2025 UNIPrice Prediction: Analyzing Key Factors That Will Shape Uniswap's Token Valuation in the Post-Bull Market Era

Introduction: UNI's Market Position and Investment Value

Uniswap (UNI), as the first automatic market making transaction protocol based on Ethereum blockchain, has achieved significant milestones since its inception in 2020. As of 2025, Uniswap's market capitalization has reached $5.89 billion, with a circulating supply of approximately 600,483,074 tokens, and a price hovering around $9.814. This asset, often hailed as the "DeFi pioneer," is playing an increasingly crucial role in decentralized finance and cryptocurrency trading.

This article will provide a comprehensive analysis of Uniswap's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. UNI Price History Review and Current Market Status

UNI Historical Price Evolution

- 2020: UNI token launched, price started at $1.03

- 2021: Bull market peak, UNI reached all-time high of $44.92

- 2022-2024: Market cycle fluctuations, price ranged between $3 and $10

UNI Current Market Situation

As of September 9, 2025, UNI is trading at $9.814, ranking 32nd in the cryptocurrency market. The token has seen a 2.23% increase in the past 24 hours, with a trading volume of $4,825,399. UNI's market capitalization stands at $5.89 billion, with a circulating supply of 600,483,073 tokens. The current price represents a significant 78.14% decrease from its all-time high of $44.92, but a 852.82% increase from its all-time low of $1.03. Over the past year, UNI has shown strong performance with a 54.51% price increase, indicating sustained interest and growth in the Uniswap ecosystem.

Click to view the current UNI market price

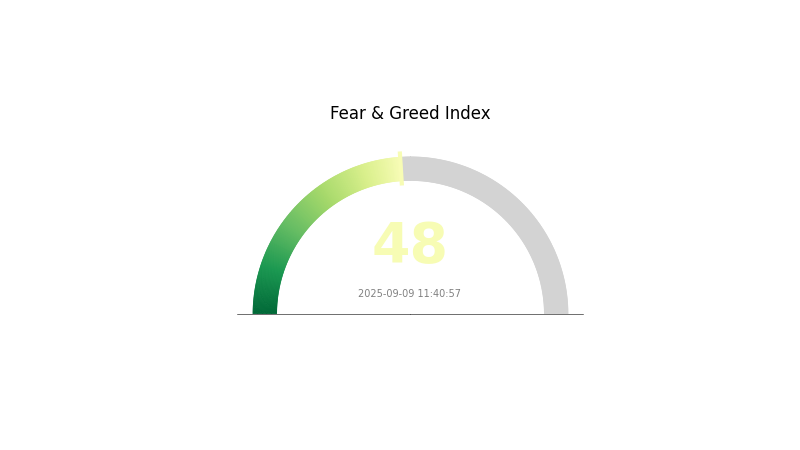

UNI Market Sentiment Indicator

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for UNI remains balanced, with the Fear and Greed Index at 48, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about UNI's prospects. Such equilibrium often presents opportunities for strategic trading decisions. Traders should stay vigilant, as neutral sentiment can quickly shift towards either fear or greed based on market developments or news. As always, it's crucial to conduct thorough research and consider multiple factors before making investment choices.

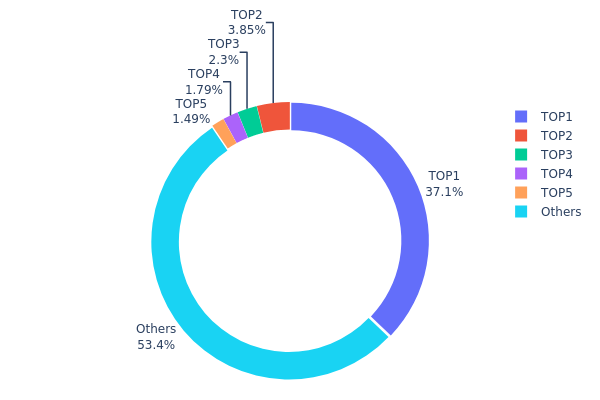

UNI Holdings Distribution

The address holdings distribution data for UNI reveals a relatively concentrated ownership structure. The top address holds a significant 37.12% of the total supply, which is a substantial concentration of tokens in a single wallet. The next four largest holders collectively account for an additional 9.41% of the supply. This level of concentration suggests a potential risk of market manipulation and price volatility.

However, it's important to note that 53.47% of UNI tokens are distributed among other addresses, indicating a degree of decentralization beyond the top holders. This distribution pattern reflects a mixed market structure, where a significant portion of the supply is widely distributed, but major players still hold considerable influence. Such a structure may lead to increased price sensitivity to large transactions or decisions made by top holders, potentially impacting UNI's market stability and liquidity dynamics.

Overall, while UNI demonstrates some level of decentralization, the high concentration in the top address poses challenges to its on-chain structural stability and market resilience. This distribution pattern underscores the importance of monitoring large holder activities and their potential impact on UNI's market behavior.

