2025 BOX Fiyat Tahmini: Kripto Ekosisteminde BOX Token’in Piyasa Eğilimleri ve Gelecekteki Değerlemesinin Analizi

Giriş: BOX'un Piyasa Konumu ve Yatırım Değeri

Debox (BOX), zincir üzerindeki en büyük varlık sahibi topluluğa ve yeni nesil sosyal borsa özelliğine sahip olarak, kuruluşundan bu yana Web3 sosyal platform alanında önemli bir konuma ulaşmıştır. 2025 yılı itibarıyla BOX'un piyasa değeri $10.816.022'ye ulaşmış, yaklaşık 285.994.399 token dolaşımda olup fiyatı $0,037819 civarında seyretmektedir. “Tümleşik web3 sosyal platformu” olarak öne çıkan bu varlık, sosyal etkileşim ile kripto para ticaretini bir araya getirme konusunda giderek kritik bir rol üstlenmektedir.

Bu makalede, BOX'un 2025-2030 dönemindeki fiyat eğilimleri kapsamlı biçimde incelenecek; tarihsel modeller, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik faktörler bir arada değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. BOX Fiyat Geçmişi ve Mevcut Piyasa Durumu

BOX Fiyatının Tarihsel Seyri

- 2024: Proje lansmanı, fiyat 6 Eylül'de tüm zamanların en yüksek seviyesi olan $0,4363'e ulaştı

- 2025: Piyasa düzeltmesi, fiyat 20 Nisan'da tüm zamanların en düşük seviyesi olan $0,00348'e geriledi

BOX Mevcut Piyasa Durumu

8 Ekim 2025 itibarıyla BOX, $0,037819 seviyesinden işlem görmekte olup 24 saatlik işlem hacmi $27.577,29'dur. Token son 24 saatte %1,68 artış gösterirken, son bir haftada %19,33 oranında düşüş kaydetmiştir. Son dönemdeki kısa vadeli gerilemeye rağmen, BOX son 30 günde %372,18 oranında dikkat çekici bir büyüme sergilemiştir. Fakat yıl başından bu yana performansı -%27,07 ile negatif seyretmektedir.

BOX'un mevcut piyasa değeri $10.816.022 olup kripto para piyasasında 1372. sırada yer almaktadır. Dolaşımdaki BOX token miktarı 285.994.399, toplam arz ise 1.000.000.000'dur; dolaşım oranı %28,59'dur.

BOX'un tamamen seyreltilmiş piyasa değeri $37.819.000, tüm token arzının dolaşıma girmesi halinde büyüme potansiyeline işaret etmektedir. Token'ın genel kripto piyasasındaki hakimiyet oranı şu anda %0,00085'tir.

Mevcut BOX piyasa fiyatını görmek için tıklayın

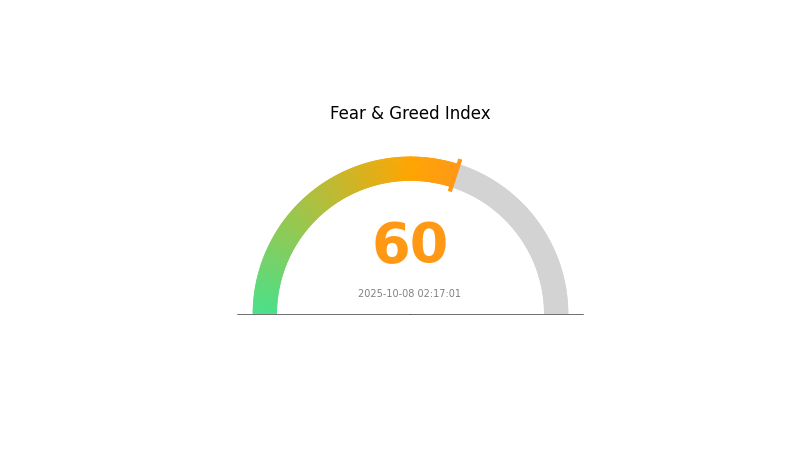

BOX Piyasa Duyarlılık Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Mevcut Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında açgözlülük hakim; Korku ve Açgözlülük Endeksi 60 seviyesine ulaştı. Bu durum yatırımcı güveninin ve iyimserliğin arttığını gösteriyor. Olumlu piyasa havası fiyatları yukarı çekebilir ancak temkinli olmak şarttır; açgözlülük genellikle düzeltmelerin öncüsüdür. Yatırımcılar, kâr al ve zarar durdur seviyelerini belirlemeli. Yeni yatırımcılar ise pozisyon almadan önce olası geri çekilmeleri beklemelidir. Çeşitlendirme ve risk yönetimi dalgalı piyasalarda her zaman kritik öneme sahiptir.

