ZeroLend's Main Features

This module explores the primary features of ZeroLend, highlighting how its staking mechanisms, innovative programs like ZERO Gravity, and lending markets offer users unique opportunities to participate in and benefit from decentralized finance. It delves into the platform's focus on capital efficiency, support for Real-World Asset (RWA) lending, and the processes that ensure seamless liquidations to safeguard system integrity. Participants will gain a comprehensive understanding of ZeroLend's functionalities and how they create value within the DeFi ecosystem.

ZeroLend Staking

ZeroLend’s staking platform allows users to earn rewards by locking their $ZERO tokens into the protocol. This mechanism incentivizes user participation while enhancing network security and liquidity. Staking serves as a key driver of engagement, encouraging holders to commit to the ecosystem for long-term benefits.

Users can choose flexible or fixed-term staking options based on their preferences. Fixed-term staking often yields higher rewards, providing an incentive for longer commitments. Rewards are distributed in $ZERO tokens, reinforcing the platform’s token utility and creating additional incentives for ecosystem participation.

The staking interface is user-friendly, making it accessible to both experienced DeFi users and beginners. Detailed analytics on expected returns and staking performance are available, ensuring transparency and informed decision-making.

ZERO Gravity

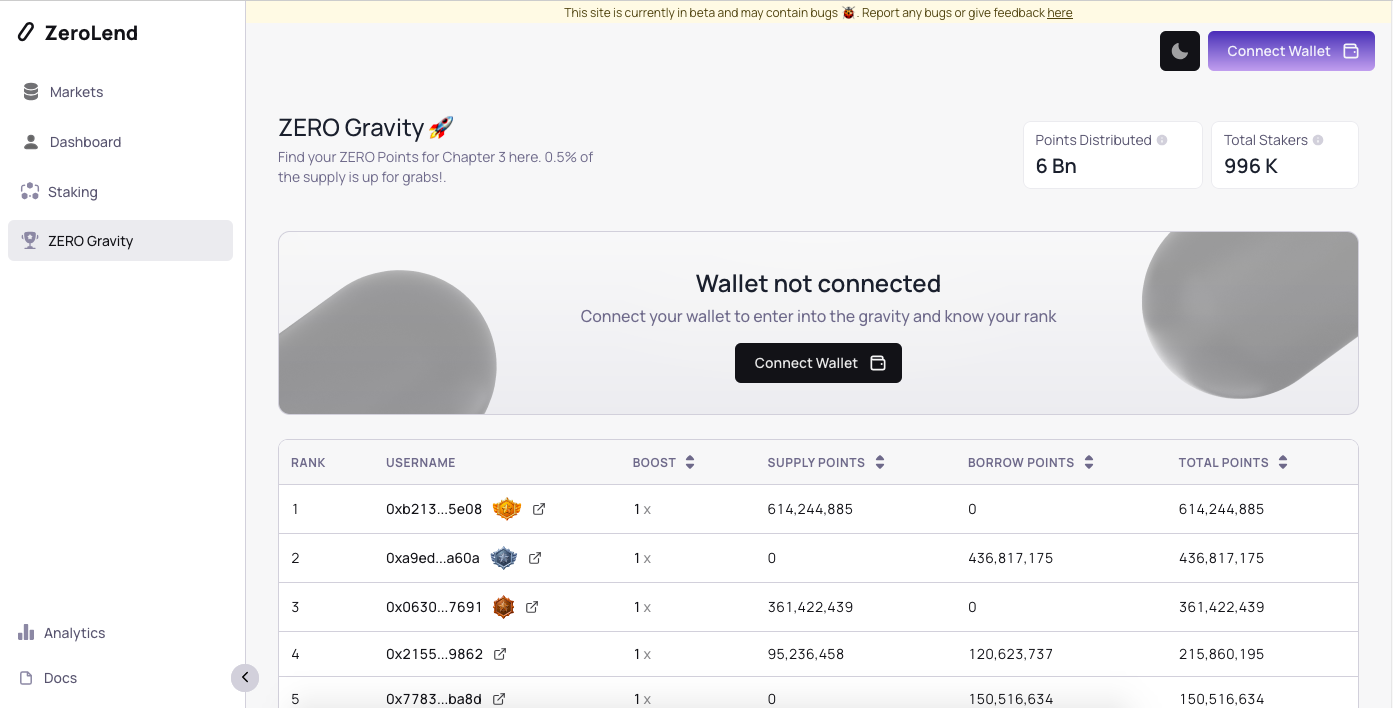

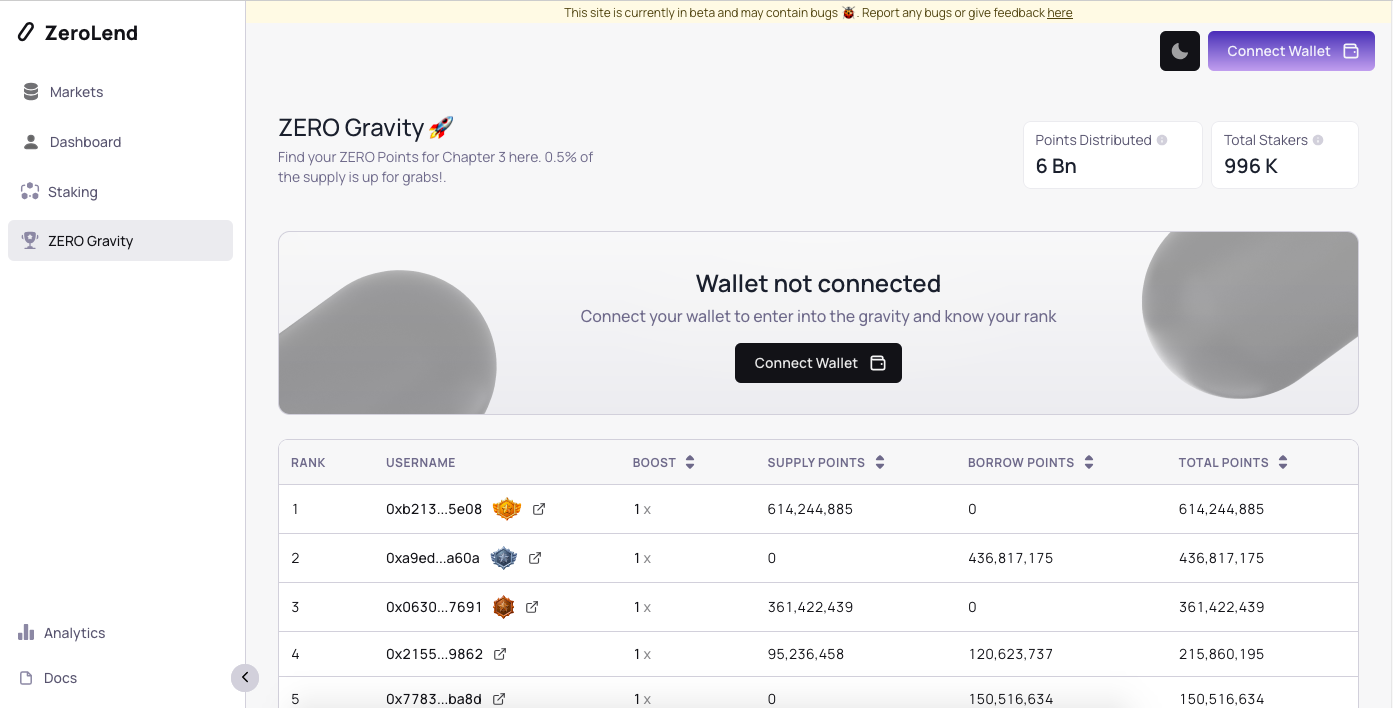

ZERO Gravity is ZeroLend’s liquidity incentive program designed to attract and retain liquidity providers. Users can earn additional rewards by participating in the program, contributing assets to liquidity pools, and maintaining a strong liquidity position within the ecosystem.

