Asiftahsin

แชร์การวิเคราะห์ตลาดที่เกี่ยวกับคริปโต แชร์ความรู้ที่เกี่ยวกับคริปโตสำหรับผู้ติดตามของฉัน (พี่ชายและน้องสาว)

Asiftahsin

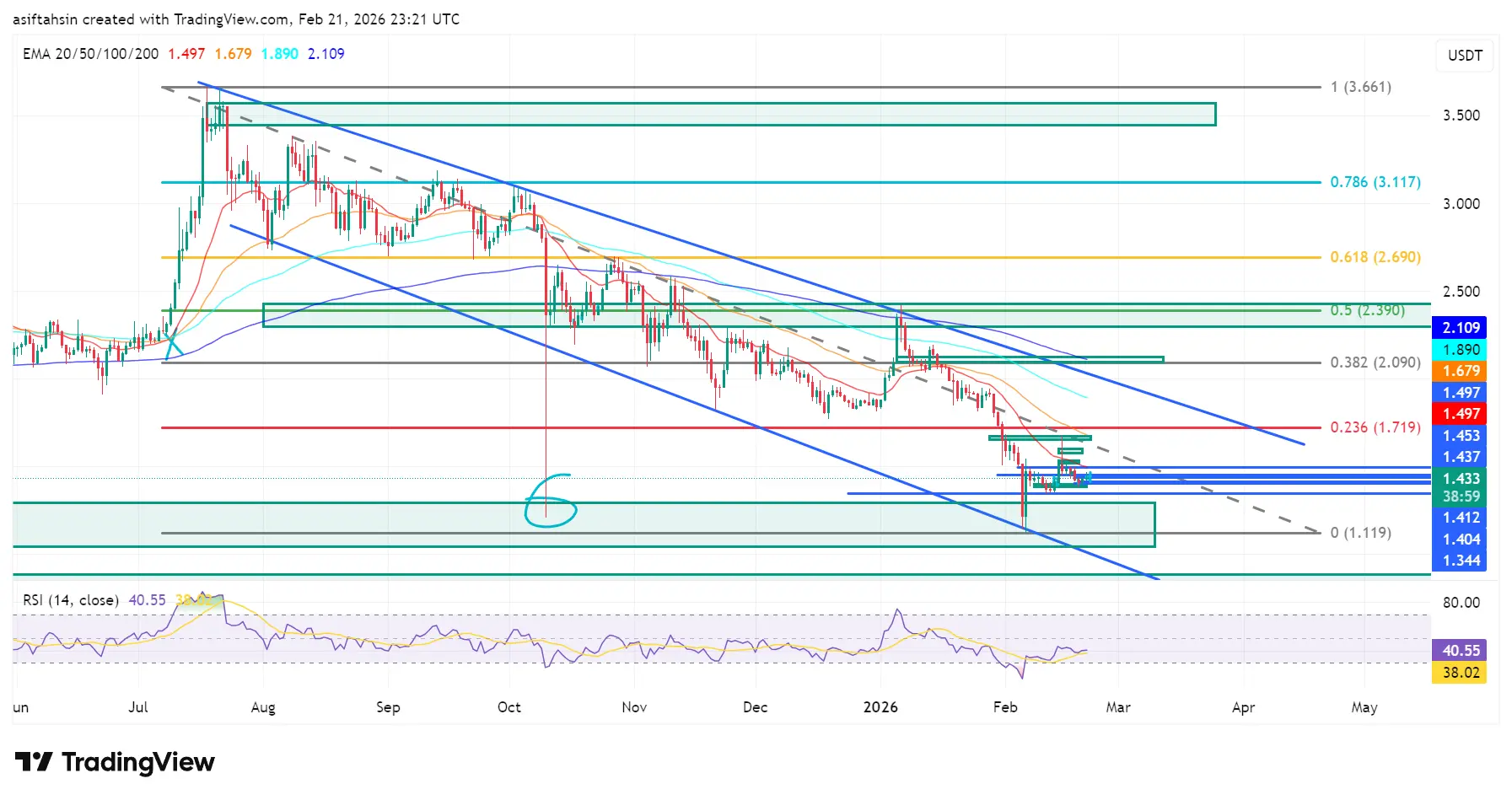

แนวโน้มทางเทคนิคของ XRP: รวมตัวเหนือฐานแมโครภายในช่องทางลง

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธจากกลุ่มแนวต้านที่ $2.39–$2.69 (โซน Fibonacci 0.5–0.618).

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($2.09) ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($1.719) ทำให้เกิดการต่อเนื่องของแนวโน้มขาลงอย่างแข็งแกร่ง

ราคาขณะนี้กำลังรวมตัวอยู่ในช่วงประมาณ $1.34–$1.46 โดยอยู่เหนือระดับ Fibonacci แมโครที่ 0 ที่ $1.119

นี่เป็นบริเวณแนวรับสำคัญในช่วงเวลาที่สูงขึ้น

โครงสร้าง EMA (แนวโน้มขาลง)

20 EMA: $1.460

50 EMA: $1.635

100 EMA: $1.851

200 EMA: $2.081

XRP ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแน

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธจากกลุ่มแนวต้านที่ $2.39–$2.69 (โซน Fibonacci 0.5–0.618).

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($2.09) ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($1.719) ทำให้เกิดการต่อเนื่องของแนวโน้มขาลงอย่างแข็งแกร่ง

ราคาขณะนี้กำลังรวมตัวอยู่ในช่วงประมาณ $1.34–$1.46 โดยอยู่เหนือระดับ Fibonacci แมโครที่ 0 ที่ $1.119

นี่เป็นบริเวณแนวรับสำคัญในช่วงเวลาที่สูงขึ้น

โครงสร้าง EMA (แนวโน้มขาลง)

