2025 ALDPrice Prediction: Comprehensive Analysis and Market Forecasts for the Coming Bull Run

Introduction: ALD's Market Position and Investment Value

AladdinDAO (ALD) as a decentralized asset management platform, has achieved significant progress in the DeFi sector since its inception in 2021. As of 2025, AladdinDAO's market capitalization has reached $12,323,677, with a circulating supply of approximately 149,831,946 tokens, and a price hovering around $0.08225. This asset, known as a "DeFi innovation catalyst," is playing an increasingly crucial role in decentralized finance and risk management.

This article will comprehensively analyze AladdinDAO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. ALD Price History Review and Current Market Status

ALD Historical Price Evolution Trajectory

- 2021: Initial launch, price reached ATH of $1.37 on September 11

- 2022-2024: Market fluctuations, price gradually declined

- 2025: Reached ATL of $0.01759207 on April 9, followed by significant recovery

ALD Current Market Situation

As of October 8, 2025, ALD is trading at $0.08225. The token has shown mixed performance across different timeframes:

- 1-hour change: -0.05%

- 24-hour change: -3.52%

- 7-day change: +17.33%

- 30-day change: -13.66%

- 1-year change: +200.73%

ALD's market cap stands at $12,323,677, ranking 1320th in the overall cryptocurrency market. The circulating supply is 149,831,946.77 ALD, which is 99.89% of the total supply of 149,991,806.39 ALD. The fully diluted market cap is $12,337,500.

The token is currently trading significantly below its all-time high, but has shown strong recovery over the past year. The recent 7-day performance indicates potential short-term bullish momentum.

Click to view the current ALD market price

ALD Market Sentiment Indicator

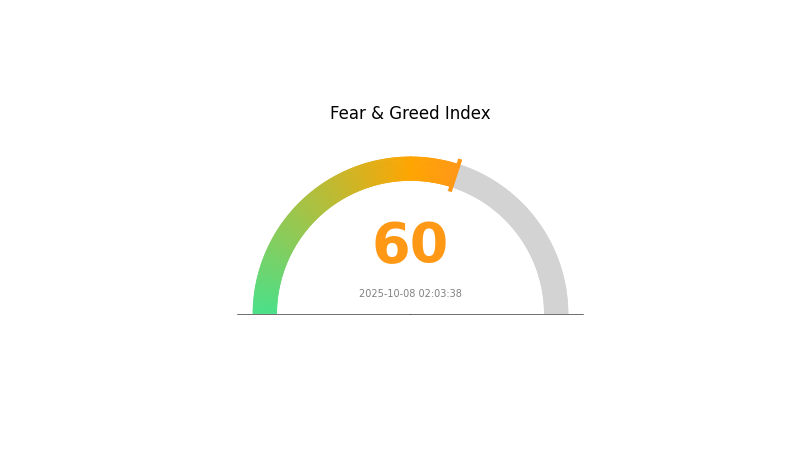

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of greed, with the Fear and Greed Index at 60. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, caution is advised as excessive greed can lead to market corrections. Traders should consider taking profits or setting stop-losses to protect gains. Keep an eye on key resistance levels and market fundamentals. As always, diversification and risk management are crucial in navigating these market conditions.

ALD Holdings Distribution

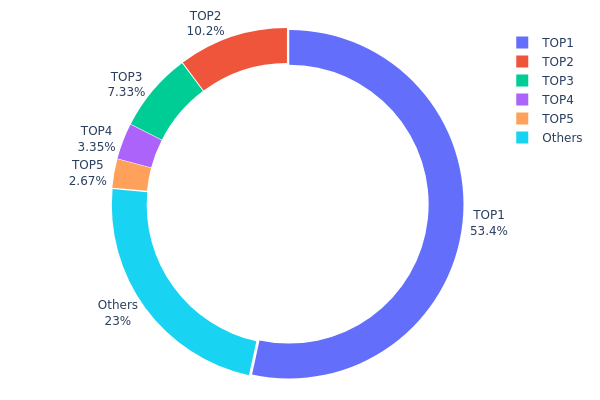

The address holdings distribution data for ALD reveals a highly concentrated ownership structure. The top address holds a significant 53.42% of the total supply, amounting to 80,125.99K tokens. This is followed by the second and third largest holders with 10.19% and 7.32% respectively. Collectively, the top five addresses control 76.93% of ALD tokens, indicating a substantial centralization of ownership.

This concentration level raises concerns about potential market manipulation and price volatility. With over half of the tokens held by a single address, any large-scale transactions from this wallet could significantly impact ALD's market dynamics. The high concentration also suggests a lower degree of decentralization, which may affect the token's resilience to external shocks and its overall market stability.

