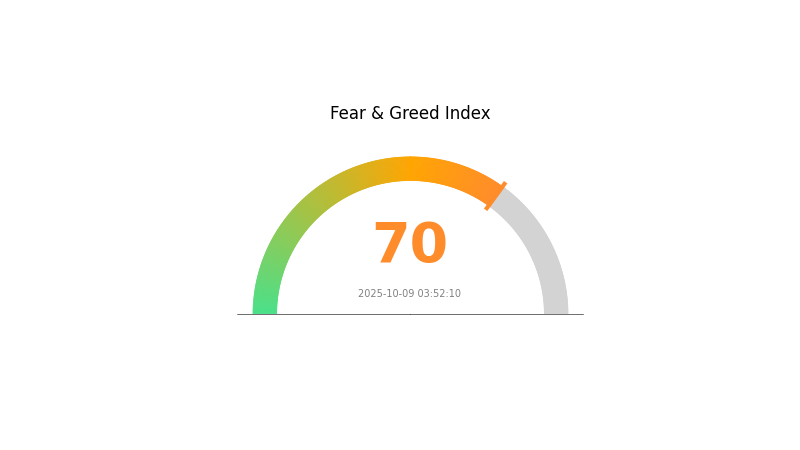

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 70. This suggests investors are becoming overly optimistic, potentially leading to overvalued assets. While bullish sentiment can drive prices higher, it's crucial to remain cautious. Experienced traders may consider taking profits or hedging positions. For those looking to enter the market, it might be wise to wait for a potential correction or accumulate gradually. Remember, market sentiment can shift quickly, so stay informed and manage your risk accordingly.

NAM Holdings Distribution

The address holdings distribution data for NAM reveals an interesting pattern in token concentration. With no specific addresses listed in the provided data, it suggests a relatively even distribution of tokens among holders without significant concentration in a few wallets.

This distribution pattern indicates a healthy level of decentralization for NAM. The absence of large individual holders reduces the risk of market manipulation and sudden price swings caused by the actions of "whales". It also suggests that the NAM ecosystem may have a more diverse and engaged community of stakeholders.

From a market structure perspective, this even distribution could contribute to more stable price action and potentially lower volatility. It may also reflect positively on the project's governance structure, implying a more democratic decision-making process if NAM involves any on-chain governance mechanisms.

Click to view the current NAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting NAM's Future Price

Supply Mechanism

- Market Supply and Demand: The balance between supply and demand in the market is a crucial factor influencing NAM's price.

- Current Impact: Changes in supply are expected to have a significant effect on NAM's price in the current market conditions.

Macroeconomic Environment

- Monetary Policy Impact: The policies of major central banks are expected to influence NAM's price.

- Geopolitical Factors: International political situations may affect NAM's price movements.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects could impact NAM's future price.

III. NAM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00799 - $0.00859

- Neutral prediction: $0.00859 - $0.00937

- Optimistic prediction: $0.00937 - $0.01014 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00538 - $0.01028

- 2028: $0.00622 - $0.01124

- Key catalysts: Technological advancements, wider adoption, market cycles

2029-2030 Long-term Outlook

- Base scenario: $0.01063 - $0.01233 (assuming steady market growth)

- Optimistic scenario: $0.01233 - $0.01727 (assuming strong bullish trends)

- Transformative scenario: $0.01727+ (extreme favorable conditions and mass adoption)

- 2030-12-31: NAM $0.01727 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01014 | 0.00859 | 0.00799 | 0 |

| 2026 | 0.01021 | 0.00937 | 0.00852 | 9 |

| 2027 | 0.01028 | 0.00979 | 0.00538 | 13 |

| 2028 | 0.01124 | 0.01003 | 0.00622 | 16 |

| 2029 | 0.01404 | 0.01063 | 0.00861 | 23 |

| 2030 | 0.01727 | 0.01233 | 0.01122 | 43 |

IV. NAM Professional Investment Strategies and Risk Management

NAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors focused on privacy-centric blockchain technology

- Operational suggestions:

- Accumulate NAM tokens during market dips

- Stay updated on Namada's technological advancements and adoption

- Store tokens in a secure, non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor NAM's correlation with major cryptocurrencies

- Pay attention to Namada ecosystem developments and partnerships

NAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance NAM with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for NAM

NAM Market Risks

- Volatility: High price fluctuations common in emerging cryptocurrencies

- Liquidity: Limited trading pairs and volumes may affect price stability

- Competition: Other privacy-focused blockchain projects may impact NAM's market share

NAM Regulatory Risks

- Privacy coin scrutiny: Increased regulatory focus on privacy-enhancing cryptocurrencies

- Cross-chain compliance: Potential challenges in adhering to diverse regulatory frameworks

- Adoption barriers: Regulatory uncertainty may hinder institutional acceptance

NAM Technical Risks

- Smart contract vulnerabilities: Potential security issues in the protocol

- Scalability challenges: Possible limitations in handling increased transaction volumes

- Interoperability issues: Unforeseen complications in cross-chain interactions

VI. Conclusion and Action Recommendations

NAM Investment Value Assessment

Namada (NAM) presents a unique value proposition in the privacy-focused blockchain space, with potential for long-term growth. However, it faces short-term risks due to market volatility and regulatory uncertainties.

NAM Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the technology

✅ Experienced investors: Allocate a moderate portion of the crypto portfolio, focusing on long-term potential

✅ Institutional investors: Conduct thorough due diligence and consider NAM as part of a diversified crypto strategy

NAM Trading Participation Methods

- Spot trading: Purchase NAM tokens on Gate.com

- DeFi participation: Explore staking or liquidity provision opportunities as they become available

- Dollar-cost averaging: Regularly invest small amounts to mitigate market volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

Share

Content