20 EMA: $1.460

50 EMA: $1.635

100 EMA: $1.851

200 EMA: $2.081

XRP ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแน

XRP-5.69%

- รางวัล

- 5

- 9

- repost

- แชร์

GateUser-f0a66e66 :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

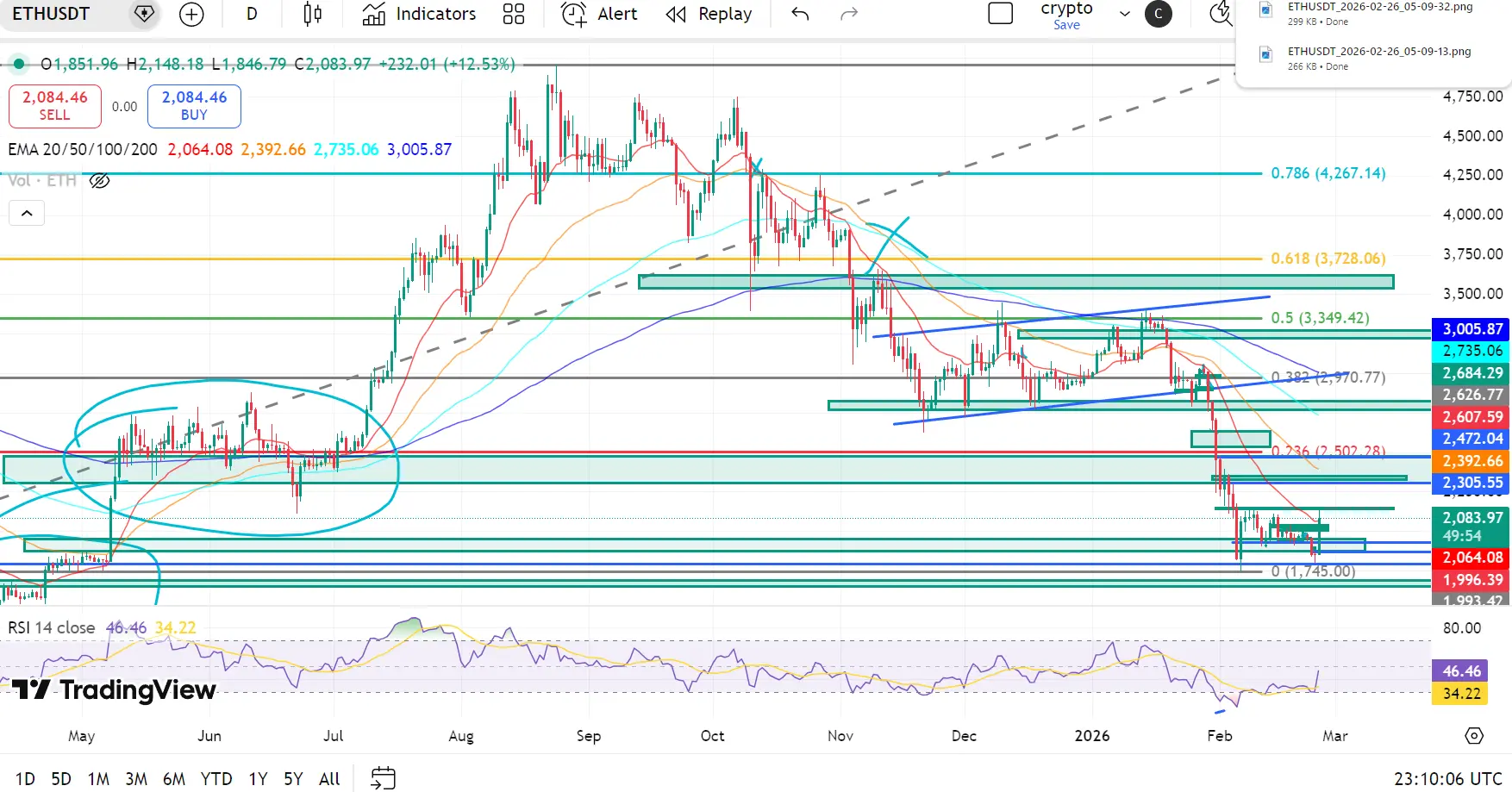

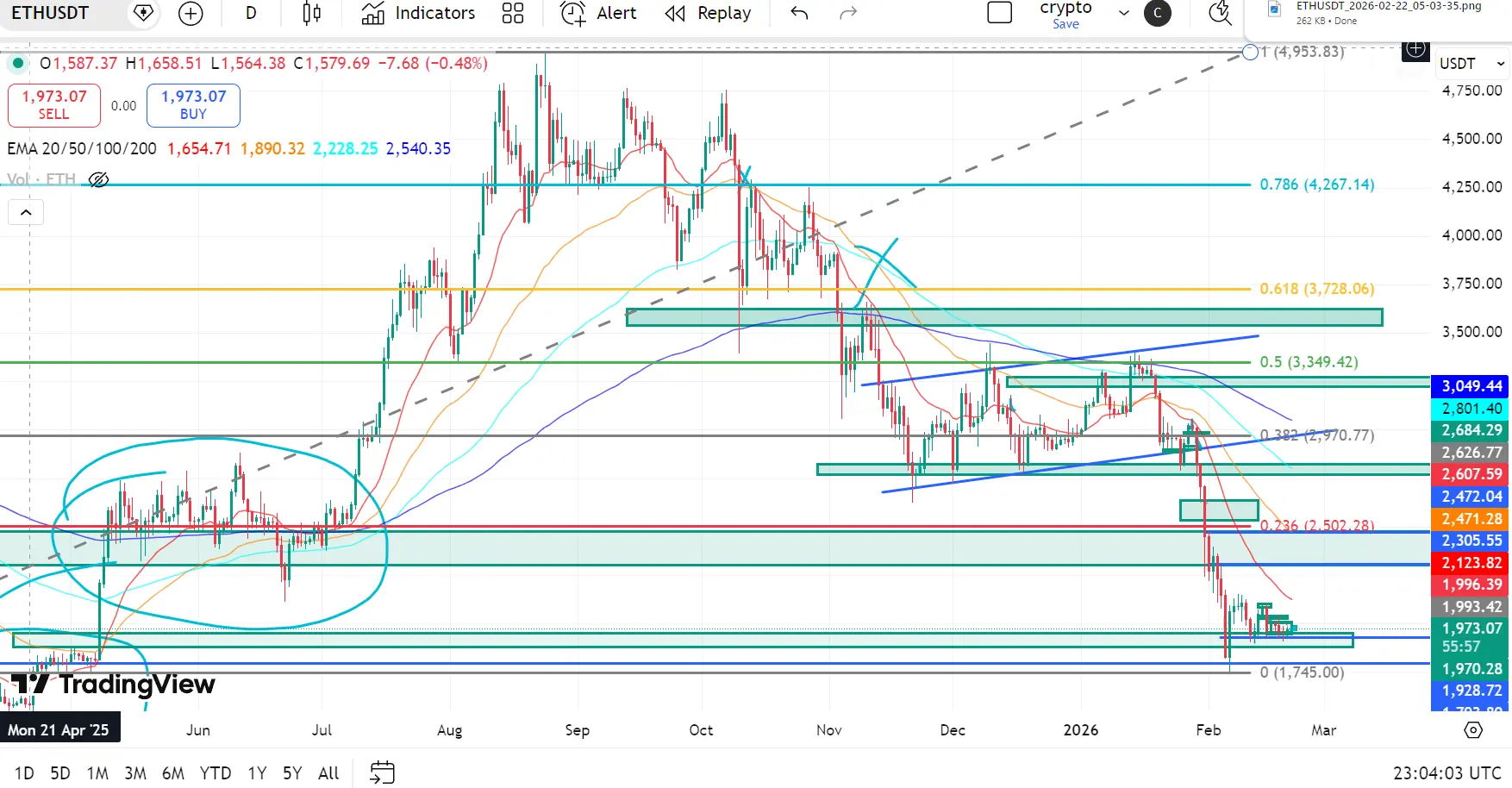

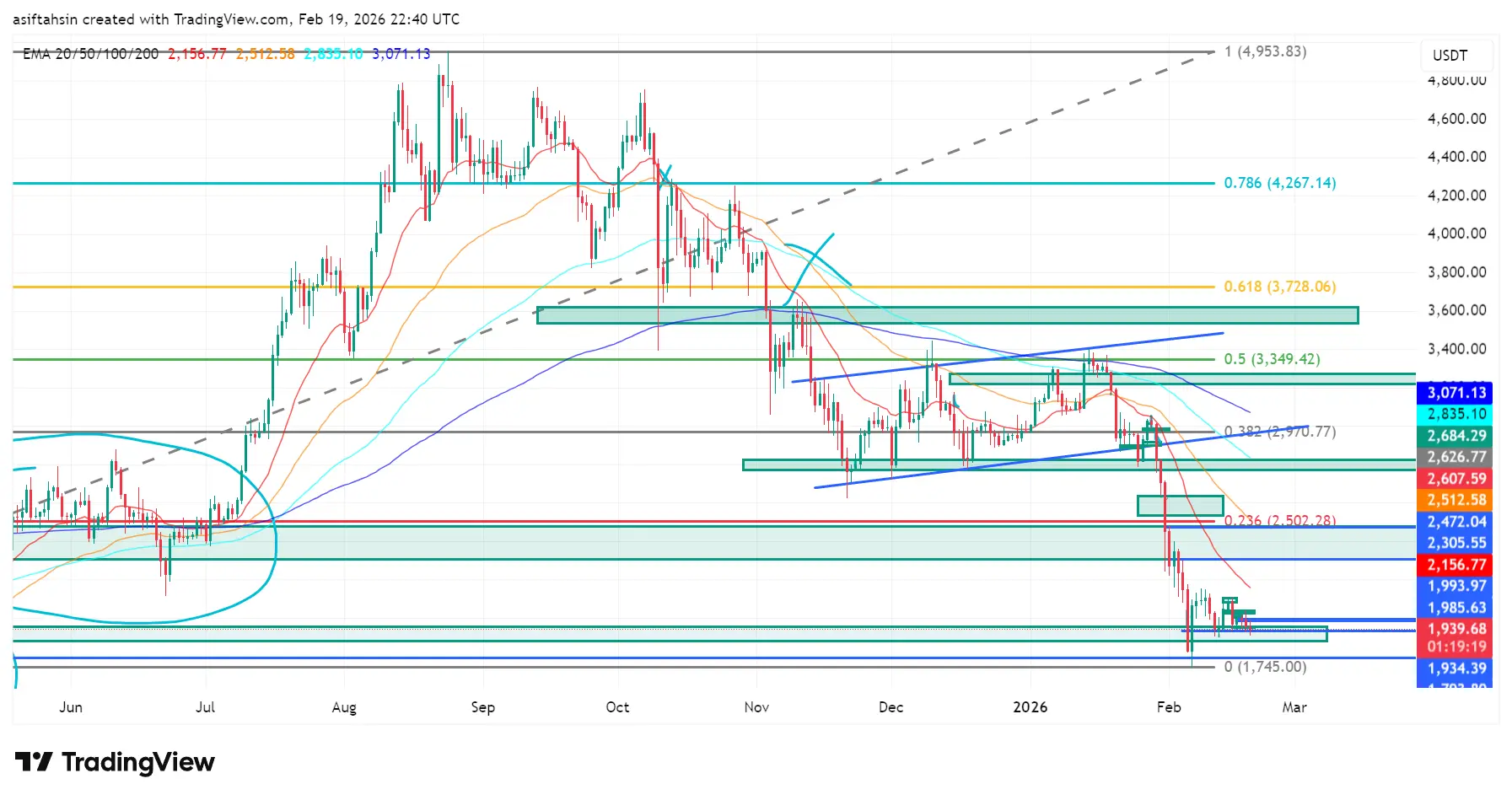

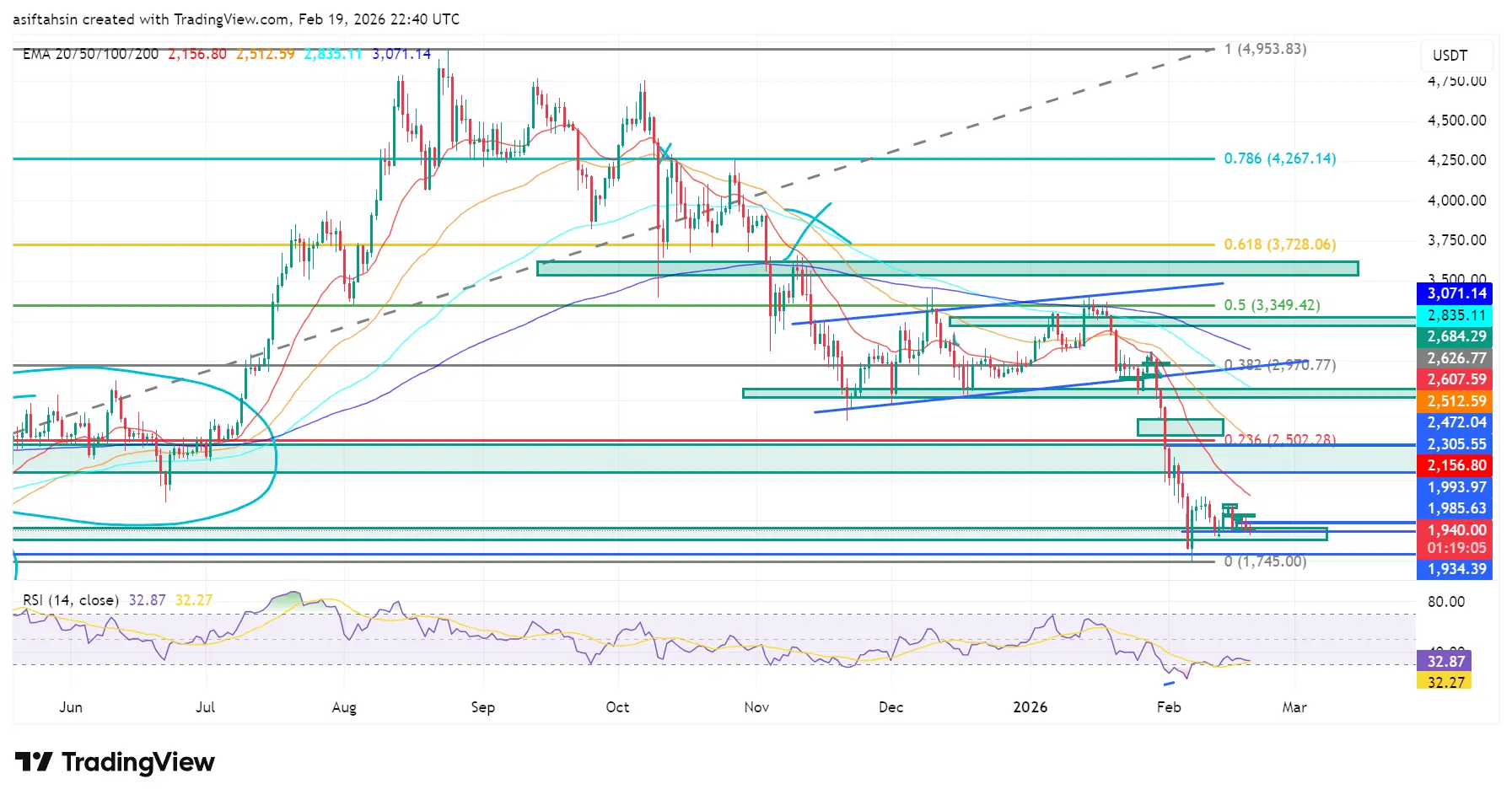

แนวโน้มทางเทคนิคของ ETH: ซื้อขายอยู่เหนือฐานแมโครหลังจากการร่วงลงครั้งใหญ่

Ethereum ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน (0.5–0.618 โซน Fibonacci) ที่ระดับ $3,349–$3,728

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($2,970) ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($2,502) ทำให้เกิดการต่อเนื่องของแนวโน้มขาลงอย่างรุนแรง

ราคาขณะนี้กำลังรวมตัวอยู่ในช่วงประมาณ $1,990–$2,080 ลอยอยู่เหนือระดับ Fibonacci แมโครที่ 0 ที่ $1,745

นี่เป็นโซนแนวรับสำคัญในกรอบเวลาที่สูงขึ้น

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,064

EMA 50: $2,392

EMA 100: $2,735

EMA 200: $3,005

ETH ซื้อขายต

Ethereum ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน (0.5–0.618 โซน Fibonacci) ที่ระดับ $3,349–$3,728