Despite these centralization risks, it's worth noting that 23.07% of tokens are distributed among other addresses, providing some level of diversification. However, the current distribution pattern indicates that ALD's on-chain structure and market behavior are likely to be heavily influenced by a small number of large holders, potentially affecting its long-term sustainability and adoption as a decentralized asset.

Click to view the current ALD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7107...d6aa2c | 80125.99K | 53.42% |

| 2 | 0xcb57...cf3e14 | 15285.76K | 10.19% |

| 3 | 0xbdfa...2b5a76 | 10989.51K | 7.32% |

| 4 | 0x78db...15ad23 | 5020.28K | 3.34% |

| 5 | 0x8bed...ff9ed9 | 4000.00K | 2.66% |

| - | Others | 34570.26K | 23.07% |

II. Key Factors Affecting ALD's Future Price

Supply Mechanism

- Semiconductor Demand: The growth of the semiconductor industry drives up demand for ALD, as semiconductors are a major component or application of ALD.

- Historical Pattern: Past increases in semiconductor demand have led to growth in the ALD market.

- Current Impact: Expected increase in semiconductor industry demand is likely to boost ALD demand.

Macroeconomic Environment

- Geopolitical Factors: Geopolitical tensions and their impact on the overall economy can affect the expansion of wafer foundries, potentially influencing ALD demand.

- Natural Disasters: Major natural disasters can impact the progress of advanced process technologies, affecting the ALD market.

Technological Developments and Ecosystem Building

- Advanced Process Technologies: The progress of advanced process technologies in semiconductor manufacturing is crucial for ALD market growth.

- New Production Capacity: The launch of new ALD production capacity can significantly impact market supply and price dynamics.

III. ALD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.06911 - $0.08227

- Neutral prediction: $0.08227 - $0.09626

- Optimistic prediction: $0.09626 - $0.11024 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.11204 - $0.16633

- 2028: $0.09442 - $0.1691

- Key catalysts: Technological advancements, wider industry partnerships, and improved market conditions

2029-2030 Long-term Outlook

- Base scenario: $0.15501 - $0.19144 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.19144 - $0.22787 (assuming strong market performance and significant adoption)

- Transformative scenario: $0.22787 - $0.24504 (assuming breakthrough innovations and mainstream acceptance)

- 2030-12-31: ALD $0.24504 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11024 | 0.08227 | 0.06911 | 0 |

| 2026 | 0.13476 | 0.09626 | 0.05872 | 17 |

| 2027 | 0.16633 | 0.11551 | 0.11204 | 40 |

| 2028 | 0.1691 | 0.14092 | 0.09442 | 71 |

| 2029 | 0.22787 | 0.15501 | 0.13486 | 88 |

| 2030 | 0.24504 | 0.19144 | 0.09955 | 132 |

IV. ALD Professional Investment Strategy and Risk Management

ALD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in DeFi

- Operation suggestions:

- Accumulate ALD during market dips

- Participate in AladdinDAO governance

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to limit downside risk

ALD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Option strategies: Use options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use offline storage for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ALD

ALD Market Risks

- High volatility: ALD price can fluctuate dramatically

- Limited liquidity: May face challenges in large-volume trading

- Competition: Increasing number of DeFi projects may impact market share

ALD Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting DeFi

- Cross-border compliance: Varying regulations across jurisdictions

- KYC/AML requirements: Possible future implementation in DeFi space

ALD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Limitations of Ethereum network may impact growth

- Oracle dependencies: Risks associated with external data sources

VI. Conclusion and Action Recommendations

ALD Investment Value Assessment

ALD presents a unique opportunity in the DeFi space, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

ALD Investment Recommendations

✅ Beginners: Start with small positions, focus on learning DeFi concepts

✅ Experienced investors: Consider dollar-cost averaging and active participation in AladdinDAO

✅ Institutional investors: Explore strategic partnerships and large-scale liquidity provision

Ways to Participate in ALD Trading

- Spot trading: Buy and sell ALD on Gate.com

- Staking: Participate in AladdinDAO's staking programs

- Governance: Engage in AladdinDAO's decision-making processes

Cryptocurrency investments are extremely risky. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ALD a good buy?

ALD appears to be a promising investment. With 14 Buy ratings and an average price target of $214.91, analysts are optimistic about its potential for growth.

What is the price target for ALT in 2025?

Based on analyst forecasts, ALT's price target for 2025 is estimated to be around $15-20 per share, considering projected earnings and market conditions.

What is the price prediction for API3 in 2026?

Based on forecasts, API3 is expected to reach a minimum price of $0.8567 and an average price of $0.935 per coin in 2026.

What is the price prediction for alt crypto in 2030?

Based on current market analysis, the price prediction for alt crypto in 2030 ranges from $0.000525 to $0.000902.

Share

Content