The program’s dynamic structure ensures rewards are proportionate to users’ contributions, encouraging fair and transparent participation. This mechanism supports liquidity depth across the protocol, enhancing its overall efficiency.

ZERO Gravity operates seamlessly with ZeroLend’s staking and lending markets, creating a holistic incentive framework. By participating, users not only earn rewards but also contribute to the protocol’s stability and growth, and the program is regularly updated to align with market trends and user needs, ensuring its ongoing relevance and impact within the DeFi space.

LRT Lending Market

The LRT Lending Market facilitates the borrowing and lending of Liquidity Reward Tokens (LRTs), enabling users to maximize capital efficiency. Borrowers can use LRTs as collateral to access funds while lenders earn interest in their contributions to the market.

This lending market is designed to enhance liquidity across the ecosystem, ensuring that assets remain active and accessible. Borrowers can utilize their LRTs without selling them, preserving their positions while accessing additional capital.

The market operates through smart contracts, ensuring transparency and minimizing risks. Interest rates are algorithmically determined based on supply and demand dynamics, providing an equitable environment for all participants. Lenders are rewarded with competitive yields, making the LRT Lending Market an attractive option for passive income generation.

RWA Lending

ZeroLend integrates Real-World Asset (RWA) lending, bridging the gap between traditional finance and DeFi. This feature enables users to tokenize physical assets and use them as collateral for loans.

RWA lending broadens the platform’s utility, allowing users to leverage assets such as real estate, invoices, or commodities within the DeFi ecosystem, this innovation expands the scope of decentralized finance beyond digital assets.