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($2,970) ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($2,502) ทำให้เกิดการต่อเนื่องของแนวโน้มขาลงอย่างรุนแรง

ราคาขณะนี้กำลังรวมตัวอยู่ในช่วงประมาณ $1,990–$2,080 ลอยอยู่เหนือระดับ Fibonacci แมโครที่ 0 ที่ $1,745

นี่เป็นโซนแนวรับสำคัญในกรอบเวลาที่สูงขึ้น

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,064

EMA 50: $2,392

EMA 100: $2,735

EMA 200: $3,005

ETH ซื้อขายต

ETH-3.41%

- รางวัล

- 2

- แสดงความคิดเห็น

- repost

- แชร์

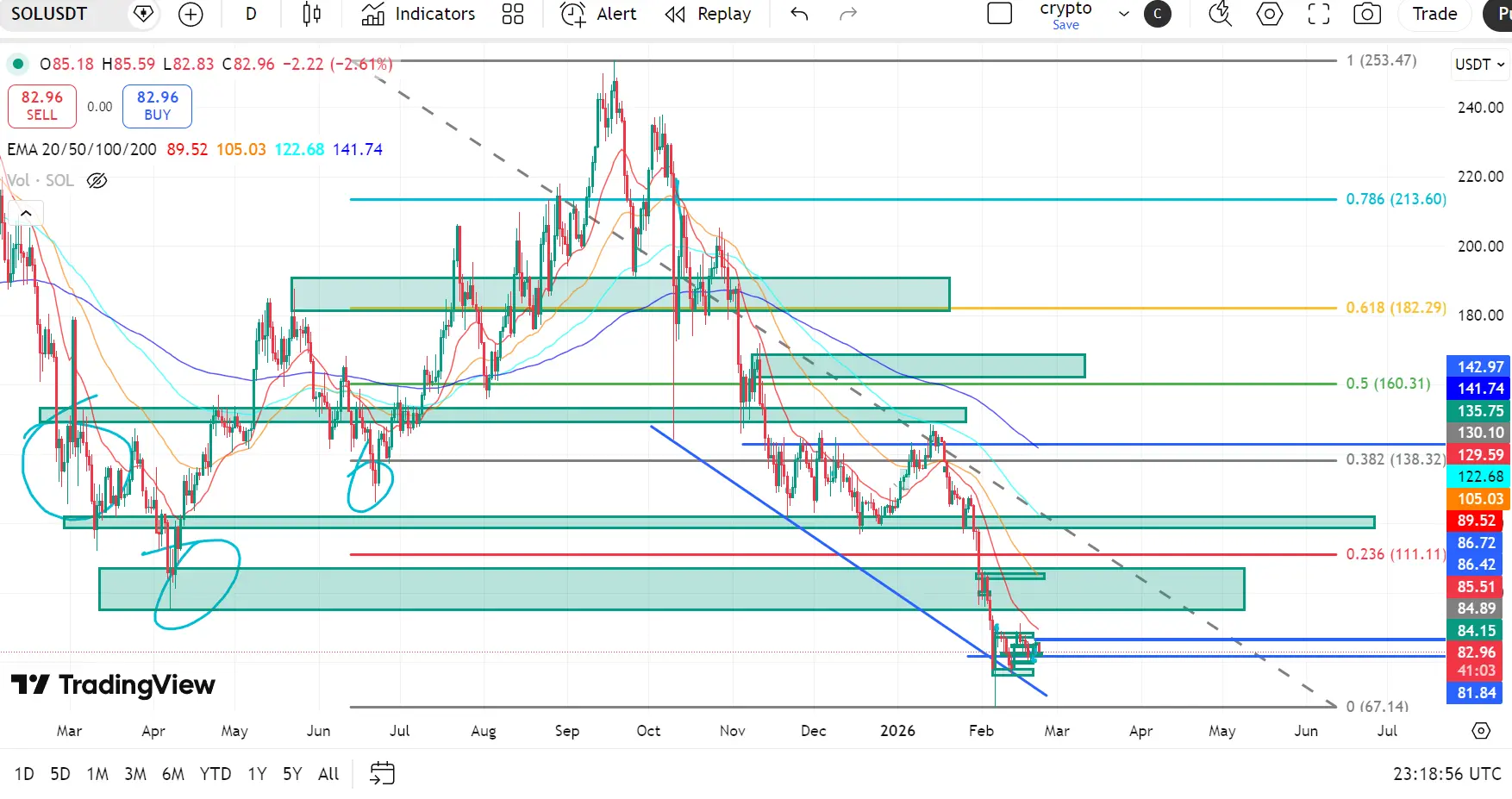

แนวโน้มทางเทคนิคของ SOL: การล่มสลายสู่ฐานแมโคราหลังการสูญเสีย 0.236

Solana ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $182 160–(0.5–0.618 โซน Fibonacci).

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($138.32) ตามด้วยการล่มสลายอย่างเด็ดขาดต่ำกว่า 0.236 ($111.11) ทำให้เกิดแรงกดดันด้านลบเร่งด่วน.

ราคาขณะนี้ซื้อขายอยู่ที่ประมาณ $78–$84 เข้าสู่ระดับ Fibonacci แมโคราที่ 0 ที่ $67.14.

นี่คือโซนแนวรับสำคัญในกรอบเวลาระยะยาว

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $87.53

EMA 50: $102.99

EMA 100: $120.95

EMA 200: $140.48

SOL ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงที่แข็งแกร

Solana ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $182 160–(0.5–0.618 โซน Fibonacci).

ความล้มเหลวในการรักษาเสถียรภาพเหนือ 0.382 ($138.32) ตามด้วยการล่มสลายอย่างเด็ดขาดต่ำกว่า 0.236 ($111.11) ทำให้เกิดแรงกดดันด้านลบเร่งด่วน.

ราคาขณะนี้ซื้อขายอยู่ที่ประมาณ $78–$84 เข้าสู่ระดับ Fibonacci แมโคราที่ 0 ที่ $67.14.

นี่คือโซนแนวรับสำคัญในกรอบเวลาระยะยาว

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $87.53

EMA 50: $102.99

EMA 100: $120.95

EMA 200: $140.48

SOL ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงที่แข็งแกร

SOL-4.03%

- รางวัล

- 8

- 7

- repost

- แชร์

NewName :

:

ขอบคุณสำหรับข้อมูล!ดูเพิ่มเติม

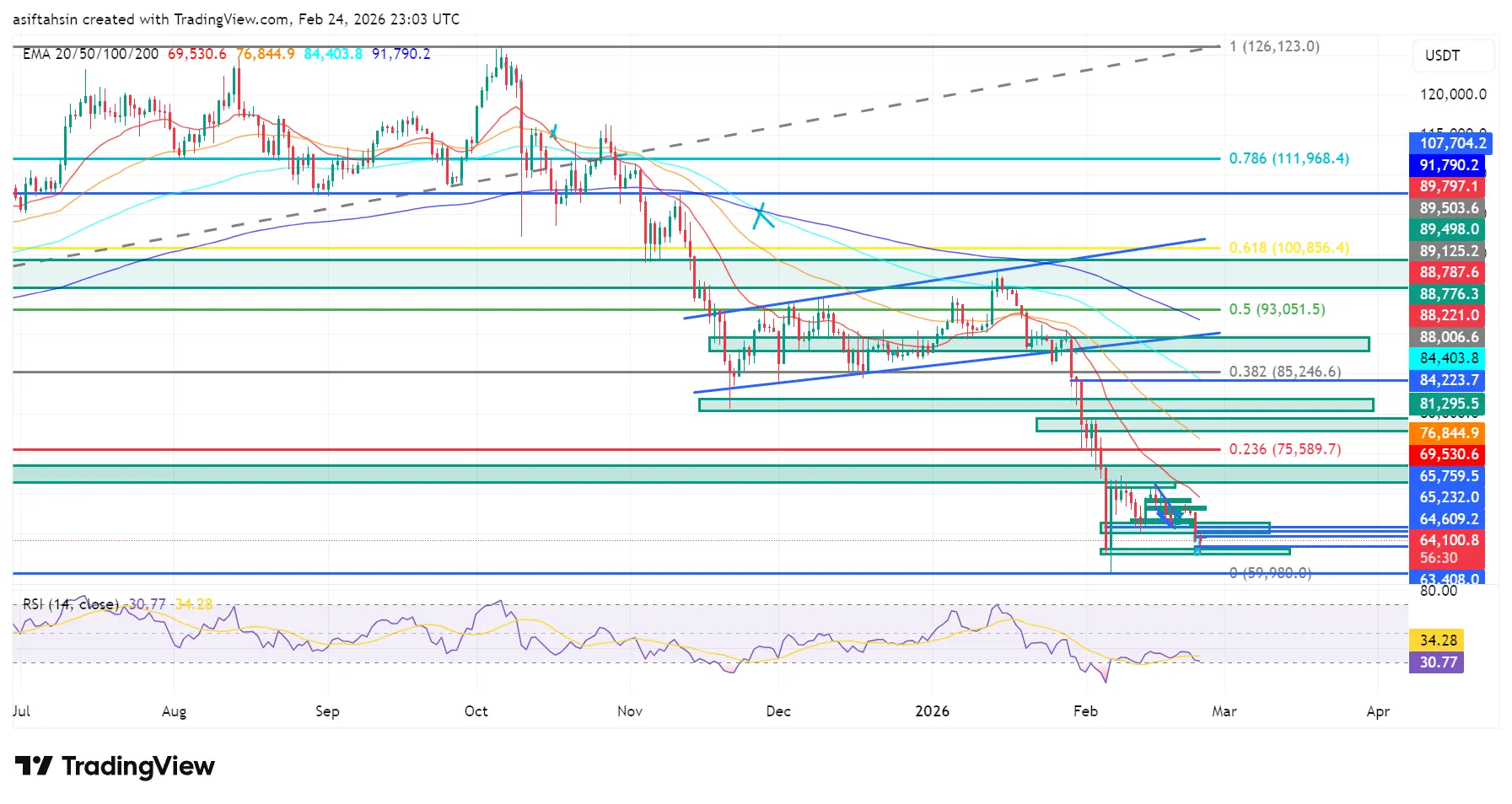

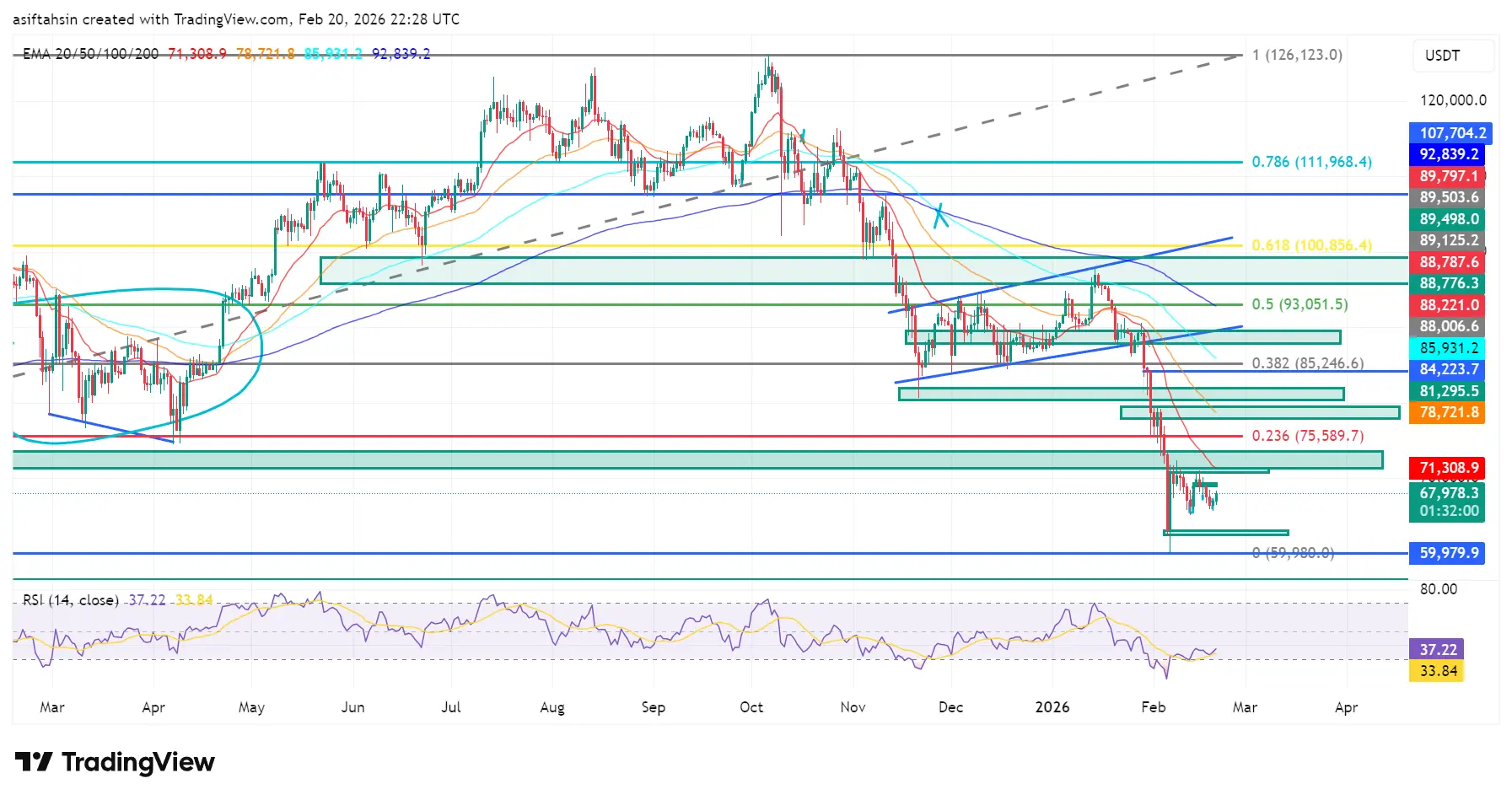

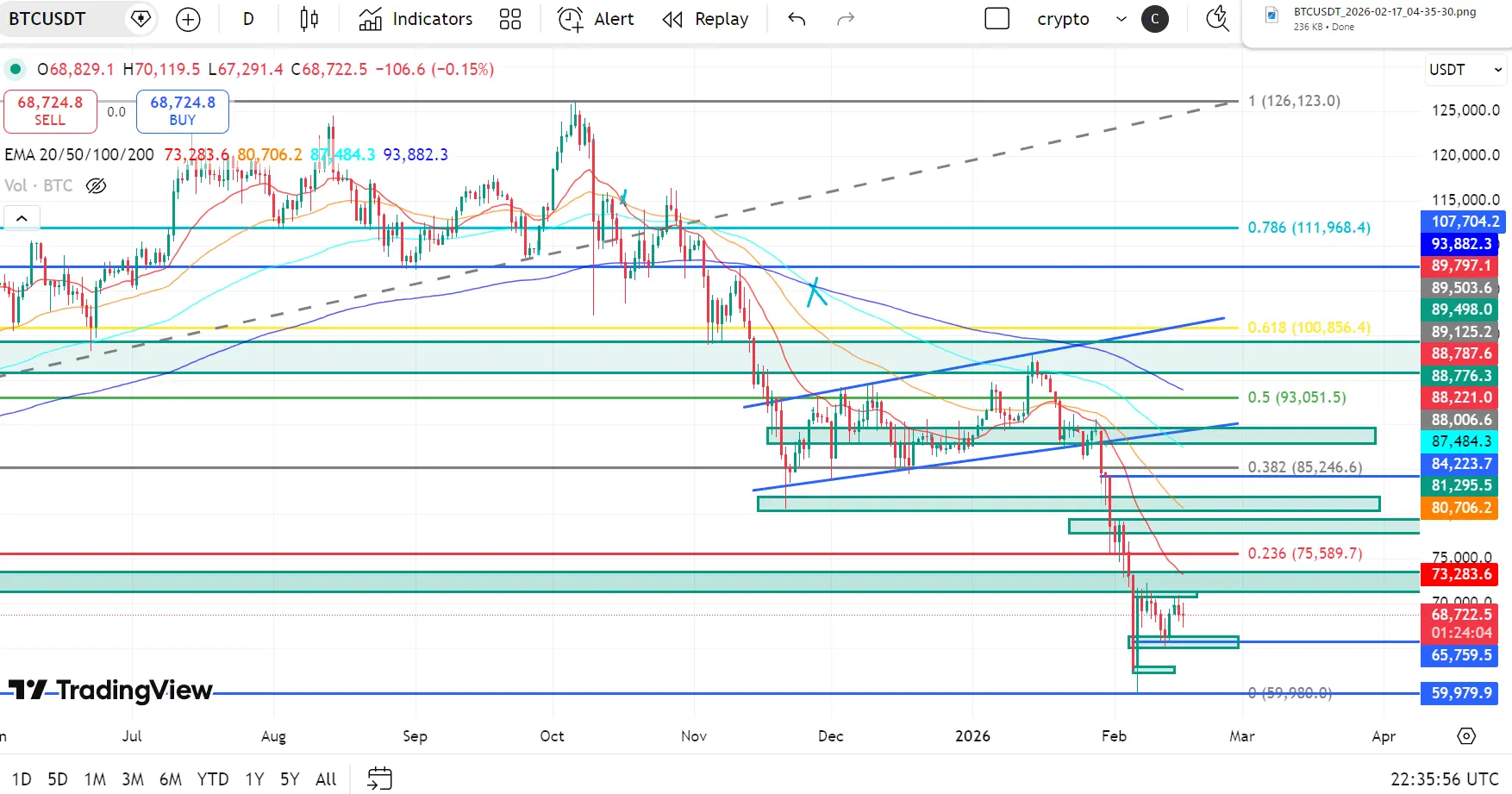

แนวโน้มทางเทคนิคของ BTC: รวมตัวใกล้ฐานแมโครหลังจากการร่วงลงของ 0.236

Bitcoin ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $100K 93K–(0.5–0.618 โซน Fibonacci).

การร่วงลงอย่างเด็ดขาดต่ำกว่า 0.382 ($85,246) และต่อมาคือการสูญเสีย 0.236 ($75,589) กระตุ้นแรงกดดันด้านลบที่เร่งขึ้น ทำให้ BTC เคลื่อนตัวไปยังแนวรับแมโคร

ปัจจุบัน BTC กำลังรวมตัวอยู่รอบๆ $64K–$66K, ลอยอยู่เหนือจุด Fibonacci แมโครที่ระดับ 0 ที่ $59,980

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $69,530

EMA 50: $76,844

EMA 100: $84,403

EMA 200: $91,790

BTC ซื้อขายต่ำกว่า EMA หลักทั้

Bitcoin ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $100K 93K–(0.5–0.618 โซน Fibonacci).

การร่วงลงอย่างเด็ดขาดต่ำกว่า 0.382 ($85,246) และต่อมาคือการสูญเสีย 0.236 ($75,589) กระตุ้นแรงกดดันด้านลบที่เร่งขึ้น ทำให้ BTC เคลื่อนตัวไปยังแนวรับแมโคร

ปัจจุบัน BTC กำลังรวมตัวอยู่รอบๆ $64K–$66K, ลอยอยู่เหนือจุด Fibonacci แมโครที่ระดับ 0 ที่ $59,980

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $69,530

EMA 50: $76,844

EMA 100: $84,403

EMA 200: $91,790

BTC ซื้อขายต่ำกว่า EMA หลักทั้

BTC-3.08%

- รางวัล

- 4

- 4

- repost

- แชร์

Ryakpanda :

:

2026 เร่งด่วน 👊ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ XRP: ยืนเหนือฐานแมโครภายในช่องทางลงที่ลดลง

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธจากกลุ่มแนวต้านที่ $2.39–$2.69 (โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า 0.382 ($2.09) และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ($1.719) เร่งแรงกดดันด้านล่าง ทำให้ราคาดิ่งลงสู่แนวรับแมโคร

ปัจจุบัน XRP กำลังรวมตัวอยู่ที่ประมาณ $1.34–$1.36 ลอยอยู่เหนือระดับ Fibonacci 0 ของแมโครที่ $1.119

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $1.474

EMA 50: $1.656

EMA 100: $1.870

EMA 200: $2.094

XRP ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงต่อเนื่องในทุก

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธจากกลุ่มแนวต้านที่ $2.39–$2.69 (โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า 0.382 ($2.09) และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ($1.719) เร่งแรงกดดันด้านล่าง ทำให้ราคาดิ่งลงสู่แนวรับแมโคร

ปัจจุบัน XRP กำลังรวมตัวอยู่ที่ประมาณ $1.34–$1.36 ลอยอยู่เหนือระดับ Fibonacci 0 ของแมโครที่ $1.119

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $1.474

EMA 50: $1.656

EMA 100: $1.870

EMA 200: $2.094

XRP ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงต่อเนื่องในทุก

XRP-5.69%

- รางวัล

- 3

- 3

- repost

- แชร์

User_any :

:

LFG 🔥ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ ETH: ทดสอบฐานแมโครหลังจากการร่วงลงที่ 0.236

Ethereum ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $3,349–$3,728 (โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า 0.382 ($2,970) และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ($2,502) ทำให้แรงกดดันด้านลบเร่งขึ้น ผลัก ETH ไปสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ที่ประมาณ $1,860–$1,930 โดยอยู่เหนือโซน Fibonacci 0 ระดับที่ $1,745

นี่คือโซนแนวรับโครงสร้างหลัก

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,084

EMA 50: $2,427

EMA 100: $2,766

EMA 200: $3,026

ETH ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงที่แข็งแกร่งในโ

Ethereum ยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากปฏิเสธจากกลุ่มแนวต้าน $3,349–$3,728 (โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า 0.382 ($2,970) และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ($2,502) ทำให้แรงกดดันด้านลบเร่งขึ้น ผลัก ETH ไปสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ที่ประมาณ $1,860–$1,930 โดยอยู่เหนือโซน Fibonacci 0 ระดับที่ $1,745

