2025 CHESS Fiyat Tahmini: CHESS Token Ekosistemi İçin Piyasa Analizi ve Gelecek Trendleri

Giriş: CHESS’in Piyasa Konumu ve Yatırım Değeri

Tranchess (CHESS), 2021’de piyasaya sürülmesinden bu yana, tokenlaştırılmış varlık yönetimi ve türev işlemleri protokolü olarak dikkat çekici bir gelişim gösterdi. 2025 yılı itibarıyla, Tranchess’in piyasa değeri 12.456.175 $’a ulaşırken, dolaşımdaki arzı yaklaşık 205.513.535 adet ve fiyatı yaklaşık 0,06061 $ seviyesinde seyrediyor. “Risk ayarlı fon çözümü” olarak tanımlanan bu varlık, merkeziyetsiz finans ve varlık yönetimi alanında giderek daha önemli bir rol üstleniyor.

Bu makalede, CHESS’in 2025-2030 arası fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında analiz edilerek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. CHESS Fiyat Geçmişi ve Güncel Piyasa Durumu

CHESS’in Tarihsel Fiyat Seyri

- 2021: CHESS lansmanı, 22 Ekim’de fiyatı 7,91 $ ile zirve yaptı

- 2022: Piyasa geriledi ve fiyat ciddi oranda düştü

- 2025: 7 Nisan’da 0,04482984 $ ile tüm zamanların en düşük seviyesine ulaştı

CHESS’in Güncel Piyasa Durumu

CHESS şu anda 0,06061 $ seviyesinde işlem görüyor ve son 24 saatte %2,5 geriledi. Token’ın piyasa değeri 12.456.175 $ olup, kripto para piyasasında 1.315’inci sırada yer alıyor. Son haftada %2,87 artış gösteren CHESS, son bir yılda ise %55,86’lık bir düşüş yaşadı. Mevcut fiyatı, tüm zamanların en yüksek seviyesi olan 7,91 $’ın %99,23 altında bulunuyor; bu, zirveden sonra ciddi bir düzeltmeye işaret ediyor. Dolaşımdaki CHESS miktarı toplam arz olan 300.000.000’un 205.513.535’i olup, dolaşım oranı %68,5’tir.

Güncel CHESS piyasa fiyatını görmek için tıklayın

CHESS Piyasa Duyarlılık Endeksi

2025-10-08 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu anda açgözlülük hakim ve Korku & Açgözlülük Endeksi 60 seviyesinde. Bu durum, yatırımcıların piyasaya olan güveninin arttığını gösteriyor. Ancak aşırı açgözlülük, aşırı değerlenmeye ve olası piyasa düzeltmelerine yol açabilir. Yatırımcıların temkinli olması ve risk yönetimi uygulaması önem taşır. Her zaman olduğu gibi, çeşitlendirme ve kapsamlı araştırma, kripto piyasasının oynaklığına karşı en güvenli stratejidir.

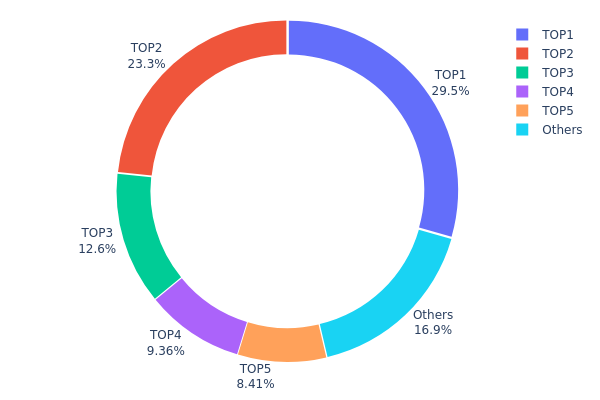

CHESS Varlık Dağılımı

CHESS’in adres bazlı varlık dağılımı, oldukça yoğunlaşmış bir sahiplik yapısı ortaya koyuyor. En büyük beş adres, toplam arzın %83,12’sini elinde bulundururken, en büyük adres tek başına %29,45’lik paya sahip. Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riski doğuruyor.