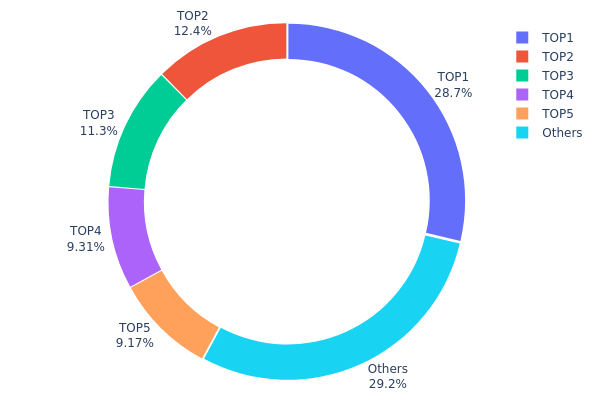

BOX Varlık Dağılımı

BOX tokenlarının önemli bir bölümü az sayıda üst adreste yoğunlaşmıştır. En büyük tutucu toplam arzın %28,68'ine sahipken, ilk 5 adres toplamda BOX tokenlarının %70,8'ini kontrol etmektedir. Bu yüksek yoğunlaşma, olası piyasa manipülasyonu ve fiyat oynaklığı riskini artırmaktadır.

Bu merkeziyetçi dağılım, BOX'un piyasa dinamiklerini önemli ölçüde etkileyebilir. Tokenların birkaç elde toplanması, büyük tutucuların ticaret hacmiyle piyasayı ciddi şekilde etkileyebileceği için fiyat oynaklığını artırabilir. Ayrıca, bu dağılım daha düşük merkeziyetsizlik anlamına gelir ve tokenın genel istikrarını, piyasa şoklarına karşı dayanıklılığını olumsuz etkileyebilir.

Mevcut adres dağılımı piyasayı az sayıda büyük tutucunun hareketlerine karşı kırılgan hale getirir. Bu yoğunlaşma, kısa vadede fiyat istikrarı sağlasa da BOX ekosisteminin uzun vadeli sağlığını riske atar. Tokenın daha fazla adrese yayılması, piyasa dayanıklılığını ve bütünlüğünü artıracaktır.

Mevcut BOX varlık dağılımını görmek için tıklayın

| En Üst | Adres | Tutulan Adet | Tutulan (%) |

|---|---|---|---|

| 1 | 0x7c9e...308f55 | 286.805,56K | 28,68% |

| 2 | 0x4a32...6202c9 | 123.958,89K | 12,39% |

| 3 | 0xa0c3...90a2ad | 112.773,17K | 11,27% |

| 4 | 0xe3b6...ed4b26 | 93.071,52K | 9,30% |

| 5 | 0xd32f...355da4 | 91.666,67K | 9,16% |

| - | Diğerleri | 291.724,19K | 29,2% |

II. Gelecekteki BOX Fiyatlarını Etkileyen Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Federal Reserve ve Avrupa Merkez Bankası gibi büyük merkez bankaları sıkılaştırmaya ara vererek olası faiz indirimleri sinyali verdi. Düşük faiz oranları, getirisi olmayan varlıkların elde tutulmasının maliyetini azaltarak genellikle altına talebi artırır.

-

Enflasyon Koruma Özellikleri: Enflasyon sabit kalırken ekonomik göstergeler zayıflarsa, altın fiyatlarında yukarı yönlü potansiyel oluşabilir.

-

Jeopolitik Faktörler: Orta Doğu’daki çatışmalar ve büyük ekonomilerdeki seçim belirsizlikleri gibi devam eden jeopolitik riskler, altına güvenli liman talebini destekliyor.

Kurumsal ve Büyük Oyuncu Dinamikleri

-

Kurumsal Varlıklar: Özellikle Çin ve Hindistan’daki merkez bankaları, küresel jeopolitik değişimler nedeniyle rezervlerini çeşitlendirirken altın alımlarını sürdürüyor.

-

Kurumsal Benimseme: Asya'da perakende talep, özellikle altın takı tarafında güçlü seyrini koruyor.

Teknik Gelişmeler ve Ekosistem Oluşumu

- Piyasa Duyarlılığı: Batı piyasalarında yatırım akışları, getiri hareketleri ve makroekonomik verilere daha bağlıdır.

III. 2025-2030 Dönemi BOX Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: $0,02459 - $0,03000

- Tarafsız tahmin: $0,03500 - $0,04000

- İyimser tahmin: $0,04500 - $0,05031 (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Olası büyüme dönemi

- Fiyat aralığı:

- 2027: $0,03596 - $0,05754

- 2028: $0,04612 - $0,07123

- Temel katalizörler: Benimsenme artışı, piyasa toparlanması, proje gelişmeleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $0,06124 - $0,07624 (istikrarlı piyasa büyümesi varsayımı)

- İyimser senaryo: $0,09124 - $0,10368 (güçlü piyasa performansı varsayımı)

- Dönüştürücü senaryo: $0,11000 - $0,12000 (istisnai proje başarısı ve piyasa koşulları)