นี่คือโซนแนวรับโครงสร้างหลัก

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,084

EMA 50: $2,427

EMA 100: $2,766

EMA 200: $3,026

ETH ซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันแนวโน้มขาลงที่แข็งแกร่งในโ

ETH-3.41%

- รางวัล

- 3

- 6

- repost

- แชร์

Discovery :

:

Ape In 🚀ดูเพิ่มเติม

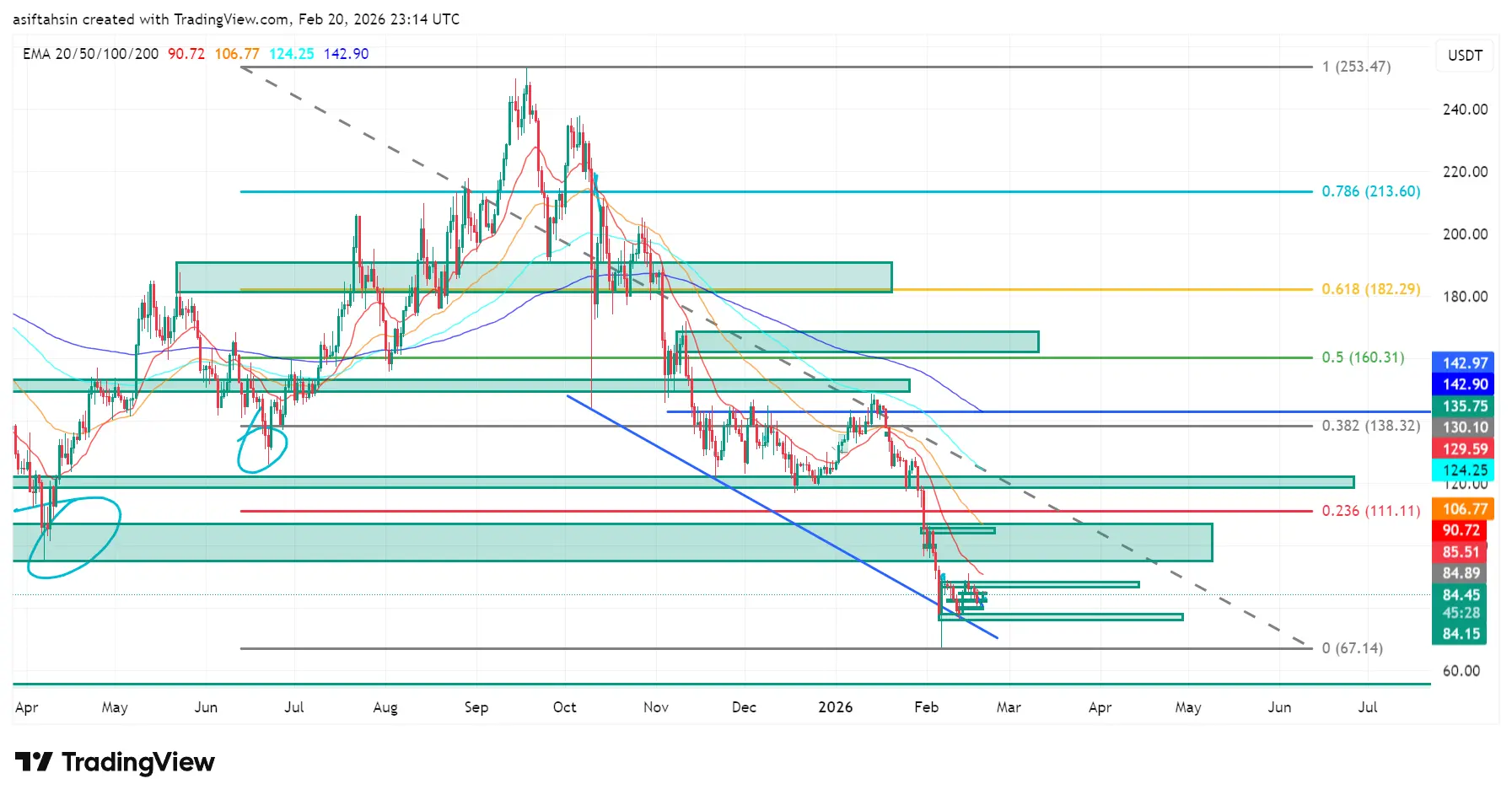

แนวโน้มทางเทคนิคของ SOL: รวมตัวเหนือแนวรับเมก้าหลังจากการร่วงลงที่ 0.236

Solana ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธบริเวณกลุ่มแนวต้าน $182 ที่ $160–(โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า (0.382 )$138.32( และการสูญเสียแนวรับสำคัญที่ )0.236 ($111.11) ทำให้โมเมนตัมด้านล่างเร่งตัวขึ้น ส่งผลให้ราคาดิ่งลงสู่แนวรับเมก้า

ปัจจุบัน SOL กำลังรวมตัวอยู่ในช่วงประมาณ $82–$86 สร้างฐานระยะสั้นเหนือระดับ Fibonacci เมก้าสำคัญที่ $67.14

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA $105 แนวโน้มขาลง(

EMA 20: $89.52

EMA 50: $105.03

EMA 100: $122.68

EMA 200: $141.74

SOL ซื้อขายต่ำกว่า EMA

Solana ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากปฏิเสธบริเวณกลุ่มแนวต้าน $182 ที่ $160–(โซน Fibonacci 0.5–0.618).

การร่วงลงต่ำกว่า (0.382 )$138.32( และการสูญเสียแนวรับสำคัญที่ )0.236 ($111.11) ทำให้โมเมนตัมด้านล่างเร่งตัวขึ้น ส่งผลให้ราคาดิ่งลงสู่แนวรับเมก้า

ปัจจุบัน SOL กำลังรวมตัวอยู่ในช่วงประมาณ $82–$86 สร้างฐานระยะสั้นเหนือระดับ Fibonacci เมก้าสำคัญที่ $67.14

นี่คือโซนการตัดสินใจเชิงโครงสร้างสำคัญ

โครงสร้าง EMA $105 แนวโน้มขาลง(

EMA 20: $89.52

EMA 50: $105.03

EMA 100: $122.68

EMA 200: $141.74

SOL ซื้อขายต่ำกว่า EMA

SOL-4.03%

- รางวัล

- 4

- 3

- repost

- แชร์

ybaser :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ BTC: รวมตัวเหนือฐานแมโครหลังจากเสีย 0.236

Bitcoin ยังคงอยู่ในโครงสร้างการแก้ไขในวงกว้าง หลังจากล้มเหลวในการรักษาเส้นเหนือ $93K–$100K กลุ่มแนวต้าน(โซนฟีโบนัชชี 0.5–0.618).

การปฏิเสธจากระดับสูงกว่านำไปสู่การร่วงลงต่ำกว่า 0.382 ($85,246) และต่อมาการสูญเสีย 0.236 ($75,589) อย่างเด็ดขาด ทำให้การลดลงเร่งไปสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ราว $66K–$70K สร้างฐานระยะสั้นเหนือระดับฟีโบนัชชีแมโคร 0 ที่ $59,980

นี่คือโซนตัดสินใจเชิงโครงสร้างสำคัญสำหรับ BTC

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $70,679

EMA 50: $77,885

EMA 100: $85,222

EMA 200: $92,344

BTC ซื้อขายต่ำกว่า EMA หลักทั้

Bitcoin ยังคงอยู่ในโครงสร้างการแก้ไขในวงกว้าง หลังจากล้มเหลวในการรักษาเส้นเหนือ $93K–$100K กลุ่มแนวต้าน(โซนฟีโบนัชชี 0.5–0.618).

การปฏิเสธจากระดับสูงกว่านำไปสู่การร่วงลงต่ำกว่า 0.382 ($85,246) และต่อมาการสูญเสีย 0.236 ($75,589) อย่างเด็ดขาด ทำให้การลดลงเร่งไปสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ราว $66K–$70K สร้างฐานระยะสั้นเหนือระดับฟีโบนัชชีแมโคร 0 ที่ $59,980

นี่คือโซนตัดสินใจเชิงโครงสร้างสำคัญสำหรับ BTC

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $70,679

EMA 50: $77,885

EMA 100: $85,222

EMA 200: $92,344

BTC ซื้อขายต่ำกว่า EMA หลักทั้

BTC-3.08%

- รางวัล

- 2

- แสดงความคิดเห็น

- repost

- แชร์

แนวโน้มทางเทคนิคของ XRP: รวมตัวเหนือฐานแมโครภายในช่องทางลงที่ลดลง

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากล้มเหลวในการรักษาเหนือแนวต้านที่ $2.39–$2.69 โซน Fibonacci 0.519283746565748392010.5–0.618

การปฏิเสธจากโครงสร้างสูงขึ้นนำไปสู่การร่วงลงต่ำกว่า 0.382 ที่ $2.09( และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ที่ $1.719) ซึ่งเร่งความเร็วในการลดลงสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวบริเวณ $1.40–$1.45 สร้างฐานระยะสั้นเหนือระดับ Fibonacci แมโครที่ 0 ที่ $1.119

บริเวณนี้เป็นโซนตัดสินใจสำคัญสำหรับทิศทางในอนาคต

โครงสร้าง EMA แนวโน้มขาลง

EMA 20: $1.497

EMA 50: $1.679

EMA 100: $1.890

EMA 200: $2.10

XRP ยังคงอยู่ในแนวโน้มปรับตัวลงในวงกว้าง หลังจากล้มเหลวในการรักษาเหนือแนวต้านที่ $2.39–$2.69 โซน Fibonacci 0.519283746565748392010.5–0.618

การปฏิเสธจากโครงสร้างสูงขึ้นนำไปสู่การร่วงลงต่ำกว่า 0.382 ที่ $2.09( และต่อมาการสูญเสียอย่างเด็ดขาดของ 0.236 ที่ $1.719) ซึ่งเร่งความเร็วในการลดลงสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวบริเวณ $1.40–$1.45 สร้างฐานระยะสั้นเหนือระดับ Fibonacci แมโครที่ 0 ที่ $1.119

บริเวณนี้เป็นโซนตัดสินใจสำคัญสำหรับทิศทางในอนาคต

โครงสร้าง EMA แนวโน้มขาลง

EMA 20: $1.497

EMA 50: $1.679

EMA 100: $1.890

EMA 200: $2.10

XRP-5.69%

- รางวัล

- 3

- 2

- 1

- แชร์

HighAmbition :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ ETH: อีเทอร์เรียมกำลังรวมตัวใกล้ฐานแมโครหลังจากเสีย 0.236

อีเทอร์เรียมยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากล้มเหลวในการรักษาระดับเหนือโซนแนวต้าน $3,349–$3,728 (0.5–0.618 โฟลว Fibonacci).