The process involves asset tokenization, collateral verification, and smart contract-based loan issuance. These steps ensure security and transparency in every transaction. By incorporating RWAs, ZeroLend attracts a wider audience, including institutional participants, and creates a more inclusive financial environment.

Capital Efficiency

ZeroLend prioritizes capital efficiency by enabling users to maximize the utility of their assets through optimized borrowing and lending mechanisms. Features like multi-collateral loans and cross-margin capabilities ensure that users can deploy their capital effectively.

Multi-collateral loans allow users to secure funds against diverse assets, reducing dependency on a single token. This flexibility mitigates risks and enhances borrowing opportunities.

Capital efficiency also benefits liquidity providers, as assets in the protocol are actively utilized to generate yields, this creates a mutually beneficial ecosystem where borrowers and lenders both maximize their returns.

Liquidations

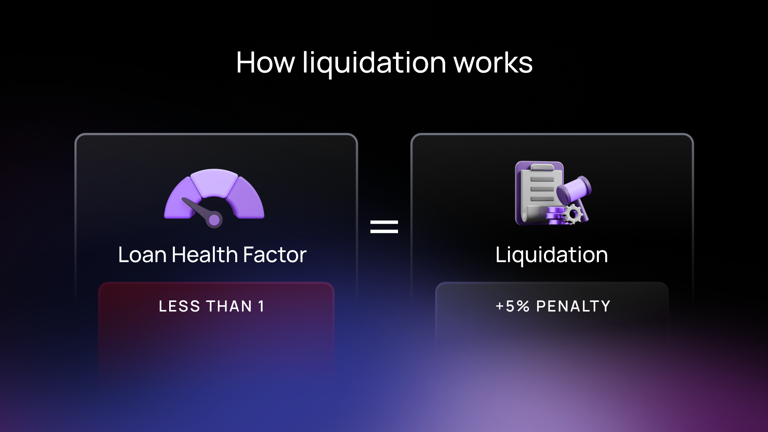

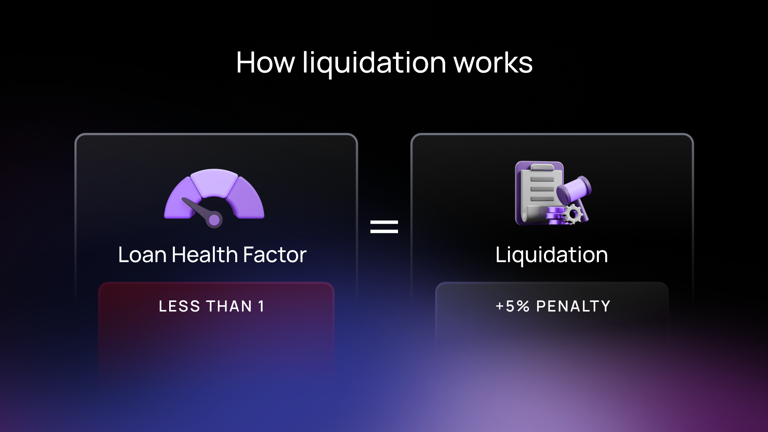

Liquidations are an integral part of maintaining the stability and security of ZeroLend, the protocol’s liquidation mechanism ensures that loans remain adequately collateralized, protecting users and the system from insolvency risks.

When a borrower’s collateral value drops below the required threshold, the protocol initiates an automated liquidation process. This ensures that outstanding loans are covered and prevents systemic risks.

The liquidation process is transparent and efficient, executed through smart contracts to eliminate human intervention and associated delays. Users can track liquidation data through the platform’s dashboard, ensuring clarity and trust.

Highlights

- ZeroLend’s staking platform allows users to earn rewards while supporting network security and governance.

- The ZERO Gravity program incentivizes liquidity providers, ensuring strong liquidity positions and ecosystem growth.

- The LRT Lending Market facilitates borrowing and lending of Liquidity Reward Tokens, optimizing asset utility.

- RWA Lending bridges traditional finance with DeFi by enabling loans backed by tokenized physical assets.

- Capital efficiency mechanisms empower users to deploy their assets effectively, maximizing returns.

- Automated liquidation processes safeguard the platform by ensuring adequate collateralization of loans.

Leçon 1:Introduction to ZeroLend (ZERO)

Leçon 2:ZeroLend's Technical Architecture

Leçon 3:ZeroLend's Main Features

Leçon 4:Zerolend Tokenomics and Governance

Leçon 5:ZeroLend's Ecosystem

Leçon 6:ZeroLend Ecosystem: Introduction to Pyth Network

Leçon 7:ZeroLend Ecosystem: Holdstation

Leçon 8:ZeroLend Ecosystem: Stakestone

ZeroLend's Main Features

This module explores the primary features of ZeroLend, highlighting how its staking mechanisms, innovative programs like ZERO Gravity, and lending markets offer users unique opportunities to participate in and benefit from decentralized finance. It delves into the platform's focus on capital efficiency, support for Real-World Asset (RWA) lending, and the processes that ensure seamless liquidations to safeguard system integrity. Participants will gain a comprehensive understanding of ZeroLend's functionalities and how they create value within the DeFi ecosystem.