Bu yapı, büyük sahiplerin alım veya satım kararlarıyla fiyatlarda önemli dalgalanmalara yol açabilir. Görece düşük merkeziyetsizlik, projenin yönetimi ve karar süreçlerini etkileyebilir. Birkaç baskın adres, CHESS ekosistemi üzerinde orantısız etki oluşturabilir.

Yoğunlaşmış sahiplik, büyük yatırımcıların uzun vadeli bağlılığı açısından istikrar sağlasa da, piyasa likiditesi ve adil fiyat oluşumu açısından risk taşır. Yatırımcılar, CHESS’e yatırım kararı verirken bu sahiplik dağılımını göz önünde bulundurmalıdır.

Güncel CHESS Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x1bf0...ff3a7b | 88.367,65K | 29,45% |

| 2 | 0xf977...41acec | 70.000,00K | 23,33% |

| 3 | 0x95a2...abc6c2 | 37.759,08K | 12,58% |

| 4 | 0x5a52...70efcb | 28.078,02K | 9,35% |

| 5 | 0x8894...e2d4e3 | 25.232,60K | 8,41% |

| - | Diğerleri | 50.562,64K | 16,88% |

II. CHESS’in Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Piyasa Oynaklığı: Kripto para piyasası yüksek oynaklık gösterir ve bu CHESS fiyatında ciddi etkiler yaratabilir.

- Tarihsel Seyir: CHESS geçmişte ciddi fiyat dalgalanmaları yaşamış, bu da tokena yönelik piyasa algısındaki değişimleri yansıtmıştır.

- Güncel Etki: Son dönemdeki fiyat hareketleri; yeni işlem çiftlerinin listelenmesi ve piyasa duyarlılığı gibi faktörlerden etkilenmiştir.

Kurumsal ve Balina Dinamikleri

- Platform Gelişimi: Tranchess platformunun iş modeli ve karlılığı halen gelişim aşamasında olup, bu durum CHESS’in piyasa performansında belirsizlik yaratmaktadır.

Makroekonomik Ortam

- Yatırımcı Duyarlılığı: Yatırımcıların genel ruh hali ve güveni, CHESS’in fiyat yönünü doğrudan etkiler.

Teknolojik Gelişim ve Ekosistem Oluşumu

- İşlem Çiftleri: CHESS/USDT perpetual sözleşmeleri gibi yeni işlem çiftleri, token fiyatına doğrudan etki eder.

- Ekosistem Uygulamaları: Tranchess platformunun ve ilişkili ürünlerin sürekli gelişimi, CHESS’in değer ve benimsenme potansiyelini artırabilir.

III. CHESS 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,04728 $ - 0,05500 $

- Tarafsız tahmin: 0,05500 $ - 0,06500 $

- İyimser tahmin: 0,06500 $ - 0,0691 $ (pozitif piyasa duyarlılığı ve artan benimsenme gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Oynaklığın arttığı potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,04679 $ - 0,08638 $

- 2028: 0,06572 $ - 0,0974 $

- Temel tetikleyiciler: Teknolojik yenilikler, daha geniş blockchain entegrasyonu ve olası iş ortaklıkları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,08829 $ - 0,10154 $ (istikrarlı piyasa büyümesi ve benimseme ile)

- İyimser senaryo: 0,11478 $ - 0,12996 $ (güçlü piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: 0,13000 $ - 0,15000 $ (olağanüstü piyasa şartları ve çığır açan kullanım alanları ile)

- 2030-12-31: CHESS 0,12996 $ (iyimser projeksiyona göre olası zirve)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,0691 | 0,06061 | 0,04728 | 0 |

| 2026 | 0,07912 | 0,06485 | 0,05902 | 7 |

| 2027 | 0,08638 | 0,07199 | 0,04679 | 18 |

| 2028 | 0,0974 | 0,07919 | 0,06572 | 30 |

| 2029 | 0,11478 | 0,08829 | 0,05474 | 45 |

| 2030 | 0,12996 | 0,10154 | 0,07615 | 67 |

IV. CHESS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CHESS Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcılar: Uzun vadeli ve risk toleransı yüksek yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde CHESS biriktirin

- Tranchess protokolünde CHESS stake ederek ödül kazanın

- Tokenları güvenli, gözetimsiz cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI: Aşırı alım/satım bölgelerini takip edin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş ve çıkış seviyeleri belirleyin

