2025 COPI Fiyat Tahmini: Değişen Dijital Varlık Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: COPI'nin Piyasa Konumu ve Yatırım Potansiyeli

Cornucopias (COPI), oyuncu odaklı bir MMORPG tokeni olarak 2021'de piyasaya sürülmesinden bu yana oyun ve kripto ekosistemlerinde öne çıkmıştır. 2025 itibarıyla COPI'nin piyasa değeri $15.833.122'ye ulaşırken, dolaşımdaki token miktarı yaklaşık 1.032.482.698 olup, fiyatı $0,015335 seviyesinde seyretmektedir. “Bubbleverse Economy Token” olarak bilinen COPI, blokzincir tabanlı oyunlar ile sanal ekonomilerin kesişiminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, COPI'nin 2025-2030 dönemindeki fiyat hareketleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde kapsamlı biçimde analiz edilerek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. COPI Fiyat Geçmişi ve Güncel Piyasa Durumu

COPI Tarihsel Fiyat Seyri

- 2021: COPI Aralık ayında $0,029 başlangıç fiyatıyla piyasaya çıktı

- 2023: 21 Aralık'ta $0,1314 ile zirveye ulaştı

- 2025: 22 Haziran'da $0,010718 ile en düşük seviyeye indi

COPI Güncel Piyasa Durumu

6 Ekim 2025 tarihinde COPI, $0,015335 fiyatından işlem görüyor. Token son 24 saatte %1,67 değer kazandı ve işlem hacmi $30.738,42 oldu. Piyasa değeri $15.833.122 ile COPI, kripto piyasasında 1.203'üncü sırada yer alıyor. Kısa vadede %5,22 yükselen COPI, son 30 günde %1,27 gerileme yaşadı. Ancak son bir yılda %33,05 düşüşle uzun vadeli negatif baskı altında bulunuyor.

Güncel COPI piyasa fiyatını görmek için tıklayın

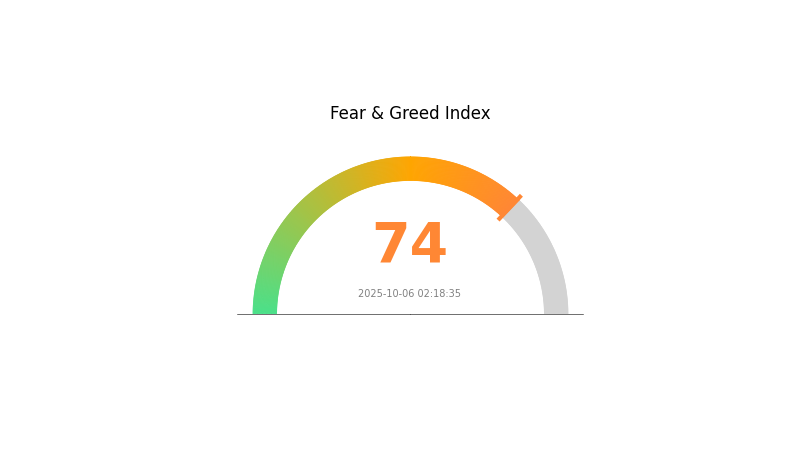

COPI Piyasa Duyarlılık Endeksi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim: Endeks 74 seviyesinde. Yatırımcıların iyimserliği ve aşırı güveni arttı. Olumlu duyarlılık fiyatları yükseltebilir; ancak temkinli olmak gerekir. Tarihsel olarak aşırı açgözlülük, genellikle piyasa düzeltmelerinin habercisidir. Yatırımcılar kar almayı veya pozisyonlarını hedge etmeyi düşünmeli. Piyasa duyarlılığı hızlı değişebilir; Gate.com'da güncel kalın ve riskinizi bilinçli yönetin.

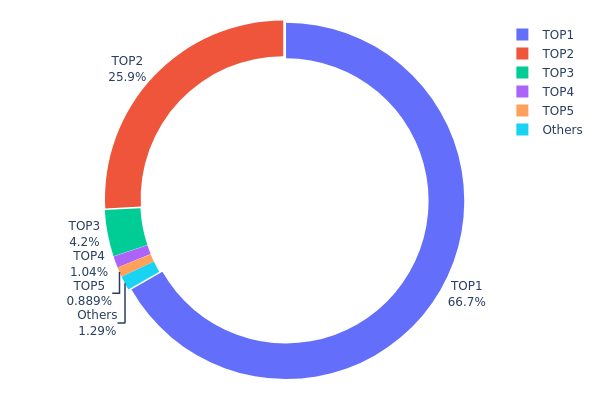

COPI Varlık Dağılımı

Adres varlık dağılımı, COPI'nin sahiplik yapısında ciddi yoğunlaşma olduğunu gösteriyor. En büyük adres, toplam arzın %66,70'ini elinde tutarken, ikinci en büyük adres %25,87 oranına sahip. Bu durum, piyasa manipülasyonu ve volatilite riskleri açısından önemli endişeler doğuruyor.