ZeroLend Staking

ZeroLend’s staking platform allows users to earn rewards by locking their $ZERO tokens into the protocol. This mechanism incentivizes user participation while enhancing network security and liquidity. Staking serves as a key driver of engagement, encouraging holders to commit to the ecosystem for long-term benefits.

Users can choose flexible or fixed-term staking options based on their preferences. Fixed-term staking often yields higher rewards, providing an incentive for longer commitments. Rewards are distributed in $ZERO tokens, reinforcing the platform’s token utility and creating additional incentives for ecosystem participation.

The staking interface is user-friendly, making it accessible to both experienced DeFi users and beginners. Detailed analytics on expected returns and staking performance are available, ensuring transparency and informed decision-making.

ZERO Gravity

ZERO Gravity is ZeroLend’s liquidity incentive program designed to attract and retain liquidity providers. Users can earn additional rewards by participating in the program, contributing assets to liquidity pools, and maintaining a strong liquidity position within the ecosystem.

The program’s dynamic structure ensures rewards are proportionate to users’ contributions, encouraging fair and transparent participation. This mechanism supports liquidity depth across the protocol, enhancing its overall efficiency.

ZERO Gravity operates seamlessly with ZeroLend’s staking and lending markets, creating a holistic incentive framework. By participating, users not only earn rewards but also contribute to the protocol’s stability and growth, and the program is regularly updated to align with market trends and user needs, ensuring its ongoing relevance and impact within the DeFi space.

LRT Lending Market

The LRT Lending Market facilitates the borrowing and lending of Liquidity Reward Tokens (LRTs), enabling users to maximize capital efficiency. Borrowers can use LRTs as collateral to access funds while lenders earn interest in their contributions to the market.

This lending market is designed to enhance liquidity across the ecosystem, ensuring that assets remain active and accessible. Borrowers can utilize their LRTs without selling them, preserving their positions while accessing additional capital.

The market operates through smart contracts, ensuring transparency and minimizing risks. Interest rates are algorithmically determined based on supply and demand dynamics, providing an equitable environment for all participants. Lenders are rewarded with competitive yields, making the LRT Lending Market an attractive option for passive income generation.

RWA Lending

ZeroLend integrates Real-World Asset (RWA) lending, bridging the gap between traditional finance and DeFi. This feature enables users to tokenize physical assets and use them as collateral for loans.

RWA lending broadens the platform’s utility, allowing users to leverage assets such as real estate, invoices, or commodities within the DeFi ecosystem, this innovation expands the scope of decentralized finance beyond digital assets.

The process involves asset tokenization, collateral verification, and smart contract-based loan issuance. These steps ensure security and transparency in every transaction. By incorporating RWAs, ZeroLend attracts a wider audience, including institutional participants, and creates a more inclusive financial environment.

Capital Efficiency

ZeroLend prioritizes capital efficiency by enabling users to maximize the utility of their assets through optimized borrowing and lending mechanisms. Features like multi-collateral loans and cross-margin capabilities ensure that users can deploy their capital effectively.

Multi-collateral loans allow users to secure funds against diverse assets, reducing dependency on a single token. This flexibility mitigates risks and enhances borrowing opportunities.

Capital efficiency also benefits liquidity providers, as assets in the protocol are actively utilized to generate yields, this creates a mutually beneficial ecosystem where borrowers and lenders both maximize their returns.

Liquidations

Liquidations are an integral part of maintaining the stability and security of ZeroLend, the protocol’s liquidation mechanism ensures that loans remain adequately collateralized, protecting users and the system from insolvency risks.

When a borrower’s collateral value drops below the required threshold, the protocol initiates an automated liquidation process. This ensures that outstanding loans are covered and prevents systemic risks.

The liquidation process is transparent and efficient, executed through smart contracts to eliminate human intervention and associated delays. Users can track liquidation data through the platform’s dashboard, ensuring clarity and trust.

Highlights

- ZeroLend’s staking platform allows users to earn rewards while supporting network security and governance.

- The ZERO Gravity program incentivizes liquidity providers, ensuring strong liquidity positions and ecosystem growth.

- The LRT Lending Market facilitates borrowing and lending of Liquidity Reward Tokens, optimizing asset utility.

- RWA Lending bridges traditional finance with DeFi by enabling loans backed by tokenized physical assets.

- Capital efficiency mechanisms empower users to deploy their assets effectively, maximizing returns.

- Automated liquidation processes safeguard the platform by ensuring adequate collateralization of loans.