- 2030-12-31: BOX $0,10368 (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Yüzde Değişim |

|---|---|---|---|---|

| 2025 | 0,05031 | 0,03783 | 0,02459 | 0 |

| 2026 | 0,04583 | 0,04407 | 0,02644 | 16 |

| 2027 | 0,05754 | 0,04495 | 0,03596 | 18 |

| 2028 | 0,07123 | 0,05124 | 0,04612 | 35 |

| 2029 | 0,09124 | 0,06124 | 0,04409 | 61 |

| 2030 | 0,10368 | 0,07624 | 0,05337 | 101 |

IV. BOX için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BOX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Uzun vadeli değer yatırımcıları

- İşlem önerileri:

- Piyasa geri çekilmelerinde BOX token biriktirin

- Piyasa oynaklığını aşmak için en az 1-2 yıl tutun

- Tokenları güvenli bir donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım seviyelerini ölçer

- Swing trade için ana noktalar:

- Teknik göstergelere dayalı net giriş ve çıkış noktaları belirleyin

- Potansiyel kayıpları sınırlamak için zarar durdur emri kullanın

BOX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyonel yatırımcılar: Portföyün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlık arasında dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Cüzdan

- Soğuk saklama alternatifi: Uzun vadeli saklama için kağıt cüzdan

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, özel anahtarları güvenli saklayın

V. BOX için Potansiyel Riskler ve Zorluklar

BOX Piyasa Riskleri

- Yüksek oynaklık: Kripto para piyasalarında hızlı fiyat değişimleri yaygındır

- Sınırlı likidite: BOX, büyük kripto paralara göre daha düşük işlem hacmine sahip olabilir

- Piyasa duyarlılığı: Yatırımcı psikolojisindeki ani değişimlere açıktır

BOX Düzenleyici Riskler

- Belirsiz regülasyon ortamı: BOX'u etkileyebilecek yeni düzenleme ihtimali

- Sınır ötesi uyum: Farklı ülkelerde değişen regülasyonlar

- Vergi etkileri: Kripto para işlemlerinde değişen vergi mevzuatı

BOX Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda istismar olasılığı

- Ağ tıkanıklığı: Yoğun kullanımda yüksek işlem ücretleri veya gecikmeler

- Teknolojik geri kalma: Daha yeni blockchain teknolojilerinin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

BOX Yatırım Değeri Analizi

BOX, Web3 sosyal platform alanında yüksek riskli ve yüksek potansiyelli bir yatırım fırsatı sunar. Uzun vadeli değer önerisi güçlü olsa da, kısa vadeli oynaklık ve regülasyon belirsizlikleri önemli riskler taşır.

BOX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük hacimli pozisyonlarla başlayın, projeyi öğrenmeye ve anlamaya odaklanın ✅ Deneyimli yatırımcılar: Kripto portföyünüzün bir bölümünü BOX'a ayırmayı düşünün, maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı analiz ve durum tespiti yapın, BOX'u çeşitlendirilmiş kripto stratejisinin bir parçası olarak değerlendirin

BOX Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden BOX token alım-satım yapın

- Staking: Varsa staking programlarına katılarak ek ödüller elde edin

- Sosyal işlem: DeBox topluluğunda aktif olun, proje gelişmelerini yakından takip edin

Kripto para yatırımları oldukça yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

SSS

BOX token alınır mı?

Evet, BOX token güçlü büyüme potansiyeli ve sağlam finansal yapısıyla mevcut piyasa koşullarında portföyünüze iyi bir ek olabilir.

BOX token için hedef fiyat nedir?

BOX token için ortalama hedef fiyat $38,14 olup; son analist tahminlerine göre en yüksek tahmin $45,00 seviyesindedir.

Boxabl için 2030 token fiyatı tahmini nedir?

Mevcut eğilimlere göre, Boxabl'ın token fiyatının 2030 yılına kadar önemli ölçüde artması ve $50-$100 aralığına ulaşması beklenmektedir.

BOX token değeri nedir?

Ekim 2025 itibarıyla BOX token, önceki kapanışa göre %2,86 artışla $33,07 seviyesinden işlem görmektedir.

2025 XCN Fiyat Tahmini: XCN Token, Yarılanma Sonrası Boğa Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 XCN Fiyat Tahmini: Değişen Kripto Ekosisteminde XCN’in Piyasa Trendleri ve Potansiyel Büyüme Dinamiklerinin Analizi

LAUNCHCOIN nedir: Kripto yatırımlarının geleceğini yeniden şekillendiren devrim niteliğindeki dijital para birimi

SCARCITY nedir: Tüketici davranışını ve piyasa dinamiklerini şekillendiren gizli güç

CHEEL nedir: Kapsamlı Sağlık ve Çevre Mühendisliği Laboratuvarı hakkında kapsamlı bir anlayış

2025 ATA Fiyat Tahmini: Automata Network için Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak

Ethereum Name Service Alan Adlarını Satın Alma ve Yönetme Yöntemleri