En büyük beş adres COPI tokenlerinin %98,69'unu kontrol ediyor; bu da piyasada aşırı merkeziyetçilik anlamına geliyor. Bu yoğunlaşma, büyük sahiplerin satış ya da alım yapması durumunda ciddi fiyat dalgalanmalarına neden olabilir. Ayrıca, merkeziyetsizlik düzeyinin düşük olması tokenin yönetişimini ve genel istikrarını olumsuz etkileyebilir.

Mevcut dağılım, zincir üzerindeki yapının kırılgan olduğunu ve COPI'nin piyasa dinamiklerinde birkaç adresin belirleyici rol oynadığını gösteriyor. Bu yoğunlaşma, küçük yatırımcılar için caydırıcı olabilir ve uzun vadeli sürdürülebilirlik ile yaygın benimsenme açısından risk teşkil edebilir.

Güncel COPI Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7b8f...16ea19 | 2.561.614,94K | 66,70% |

| 2 | 0x8730...81be87 | 993.484,82K | 25,87% |

| 3 | 0xc653...dee414 | 161.329,05K | 4,20% |

| 4 | 0x450a...4afaf9 | 40.000,00K | 1,04% |

| 5 | 0xca9a...499a46 | 34.142,37K | 0,88% |

| - | Diğerleri | 49.428,81K | 1,31% |

II. COPI'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Ortam

-

Para Politikası Etkisi: ABD Merkez Bankası'nın (Federal Reserve) para politikası kararları COPI'nin fiyatında belirleyici rol oynayacaktır. Faiz oranı değişimleri ve niceliksel genişleme, piyasa likiditesi ve yatırım akışlarını doğrudan etkiler.

-

Enflasyona Karşı Koruma: COPI'nin enflasyonist ortamda performansı yakından takip edilecektir. Artan tüketici fiyatları ve ham madde maliyetleri, COPI'ye enflasyona karşı bir koruma aracı olarak ilgi doğurabilir.

-

Jeopolitik Gelişmeler: Özellikle Rusya-Ukrayna savaşı gibi uluslararası gerilimler, küresel ekonomik istikrarı ve COPI gibi kripto varlıklara yönelik yatırımcı algısını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

-

Piyasa Davranışı: Fiyat trendleri, tüm temel unsurları yansıtarak belirli bir süre eğilimini sürdürebilir. COPI'nin fiyat hareketleri, piyasa duyarlılığı ve teknik analizle bu tip bir seyir izleyebilir.

-

Topluluk Etkileşimi: Diğer meme coinlerde olduğu gibi COPI'nin değeri, topluluk bağlılığı ve sosyal medya trendleriyle şekillenebilir; bu nedenle volatilite yüksek olabilir.

III. COPI'nin 2025-2030 Fiyat Öngörüleri

2025 Beklentisi

- Tedbirli tahmin: $0,01319 - $0,01533

- Tarafsız tahmin: $0,01533 - $0,01779

- İyimser tahmin: $0,01779 - $0,02024 (olumlu piyasa koşullarında)

2027-2028 Beklentisi

- Piyasa evresi: Kademeli büyüme dönemi

- Fiyat aralığı:

- 2027: $0,01064 - $0,02054

- 2028: $0,0102 - $0,02686

- Temel katalizörler: Artan benimsenme ve teknolojik yenilikler

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: $0,02324 - $0,02695 (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: $0,02695 - $0,03067 (hızlı benimseme varsayımıyla)

- Dönüştürücü senaryo: $0,03067 - $0,03127 (çığır açan kullanım senaryolarında)

- 2030-12-31: COPI $0,03127 (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02024 | 0,01533 | 0,01319 | 0 |

| 2026 | 0,01956 | 0,01779 | 0,01281 | 15 |

| 2027 | 0,02054 | 0,01867 | 0,01064 | 21 |

| 2028 | 0,02686 | 0,01961 | 0,0102 | 27 |

| 2029 | 0,03067 | 0,02324 | 0,01278 | 51 |

| 2030 | 0,03127 | 0,02695 | 0,01725 | 75 |

IV. COPI için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

COPI Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcılar: Yüksek risk toleransına sahip, oyun sektörüne güvenenler

- İşlem önerileri:

- Piyasa düşüşlerinde COPI biriktirin

- Cornucopias oyun geliştirme sürecini yakından izleyin

- Tokenleri güvenli bir cüzdanda tutun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri takip edin

- RSI: Aşırı alım ve aşırı satım noktalarını tespit edin

- Dalgalı işlem için önemli noktalar:

- Risk yönetimi için zarar-durdur emirleri belirleyin

- Belirli seviyelerde kar alımını planlayın

COPI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3'ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyonel yatırımcılar: Portföyün %10-15'i

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Oyun tokenleri ve geleneksel varlıklarla portföyü çeşitlendirin

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdan

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın

V. COPI ile İlgili Potansiyel Riskler ve Zorluklar

COPI Piyasa Riskleri

- Volatilite: Oyun tokenlerinde sıkça görülen yüksek fiyat dalgalanmaları

- Rekabet: Blokzincir tabanlı oyun projelerinin sayısı hızla artıyor

- Piyasa duyarlılığı: Genel kripto piyasası trendlerine karşı hassaslık

COPI Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto oyunlarına ilişkin düzenleyici değişiklik ihtimali

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- Token sınıflandırması: Menkul kıymet olarak değerlendirilme riski

COPI Teknik Riskler

- Akıllı kontrat açıkları: Sömürü ve hata riski

- Ölçeklenebilirlik sorunları: Kullanıcı yükünün artmasıyla ortaya çıkan zorluklar

- Blokzincirler arası uyumluluk: Çoklu zincir desteğinde teknik riskler

VI. Sonuç ve Eylem Önerileri

COPI Yatırım Potansiyeli Değerlendirmesi

COPI, blokzincir oyun sektöründe yüksek riskli fakat yüksek getiri potansiyeli taşıyor. Uzun vadeli değer, Cornucopias'ın başarısına bağlı; kısa vadede ise piyasa volatilitesi ve düzenleyici belirsizlikler öne çıkıyor.

COPI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, blokzincir oyunları hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Dengeli yaklaşım ve sıkı risk yönetimi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yaparak portföye çeşitlilik katın

COPI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden COPI alın ve satın

- DeFi staking: Uygun ise likidite farmına katılın

- Oyun içi harcama: COPI ile Cornucopias oyun ekosisteminde işlem yapın

Kripto yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı risk toleransına göre hareket etmeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

ICP $100 seviyesine ulaşabilir mi?

Evet, ICP'nin $100 seviyesine ulaşması mümkündür. Garanti olmamakla birlikte, proje gelişimi sürdüğü ve piyasa koşulları olumlu olduğu sürece bu olasılık mevcuttur.

Orchid OXT iyi bir yatırım mı?

Evet, Orchid (OXT) yatırım açısından umut vaat ediyor. Teknolojisi gelişiyor ve benimsenme oranı artıyor; bu da uzun vadeli büyüme potansiyeline işaret ediyor.

Orchid kripto paranın geleceği var mı?

Evet, Orchid kripto para için gelecek öngörülüyor. Tahminler uzun vadede $0,2512 seviyesine ulaşabileceğini gösteriyor. Başarı, benimsenme oranları ve gizliliğe dayalı internet teknolojilerindeki gelişmelere bağlıdır.

ICP 2025'te ne kadar yükselebilir?

Mevcut öngörülere göre ICP, 2025'te $35,64 seviyesine ulaşabilir. Ortalama tahmin $27,80 civarında olup, potansiyel aralık $19,56 - $35,64 arasındadır.

2025 WEMIX Fiyat Tahmini: Gelişen Kripto Ekosisteminde Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 ALICE Fiyat Tahmini: My Neighbor Alice Token’ın Gelecekteki Piyasa Trendleri ve Büyüme Potansiyeli Analizi

LUMIA vs SAND: Modern akıllı telefonlarda yeni nesil ekran teknolojilerinin karşılaştırmalı analizi

Elysium (ELY) yatırım için uygun mu?: Bu Gelişmekte Olan Kripto Paranın Potansiyeli ve Riskleri Üzerine Analiz

VDT nedir: Görsel Ekran Terminalleri ve İş Yeri Ergonomisine Etkileri

2025'te Kripto Piyasa Görünümü Nasıl Değişti?

Golem Crypto'yı Keşfedin: Web3 ekosisteminin gelişimine yön veren ileri teknoloji bir ağ

Echelon Prime’ı Anlamak: Kapsamlı Bir Genel Bakış

DFYN Token’ı Anlamak: Kapsamlı Bir İnceleme

Carv Token Hakkında Kapsamlı Rehber: Bilmeniz Gereken Tüm Detaylar

Bonfida FIDA Coin: FIDA Tokenlarını Anlamak İçin Kapsamlı Bir Rehber