Click to view the current UNI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1a9c...be35bc | 371260.16K | 37.12% |

| 2 | 0xf977...41acec | 38498.83K | 3.84% |

| 3 | 0x61cb...2096eb | 23047.48K | 2.30% |

| 4 | 0x5a52...70efcb | 17944.01K | 1.79% |

| 5 | 0x5069...680f7e | 14880.12K | 1.48% |

| - | Others | 534369.39K | 53.47% |

II. Key Factors Affecting UNI's Future Price

Supply Mechanism

- Circulating Supply: Currently, there are 628,739,836.71 UNI tokens in circulation out of a total supply of 1,000,000,000.

- Historical Pattern: The gradual release of UNI tokens has historically impacted price movements.

- Current Impact: With 62.87% of the total supply already in circulation, future releases may have a diminishing effect on price.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions and venture capital firms like Coinbase Ventures, Three Arrows Capital, and Pantera Capital hold significant UNI positions.

- Corporate Adoption: Uniswap's decentralized exchange protocol has been widely adopted in the DeFi ecosystem.

Macroeconomic Environment

- Inflation Hedge Properties: UNI has shown some potential as an inflation hedge, aligning with broader cryptocurrency market trends.

- Geopolitical Factors: Global economic uncertainties and regulatory changes in major economies can impact UNI's price.

Technical Development and Ecosystem Building

- V4 Upgrade: The successful implementation of Uniswap V4 is crucial for UNI's future performance.

- Governance Proposals: Ongoing discussions and decisions regarding fee structures and protocol upgrades directly influence UNI's value.

- Ecosystem Applications: Uniswap's dominance in the DEX market and its integration with various DeFi protocols contribute to UNI's utility and demand.

III. UNI Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $7.44 - $9.79

- Neutral forecast: $9.79 - $11.16

- Optimistic forecast: $11.16 - $12.54 (requires favorable market conditions and increased DeFi adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $10.92 - $15.60

- 2028: $8.14 - $20.43

- Key catalysts: Uniswap protocol upgrades, broader DeFi integration, and potential regulatory clarity

2030 Long-term Outlook

- Base scenario: $17.55 - $19.94 (assuming steady DeFi growth and market maturation)

- Optimistic scenario: $19.94 - $27.51 (assuming widespread DeFi adoption and favorable regulatory environment)

- Transformative scenario: $27.51+ (assuming Uniswap becomes a dominant force in decentralized finance)

- 2030-12-31: UNI $19.94 (103% increase from 2025 average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 12.53504 | 9.793 | 7.44268 | 0 |

| 2026 | 12.83862 | 11.16402 | 7.47989 | 13 |

| 2027 | 15.60172 | 12.00132 | 10.9212 | 22 |

| 2028 | 20.42625 | 13.80152 | 8.1429 | 40 |

| 2029 | 22.76147 | 17.11388 | 13.51997 | 74 |

| 2030 | 27.51399 | 19.93768 | 17.54515 | 103 |

IV. UNI Professional Investment Strategies and Risk Management

UNI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and DeFi enthusiasts

- Operation suggestions:

- Accumulate UNI tokens during market dips

- Participate in Uniswap governance to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor Uniswap protocol upgrades and governance proposals

UNI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Options strategies: Use UNI options to hedge against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for UNI

UNI Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Emerging DEX protocols may challenge Uniswap's market share

- Liquidity risk: Potential for impermanent loss in liquidity pools

UNI Regulatory Risks

- Regulatory uncertainty: Evolving DeFi regulations may impact Uniswap operations

- Compliance challenges: Potential issues with KYC/AML requirements

- Geopolitical factors: Varying crypto regulations across jurisdictions

UNI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Ethereum network congestion may affect Uniswap performance

- Oracle manipulation: Risks associated with price feed inaccuracies

VI. Conclusion and Action Recommendations

UNI Investment Value Assessment

Uniswap (UNI) presents a compelling long-term value proposition as a leading DEX protocol, but investors should be aware of short-term volatility and regulatory uncertainties in the DeFi space.

UNI Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about DeFi

✅ Experienced investors: Consider a balanced approach with both holding and trading strategies

✅ Institutional investors: Explore yield farming opportunities and governance participation

UNI Trading Participation Methods

- Spot trading: Purchase UNI tokens on Gate.com

- Liquidity provision: Provide liquidity to Uniswap pools for fee earnings

- Governance participation: Stake UNI tokens to vote on protocol proposals

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will Uniswap be worth in 2025?

Based on price forecasts, Uniswap (UNI) is expected to be worth around $9.29 per token in 2025. This prediction uses machine gradient methods and suggests a potential increase from current levels.

Will Uniswap reach $100?

Uniswap is unlikely to reach $100. Its all-time high was $44.92, and current predictions suggest a maximum of $45.74. UNI will likely remain a top token but not exceed this price range.

Does Uni Coin have a future?

Yes, Uni Coin has a promising future. As Uniswap's adoption grows, UNI token demand may increase. The coin's value could rise with expanded decentralized trading and liquidity provision.

How high will Uni go?

UNI could reach a maximum of $45.74 by 2025, based on current predictions. This potential high depends on increased trading volumes and a strong crypto market rally.

Share

Content