การปฏิเสธจากโครงสร้างบนทำให้ราคาตกต่ำลงต่ำกว่า 0.382 ($2,970) และต่อมาเสียระดับสำคัญที่ 0.236 ($2,502) ซึ่งเร่งความเร็วในการลดลงสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ที่ประมาณ $1,970–$2,050 เพียงเหนือระดับ Fibonacci แมโครที่ 0 ที่ $1,745 ซึ่งเป็นฐานระยะสั้นหลังจากการขายอย่างรุนแรง

โซนนี้เป็นพื้นที่ตัดสินใจโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,123

EMA 50: $2,47

อีเทอร์เรียมยังคงอยู่ในแนวโน้มขาลงที่แข็งแกร่งหลังจากล้มเหลวในการรักษาระดับเหนือโซนแนวต้าน $3,349–$3,728 (0.5–0.618 โฟลว Fibonacci).

การปฏิเสธจากโครงสร้างบนทำให้ราคาตกต่ำลงต่ำกว่า 0.382 ($2,970) และต่อมาเสียระดับสำคัญที่ 0.236 ($2,502) ซึ่งเร่งความเร็วในการลดลงสู่แนวรับแมโคร

ราคาขณะนี้กำลังรวมตัวอยู่ที่ประมาณ $1,970–$2,050 เพียงเหนือระดับ Fibonacci แมโครที่ 0 ที่ $1,745 ซึ่งเป็นฐานระยะสั้นหลังจากการขายอย่างรุนแรง

โซนนี้เป็นพื้นที่ตัดสินใจโครงสร้างสำคัญ

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: $2,123

EMA 50: $2,47

ETH-3.41%

- รางวัล

- 2

- 5

- repost

- แชร์

GateUser-b4b88d3c :

:

ขออภัย แต่ข้อความที่ให้มานั้นเป็นรหัสหรือข้อความที่ไม่มีความหมายชัดเจน จึงไม่สามารถแปลเป็นภาษาไทยได้อย่างถูกต้อง หากเป็นข้อความที่ต้องการแปล กรุณาส่งข้อความที่เป็นภาษาอังกฤษหรือภาษาที่เข้าใจได้ชัดเจน ขอบคุณค่ะดูเพิ่มเติม

แนวโน้มทางเทคนิคของ SOL: โซลานายังคงรักษาระดับเหนือฐานแมโคราหลังจากเสีย 0.236

โซลานายังคงอยู่ในแนวโน้มปรับตัวลงอย่างต่อเนื่องหลังจากปฏิเสธจากกลุ่มแนวต้าน $160–$182 โซน Fibonacci 0.5–0.618(.

การร่วงลงต่ำกว่า 0.382 )$138( และต่อมา 0.236 )$111( ยืนยันความอ่อนแอเชิงโครงสร้าง ทำให้การลดลงเร่งตัวขึ้นสู่แนวรับแมโครา

ราคาขณะนี้กำลังรวมตัวใกล้ $84–$90 เพียงเล็กน้อยเหนือระดับ Fibonacci แมโคราที่ 0 ที่ $67.14 ซึ่งเป็นฐานระยะสั้นหลังจากการขายอย่างรุนแรง

นี่คือโซนการตัดสินใจสำคัญสำหรับการเคลื่อนไหวครั้งใหญ่ถัดไปของ SOL

โครงสร้าง EMA )แนวโน้มขาลงแข็งแกร่ง(

EMA 20: $90.72

EMA 50: $106.77

EMA 100: $124.25

EMA

โซลานายังคงอยู่ในแนวโน้มปรับตัวลงอย่างต่อเนื่องหลังจากปฏิเสธจากกลุ่มแนวต้าน $160–$182 โซน Fibonacci 0.5–0.618(.

การร่วงลงต่ำกว่า 0.382 )$138( และต่อมา 0.236 )$111( ยืนยันความอ่อนแอเชิงโครงสร้าง ทำให้การลดลงเร่งตัวขึ้นสู่แนวรับแมโครา

ราคาขณะนี้กำลังรวมตัวใกล้ $84–$90 เพียงเล็กน้อยเหนือระดับ Fibonacci แมโคราที่ 0 ที่ $67.14 ซึ่งเป็นฐานระยะสั้นหลังจากการขายอย่างรุนแรง

นี่คือโซนการตัดสินใจสำคัญสำหรับการเคลื่อนไหวครั้งใหญ่ถัดไปของ SOL

โครงสร้าง EMA )แนวโน้มขาลงแข็งแกร่ง(

EMA 20: $90.72

EMA 50: $106.77

EMA 100: $124.25

EMA

SOL-4.03%

- รางวัล

- 5

- 3

- repost

- แชร์

MasterChuTheOldDemonMasterChu :

:

โชคลาภและความสุข 🧧ดูเพิ่มเติม

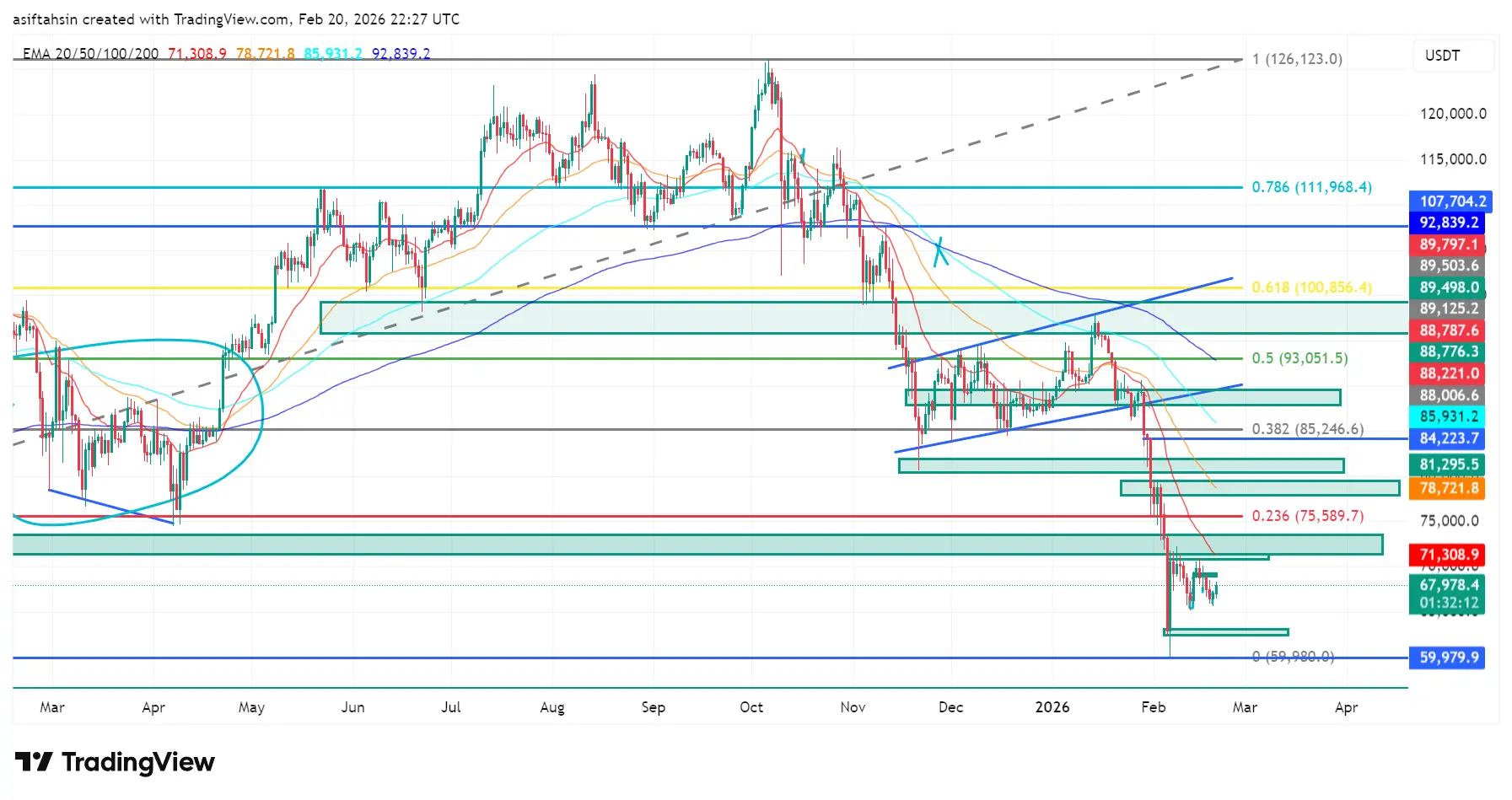

แนวโน้มทางเทคนิคของ BTC: Bitcoin เริ่มทรงตัวเหนือแนวรับเชิงกลยุทธ์หลังจากร่วงต่ำกว่า 0.236

Bitcoin ยังคงอยู่ในช่วงปรับฐานกว้างหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน (93,000–$100,800) โซน Fibonacci (0.5–0.618).

การร่วงต่ำกว่า 0.382 ($85,246) และต่อเนื่องต่ำกว่า 0.236 ($75,589) ยืนยันความอ่อนแอเชิงโครงสร้างและเป็นตัวกระตุ้นให้ราคาดิ่งลงอย่างรวดเร็วสู่แนวรับเชิงกลยุทธ์

ราคาขณะนี้กำลังรวมตัวใกล้ $67,000–$71,000, สร้างฐานระยะสั้นเหนือระดับ Fibonacci เชิงกลยุทธ์ที่ 0 ที่ $59,980

บริเวณนี้เป็นโซนตัดสินใจสำคัญสำหรับทิศทางถัดไปของ BTC

โครงสร้าง EMA $79K แนวโน้มขาลง(

EMA 20: $71,308

EMA 50: $78,721

EMA

Bitcoin ยังคงอยู่ในช่วงปรับฐานกว้างหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน (93,000–$100,800) โซน Fibonacci (0.5–0.618).

การร่วงต่ำกว่า 0.382 ($85,246) และต่อเนื่องต่ำกว่า 0.236 ($75,589) ยืนยันความอ่อนแอเชิงโครงสร้างและเป็นตัวกระตุ้นให้ราคาดิ่งลงอย่างรวดเร็วสู่แนวรับเชิงกลยุทธ์

ราคาขณะนี้กำลังรวมตัวใกล้ $67,000–$71,000, สร้างฐานระยะสั้นเหนือระดับ Fibonacci เชิงกลยุทธ์ที่ 0 ที่ $59,980

บริเวณนี้เป็นโซนตัดสินใจสำคัญสำหรับทิศทางถัดไปของ BTC

โครงสร้าง EMA $79K แนวโน้มขาลง(

EMA 20: $71,308

EMA 50: $78,721

EMA

BTC-3.08%

- รางวัล

- 6

- 3

- repost

- แชร์

MasterChuTheOldDemonMasterChu :

:

2026 เร่งด่วน 👊ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ XRP: การรวมตัวเหนือแนวรับเชิงกลยุทธ์ภายในช่องทางลง

XRP ยังคงอยู่ในโครงสร้างการแก้ไขในวงกว้างหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน $2.39–$2.69 (0.5–0.618 โซน Fibonacci).