- BTC fiyat hareketlerini izleyin, çünkü CHESS’i etkileyebilir

CHESS Risk Yönetimi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımı farklı kripto varlıklara dağıtın

- Zarar durdurma emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifre kullanın

V. CHESS İçin Potansiyel Riskler ve Zorluklar

CHESS Piyasa Riskleri

- Yüksek oynaklık: CHESS fiyatında ciddi dalgalanma potansiyeli

- BTC ile korelasyon: CHESS performansı Bitcoin piyasasıyla ilişkili olabilir

- Düşük likidite: Büyük işlemlerin fiyatı etkilemeden gerçekleşmesi zor olabilir

CHESS Düzenleyici Riskler

- Belirsiz düzenleyici ortam: DeFi projelerine yönelik yeni ve katı düzenlemeler gelebilir

- Sınır ötesi uyum: Uluslararası regülasyonlara uyum sağlama zorlukları

- Vergi etkileri: Gelişen vergi mevzuatı CHESS işlemlerini ve varlıklarını etkileyebilir

CHESS Teknik Riskler

- Akıllı sözleşme açıkları: Tranchess protokolünde güvenlik ve hata riski

- Ölçeklenebilirlik sorunları: Yüksek talepte ağ tıkanıklığı

- Çapraz zincir uyumluluk: Zincirler arası entegrasyon sorunları

VI. Sonuç ve Eylem Önerileri

CHESS Yatırım Değeri Değerlendirmesi

CHESS, Tranchess ekosisteminde uzun vadeli değer potansiyeli sunar; ancak piyasa oynaklığı ve regülasyon belirsizlikleri nedeniyle kısa vadede risk taşır. Performansı, DeFi ve genel kripto piyasası trendleriyle yakından bağlantılıdır.

CHESS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp Tranchess protokolünü öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Portföyün bir kısmını CHESS’e ayırarak çeşitlendirilmiş DeFi stratejisi oluşturun ✅ Kurumsal yatırımcılar: CHESS’i kripto türevleri ve getiri odaklı portföyün bir parçası olarak değerlendirin

CHESS İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden CHESS token işlemleri

- Staking: Tranchess protokolünde ek ödül kazanmak için stake etme

- Getiri çiftçiliği: Tranchess ekosisteminde likidite sağlama fırsatlarını değerlendirme

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Hangi kripto para 1000 kat büyüme potansiyeline sahip?

Ethereum, Solana ve Cardano’nun 1000 kat büyüme potansiyeli olduğu öngörülüyor. Mevcut piyasa trendlerine göre bu kripto paralar güçlü gelecek vaat ediyor.

2025’te hangi coin yükselişe geçecek?

Mevcut trendler doğrultusunda Ethereum (ETH), devam eden güncellemeleri ve büyüyen ekosistemi sayesinde 2025’te güçlü performans gösterebilir.

Hangi coin 1 $’a ulaşabilir?

Snorter Bot’un 1 $’a ulaşması öngörülüyor. Mevcut fiyatı 1 $’ın altında. Piyasa trendleri büyüme potansiyeline işaret ediyor.

CHESS kripto parası ne kadar?

2025-10-08 tarihinde CHESS kripto parası 0,05972 $ seviyesindedir. 24 saatlik işlem hacmi 149.405 $’tır. Fiyat son 24 saatte %3,56 gerilemiştir.

2025 1INCH Fiyat Tahmini: DeFi Toplayıcı Tokeninin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 MLN Fiyat Öngörüsü: Önümüzdeki Piyasa Döngüsünde MLN Değerini Belirleyecek Temel Faktörlerin İncelenmesi

2025 UNCX Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 EDGE Fiyat Tahmini: Bu kripto varlık yeni zirvelere ulaşacak mı yoksa düşüşle mi karşılaşacak?

2025 ITHACA Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 HFT Fiyat Tahmini: Hashflow Token’ın Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Merkeziyetsiz Borsaları Anlamak: Detaylı Bir Kılavuz

TAO'yu Keşfedin: Borsa Güncellemeleri ve Token Satın Alma için Başlangıç Rehberi