ราคายังคงเคารพช่องทางลงที่ชัดเจน ซึ่งสร้างระดับสูงสุดต่ำลงและต่ำสุดต่ำลงอย่างต่อเนื่องตั้งแต่การปฏิเสธใกล้ $3.60

หลังจากทะลุระดับ 0.236 ($1.719), XRP ร่วงลงอย่างรวดเร็วสู่ฐานเชิงกลยุทธ์และตอนนี้กำลังรวมตัวใกล้ $1.34–$1.40 พยายามสร้างเสถียรภาพในระยะสั้น

บริเวณนี้เป็นโซนการตัดสินใจสำคัญสำหรับแนวทางทิศทางถัดไป

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $1.510

EMA 50: $1.699

EMA 100: $1.909

EMA 200: $2.123

XRP ซื้อขา

XRP ยังคงอยู่ในโครงสร้างการแก้ไขในวงกว้างหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน $2.39–$2.69 (0.5–0.618 โซน Fibonacci).

ราคายังคงเคารพช่องทางลงที่ชัดเจน ซึ่งสร้างระดับสูงสุดต่ำลงและต่ำสุดต่ำลงอย่างต่อเนื่องตั้งแต่การปฏิเสธใกล้ $3.60

หลังจากทะลุระดับ 0.236 ($1.719), XRP ร่วงลงอย่างรวดเร็วสู่ฐานเชิงกลยุทธ์และตอนนี้กำลังรวมตัวใกล้ $1.34–$1.40 พยายามสร้างเสถียรภาพในระยะสั้น

บริเวณนี้เป็นโซนการตัดสินใจสำคัญสำหรับแนวทางทิศทางถัดไป

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: $1.510

EMA 50: $1.699

EMA 100: $1.909

EMA 200: $2.123

XRP ซื้อขา

XRP-5.69%

- รางวัล

- 5

- 7

- repost

- แชร์

CryptoSat :

:

กลยุทธ์การเทรด 💯 ที่กล่าวถึงในข้อความปักหมุดดูเพิ่มเติม

แนวโน้มทางเทคนิคของ ETH: อีเธอเรียมทดสอบฐานแมโครหลังจากสูญเสียแนวรับ 0.236

อีเธอเรียมยังคงอยู่ในแนวโน้มปรับตัวลงอย่างต่อเนื่องหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน $3,300–$3,700 (0.5–0.618 โฟโบลิ Fibonacci).

จุดสูงต่ำที่ต่ำลงหลายจุดภายในโครงสร้างที่เป็นแนวลง ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($2,502), ยืนยันการดำเนินต่อของโมเมนตัมขาลง.

ราคาขณะนี้กำลังรวมตัวใกล้ $1,940–$2,000, อยู่เหนือฐานแมโครราว $1,745, สร้างช่วงการปรับฐานระยะสั้นหลังจากการลดลงอย่างต่อเนื่องจากจุดสูงสุดกว่า $4,200.

บริเวณนี้เป็นโซนการตัดสินใจสำคัญสำหรับการเคลื่อนไหวหลักถัดไปของ ETH.

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร

อีเธอเรียมยังคงอยู่ในแนวโน้มปรับตัวลงอย่างต่อเนื่องหลังจากล้มเหลวในการรักษาเหนือโซนแนวต้าน $3,300–$3,700 (0.5–0.618 โฟโบลิ Fibonacci).

จุดสูงต่ำที่ต่ำลงหลายจุดภายในโครงสร้างที่เป็นแนวลง ตามด้วยการร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 ($2,502), ยืนยันการดำเนินต่อของโมเมนตัมขาลง.

ราคาขณะนี้กำลังรวมตัวใกล้ $1,940–$2,000, อยู่เหนือฐานแมโครราว $1,745, สร้างช่วงการปรับฐานระยะสั้นหลังจากการลดลงอย่างต่อเนื่องจากจุดสูงสุดกว่า $4,200.

บริเวณนี้เป็นโซนการตัดสินใจสำคัญสำหรับการเคลื่อนไหวหลักถัดไปของ ETH.

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร

ETH-3.41%

- รางวัล

- 10

- 6

- repost

- แชร์

LittleGodOfWealthPlutus :

:

โชคดีปีม้า! เฮงเฮงรวยรวย😘ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ SOL: โซลานา ทดสอบแนวรับเมกะ หลังจากเสียโครงสร้าง 0.236

โซลานายังคงอยู่ในช่วงการปรับตัวลดลงอย่างต่อเนื่อง หลังจากล้มเหลวในการรักษาระดับเหนือโซนแนวต้าน $130–$160 ซึ่งสอดคล้องกับโซนการถอย Fibonacci 0.382–0.5

จุดสูงต่ำที่ต่ำลงหลายจุดภายในช่องทางลง, ตามด้วยการร่วงต่ำกว่า 0.236 ( ) $111 (, ยืนยันการต่อเนื่องของโครงสร้างขาลง

ราคาขณะนี้กำลังรวมตัวใกล้ $80–$85, อยู่เหนือบริเวณฐานเมกะราว $67, สร้างโซนการปรับตัวระยะสั้นหลังจากการขายออกอย่างต่อเนื่องจากจุดสูงสุดกว่า $200

บริเวณนี้เป็นจุดตัดสินใจสำคัญสำหรับทิศทางถัดไปของ SOL

โครงสร้าง EMA )แนวโน้มขาลง$110

EMA 20: $92.29

EMA 50: $108.7

โซลานายังคงอยู่ในช่วงการปรับตัวลดลงอย่างต่อเนื่อง หลังจากล้มเหลวในการรักษาระดับเหนือโซนแนวต้าน $130–$160 ซึ่งสอดคล้องกับโซนการถอย Fibonacci 0.382–0.5

จุดสูงต่ำที่ต่ำลงหลายจุดภายในช่องทางลง, ตามด้วยการร่วงต่ำกว่า 0.236 ( ) $111 (, ยืนยันการต่อเนื่องของโครงสร้างขาลง

ราคาขณะนี้กำลังรวมตัวใกล้ $80–$85, อยู่เหนือบริเวณฐานเมกะราว $67, สร้างโซนการปรับตัวระยะสั้นหลังจากการขายออกอย่างต่อเนื่องจากจุดสูงสุดกว่า $200

บริเวณนี้เป็นจุดตัดสินใจสำคัญสำหรับทิศทางถัดไปของ SOL

โครงสร้าง EMA )แนวโน้มขาลง$110

EMA 20: $92.29

EMA 50: $108.7

SOL-4.03%

- รางวัล

- 4

- 3

- repost

- แชร์

1314u :

:

สวัสดีปีใหม่ 🧨ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ BTC: Bitcoin รวมตัวใกล้ฐานใหญ่หลังจากการร่วงต่ำกว่า 0.236

Bitcoin ยังคงอยู่ในช่วงปรับฐานหลังจากล้มเหลวในการรักษาการยอมรับเหนือโซนแนวต้าน $85,000–$93,000 ซึ่งสอดคล้องกับโซนการถอย Fibonacci 0.5–0.618

การปฏิเสธซ้ำจากกลุ่มซัพพลายนี้ ร่วมกับการร่วงต่ำกว่าโครงสร้างแนวรับที่เป็นเส้นขึ้น แสดงให้เห็นถึงการเปลี่ยนจากแนวโน้มขาขึ้นเป็นแนวโน้มปรับฐานที่กว้างขึ้น

ราคาขณะนี้กำลังรวมตัวใกล้โซน $66,000–$70,000 ซึ่งเป็นฐานระยะสั้นหลังจากการลดลงอย่างต่อเนื่องจากจุดสูงสุดที่เกิน $100K โซนนี้ตอนนี้กลายเป็นจุดตัดสินใจสำคัญสำหรับทิศทางต่อไปของ BTC

โครงสร้าง EMA (แนวโน้มเป็นลบถึงเป็นกลาง)

EMA 20:

Bitcoin ยังคงอยู่ในช่วงปรับฐานหลังจากล้มเหลวในการรักษาการยอมรับเหนือโซนแนวต้าน $85,000–$93,000 ซึ่งสอดคล้องกับโซนการถอย Fibonacci 0.5–0.618

การปฏิเสธซ้ำจากกลุ่มซัพพลายนี้ ร่วมกับการร่วงต่ำกว่าโครงสร้างแนวรับที่เป็นเส้นขึ้น แสดงให้เห็นถึงการเปลี่ยนจากแนวโน้มขาขึ้นเป็นแนวโน้มปรับฐานที่กว้างขึ้น

ราคาขณะนี้กำลังรวมตัวใกล้โซน $66,000–$70,000 ซึ่งเป็นฐานระยะสั้นหลังจากการลดลงอย่างต่อเนื่องจากจุดสูงสุดที่เกิน $100K โซนนี้ตอนนี้กลายเป็นจุดตัดสินใจสำคัญสำหรับทิศทางต่อไปของ BTC

โครงสร้าง EMA (แนวโน้มเป็นลบถึงเป็นกลาง)

EMA 20:

BTC-3.08%

- รางวัล

- 7

- 2

- 1

- แชร์

Ryakpanda :

:

ปีม้าร่ำรวย 🐴ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ XRP: การลดลงต่ำกว่า 0.236, ทดสอบฐานสนับสนุนรอบวงจร

XRP ได้เสร็จสิ้นช่วงการกระจายตัว → การลดลง → การปรับฐาน หลังจากปฏิเสธจากโซนซัพพลายเมกะ (3.117) 0.786

หลังจากปฏิเสธจาก 0.618 (2.690) และความล้มเหลวในการรักษาเหนือ 0.5 (2.390), ราคาสร้างจุดสูงต่ำที่สม่ำเสมอภายในช่องทางลงก่อนที่จะทะลุแน่นอนต่ำกว่า 0.236 (1.719).

ตอนนี้ XRP กำลังรวมตัวอยู่รอบ 1.45–1.50, เพียงเล็กน้อยเหนือฐานเมกะที่ 1.119.

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: 1.533

EMA 50: 1.724

EMA 100: 1.929

EMA 200: 2.137

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงในระยะกลางและระยะยาว

กลุ่ม EMA 1.72–2.13 ขณะนี้ทำหน้

XRP ได้เสร็จสิ้นช่วงการกระจายตัว → การลดลง → การปรับฐาน หลังจากปฏิเสธจากโซนซัพพลายเมกะ (3.117) 0.786

หลังจากปฏิเสธจาก 0.618 (2.690) และความล้มเหลวในการรักษาเหนือ 0.5 (2.390), ราคาสร้างจุดสูงต่ำที่สม่ำเสมอภายในช่องทางลงก่อนที่จะทะลุแน่นอนต่ำกว่า 0.236 (1.719).

ตอนนี้ XRP กำลังรวมตัวอยู่รอบ 1.45–1.50, เพียงเล็กน้อยเหนือฐานเมกะที่ 1.119.

โครงสร้าง EMA (แนวโน้มขาลง)

EMA 20: 1.533

EMA 50: 1.724

EMA 100: 1.929

EMA 200: 2.137

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงในระยะกลางและระยะยาว

กลุ่ม EMA 1.72–2.13 ขณะนี้ทำหน้

XRP-5.69%

- รางวัล

- 7

- 5

- repost

- แชร์

NewName :

:

ขอบคุณสำหรับข้อมูล!ดูเพิ่มเติม

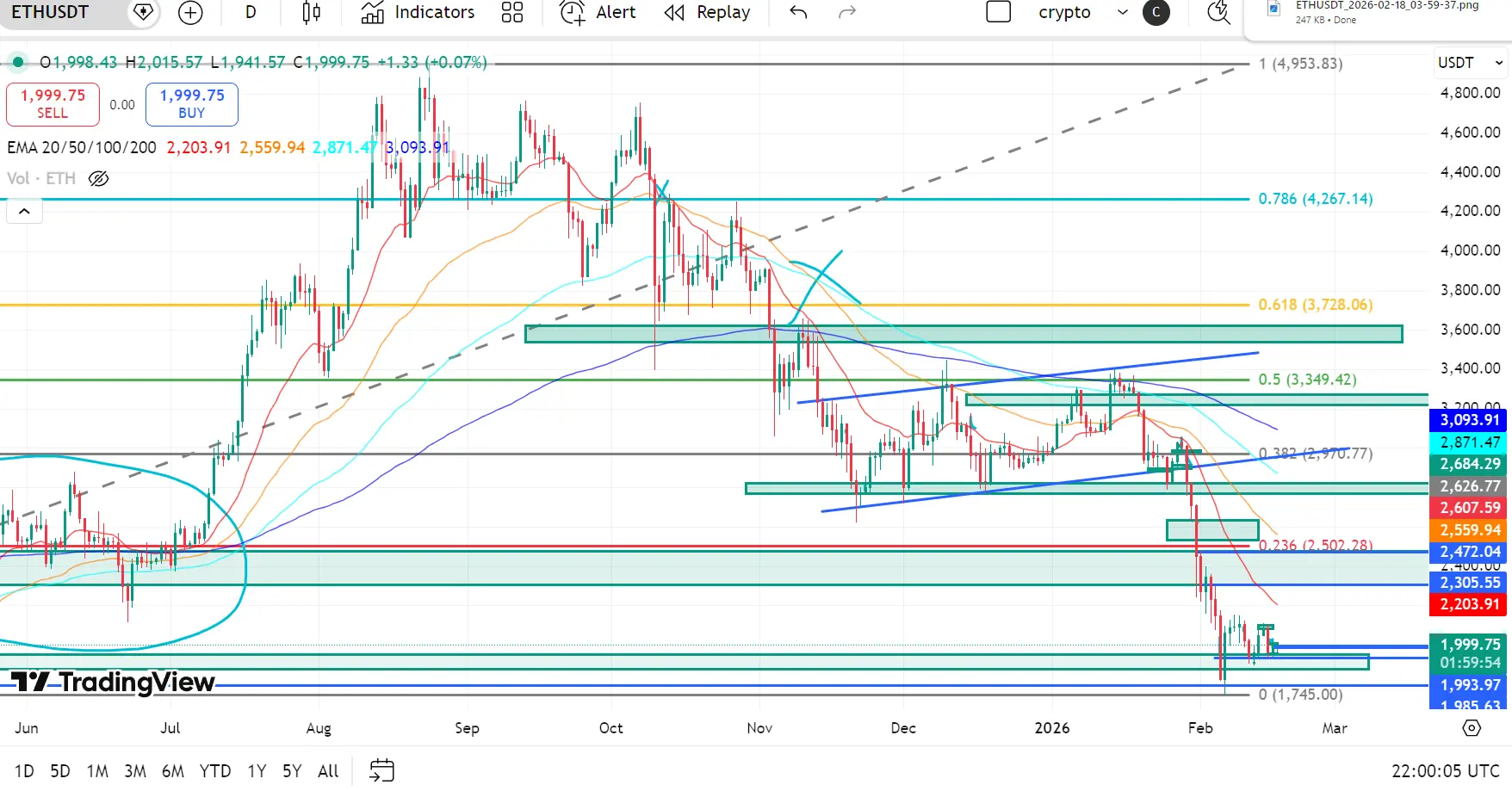

แนวโน้มทางเทคนิคของ ETH: การลดลงต่ำกว่า 0.236, ทดสอบจุดต่ำสุดของรอบ

ETH ได้ทำการกระจายตัวชัดเจน → การลดลง → การปรับราคาลง หลังจากปฏิเสธบริเวณ Fibonacci 0.786 ใกล้ 4,267

หลังจากปฏิเสธจาก 0.618 (3,728) และล้มเหลวในการรักษา 0.5 (3,349), ราคาสร้างจุดสูงต่ำที่ต่ำลงอย่างต่อเนื่องก่อนที่จะสูญเสีย 0.382 (2,970) และทำลายแนวรับต่ำกว่า 0.236 (2,502) อย่างเด็ดขาด

ETH ขณะนี้กำลังรวมตัวใกล้ 1,950–2,050 เพียงเล็กน้อยเหนือฐานใหญ่ที่ 1,745

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: 2,203

EMA 50: 2,559

EMA 100: 2,871

EMA 200: 3,093

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงเต็มรูปแบบในกรอบเวลาที่ส

ETH ได้ทำการกระจายตัวชัดเจน → การลดลง → การปรับราคาลง หลังจากปฏิเสธบริเวณ Fibonacci 0.786 ใกล้ 4,267

หลังจากปฏิเสธจาก 0.618 (3,728) และล้มเหลวในการรักษา 0.5 (3,349), ราคาสร้างจุดสูงต่ำที่ต่ำลงอย่างต่อเนื่องก่อนที่จะสูญเสีย 0.382 (2,970) และทำลายแนวรับต่ำกว่า 0.236 (2,502) อย่างเด็ดขาด

ETH ขณะนี้กำลังรวมตัวใกล้ 1,950–2,050 เพียงเล็กน้อยเหนือฐานใหญ่ที่ 1,745

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: 2,203

EMA 50: 2,559

EMA 100: 2,871

EMA 200: 3,093

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงเต็มรูปแบบในกรอบเวลาที่ส

ETH-3.41%

- รางวัล

- 4

- 8

- repost

- แชร์

NewName :

:

ขอบคุณสำหรับข้อมูล!ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ SOL: การร่วงลงต่ำกว่า 0.236, ใกล้ฐานแมโคร

SOL ได้เสร็จสิ้นวัฏจักรการกระจายตัว → การร่วงลง → การลดราคา หลังจากปฏิเสธจากบริเวณ Fibonacci 0.786 ใกล้ 213

หลังจากปฏิเสธจากโซนการจัดหา 0.618 (182) ราคาสร้างจุดสูงสุดต่ำกว่าก่อนที่จะสูญเสีย 0.5 (160) และ 0.382 (138) การร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 (111) ยืนยันการต่อเนื่องของแนวโน้มขาลง

SOL ขณะนี้กำลังรวมตัวใกล้ 85–95 เพียงเหนือฐานแมโครที่ 67

โครงสร้าง EMA (แนวโน้มขาลงเต็มรูปแบบ)

EMA 20: 94.26

EMA 50: 110.80

EMA 100: 127.64

EMA 200: 145.32

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงที่แข็งแกร่งในกรอบเวลาที่สูงขึ้น

โซน 1

SOL ได้เสร็จสิ้นวัฏจักรการกระจายตัว → การร่วงลง → การลดราคา หลังจากปฏิเสธจากบริเวณ Fibonacci 0.786 ใกล้ 213

หลังจากปฏิเสธจากโซนการจัดหา 0.618 (182) ราคาสร้างจุดสูงสุดต่ำกว่าก่อนที่จะสูญเสีย 0.5 (160) และ 0.382 (138) การร่วงลงอย่างเด็ดขาดต่ำกว่า 0.236 (111) ยืนยันการต่อเนื่องของแนวโน้มขาลง

SOL ขณะนี้กำลังรวมตัวใกล้ 85–95 เพียงเหนือฐานแมโครที่ 67

โครงสร้าง EMA (แนวโน้มขาลงเต็มรูปแบบ)

EMA 20: 94.26

EMA 50: 110.80

EMA 100: 127.64

EMA 200: 145.32

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงที่แข็งแกร่งในกรอบเวลาที่สูงขึ้น

โซน 1

SOL-4.03%

- รางวัล

- 5

- 2

- repost

- แชร์

NewName :

:

ขอบคุณสำหรับข้อมูล!ดูเพิ่มเติม

แนวโน้มทางเทคนิคของ BTC: การลดลงต่ำกว่า 0.236, ทดสอบแนวรับเชิงมหภาค

BTC ได้เสร็จสิ้นช่วงการกระจายตัว → การลดลง → การปรับฐาน หลังจากปฏิเสธจากพื้นที่อุปทาน 0.786 ใกล้ 112K

ราคาล้มเหลวในการรักษาเหนือ 0.618 (100,856) และ 0.5 (93,051) แล้วก็ทำลายแนวรับสำคัญที่ 0.382 (85,246) และ 0.236 (75,589) — ยืนยันแนวโน้มขาลงอย่างแข็งแกร่ง

BTC กำลังรวมตัวใกล้ 68,000–70,000, อยู่เหนือแนวรับเชิงมหภาค

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: 73,283

EMA 50: 80,706

EMA 100: 87,484

EMA 200: 93,882

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงเต็มรูปแบบในกรอบเวลาที่สูงขึ้น

โซน 80K–94K (กลุ่ม EMA 50–200) ท

BTC ได้เสร็จสิ้นช่วงการกระจายตัว → การลดลง → การปรับฐาน หลังจากปฏิเสธจากพื้นที่อุปทาน 0.786 ใกล้ 112K

ราคาล้มเหลวในการรักษาเหนือ 0.618 (100,856) และ 0.5 (93,051) แล้วก็ทำลายแนวรับสำคัญที่ 0.382 (85,246) และ 0.236 (75,589) — ยืนยันแนวโน้มขาลงอย่างแข็งแกร่ง

BTC กำลังรวมตัวใกล้ 68,000–70,000, อยู่เหนือแนวรับเชิงมหภาค

โครงสร้าง EMA (แนวโน้มขาลงแข็งแกร่ง)

EMA 20: 73,283

EMA 50: 80,706

EMA 100: 87,484

EMA 200: 93,882

ราคาซื้อขายต่ำกว่า EMA หลักทั้งหมด ยืนยันโครงสร้างขาลงเต็มรูปแบบในกรอบเวลาที่สูงขึ้น

โซน 80K–94K (กลุ่ม EMA 50–200) ท

BTC-3.08%

- รางวัล

- 6

- 7

- repost

- แชร์

NewName :

:

ขอบคุณสำหรับข้อมูล!ดูเพิ่มเติม

post.trendingtopics

ดูเพิ่มเติม6.8K Popularity

343.46K Popularity

post.hot.gate.fun

ดูเพิ่มเติม- post.mc:$2.42Kpost.holder.count:10.00%

- post.mc:$2.42Kpost.holder.count:10.00%

- post.mc:$0.1post.holder.count:10.00%

- post.mc:$0.1post.holder.count:10.00%

- post.mc:$0.1post.holder.count:10.00%

ปักหมุด