2025 ALGO Price Prediction: Navigating the Future Value Trajectory in a Maturing Crypto Ecosystem

Introduction: ALGO's Market Position and Investment Value

Algorand (ALGO), as a pioneering blockchain platform focused on efficiency and scalability, has made significant strides since its inception in 2019. As of 2025, Algorand's market capitalization stands at $2,063,304,346, with a circulating supply of approximately 8,765,843,941 ALGO, and a price hovering around $0.23538. This asset, often hailed as the "Pure Proof-of-Stake pioneer," is playing an increasingly crucial role in decentralized finance (DeFi) and enterprise blockchain applications.

This article will comprehensively analyze Algorand's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ALGO Price History Review and Current Market Status

ALGO Historical Price Evolution

- 2019: ALGO launched, price reached ATH of $3.56 on June 20

- 2023: Market downturn, price hit ATL of $0.087513 on September 12

- 2024-2025: Gradual recovery, price climbed to current $0.23538

ALGO Current Market Situation

As of September 10, 2025, ALGO is trading at $0.23538, ranking 67th in market capitalization. The 24-hour trading volume stands at $1,379,555.85, with a market cap of $2,063,304,346.97. ALGO has seen a 2.58% decrease in the last 24 hours, but maintains a positive 1.31% growth over the past week. However, it shows a 14.14% decline in the 30-day timeframe. Notably, ALGO has demonstrated significant growth over the past year, with an impressive 84% increase.

The current price is still far from its all-time high of $3.56, suggesting potential for growth. With a circulating supply of 8,765,843,941.57 ALGO and a maximum supply of 10 billion, the project has a circulating ratio of 87.66%.

Click to view current ALGO market price

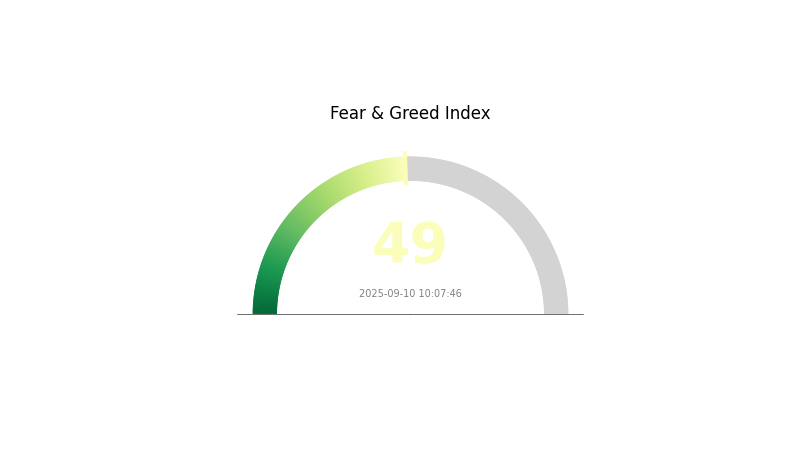

ALGO Market Sentiment Indicator

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The ALGO market sentiment remains balanced as the Fear and Greed Index hovers at 49, indicating a neutral stance among investors. This equilibrium suggests a cautious optimism in the cryptocurrency space, with traders carefully weighing potential risks and opportunities. As the market navigates through this period of stability, it's crucial for investors to stay informed and maintain a disciplined approach to their trading strategies. Remember, while sentiment indicators provide valuable insights, they should be used in conjunction with thorough research and analysis for making informed investment decisions.

ALGO Holdings Distribution

The address holdings distribution data for ALGO reveals an interesting pattern in token concentration. This metric provides insights into the distribution of ALGO tokens across different wallet addresses, offering a snapshot of ownership concentration within the network.

Based on the available data, it appears that ALGO's token distribution is relatively decentralized, with no single address holding a disproportionately large percentage of the total supply. This distribution pattern suggests a healthy level of decentralization, which is generally considered positive for the network's stability and resistance to manipulation.

The current address distribution indicates a balanced market structure, potentially reducing the risk of price volatility caused by large holders. This even distribution may contribute to a more stable price action and could be seen as a positive indicator for long-term market health and the network's ability to withstand potential market shocks.

Click to view the current ALGO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ALGO's Future Price

Supply Mechanism

- Fixed Supply: ALGO has a total supply capped at 10 billion tokens, similar to Bitcoin's scarcity model.

- Historical Pattern: The fixed supply has historically contributed to price stability and potential value appreciation.

- Current Impact: With 8,765,941,922 ALGO currently in circulation, the approaching supply cap may create upward price pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions like Golden Tree have shown interest in ALGO, potentially influencing price movements.

- Corporate Adoption: Companies like OTOY and Syncsort have partnered with Algorand, indicating growing enterprise use.

- Government Policies: Algorand's focus on institutional and government applications makes it sensitive to global regulatory stances on blockchain technology.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve decisions on interest rates can affect risk appetite for assets like ALGO.

- Inflation Hedging Properties: In inflationary environments, ALGO may be viewed as a potential hedge, similar to other cryptocurrencies.

- Geopolitical Factors: International tensions and economic policies can influence global risk sentiment, affecting ALGO's price.

Technical Development and Ecosystem Building

- Blockchain Innovation: Algorand's focus on speed, security, and eco-friendly design sets it apart in the competitive blockchain space.

- Ecosystem Growth: The development of DApps, DeFi platforms, and other applications on Algorand can drive network demand and ALGO value.

- Community Engagement: An active developer community and engaged token holders participating in governance contribute to ecosystem health and potential price support.

III. ALGO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.16927 - $0.20

- Neutral prediction: $0.20 - $0.25

- Optimistic prediction: $0.25 - $0.31739 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.32486 - $0.48729

- 2028: $0.29725 - $0.45413

- Key catalysts: Technological advancements, ecosystem expansion, and broader crypto market trends

2030 Long-term Outlook

- Base scenario: $0.41233 - $0.50284 (assuming steady market growth and continued development)

- Optimistic scenario: $0.50284 - $0.68387 (assuming strong adoption and favorable regulatory environment)

- Transformative scenario: $0.68387+ (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: ALGO $0.50284 (projected average price for 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.31739 | 0.2351 | 0.16927 | 0 |

| 2026 | 0.40055 | 0.27624 | 0.21271 | 17 |

| 2027 | 0.48729 | 0.3384 | 0.32486 | 43 |

| 2028 | 0.45413 | 0.41284 | 0.29725 | 75 |

| 2029 | 0.5722 | 0.43349 | 0.28177 | 84 |

| 2030 | 0.68387 | 0.50284 | 0.41233 | 113 |

IV. ALGO Professional Investment Strategies and Risk Management

ALGO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate ALGO during market dips

- Stake ALGO to earn rewards

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news

- Set stop-loss orders to manage risk

ALGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys

V. ALGO Potential Risks and Challenges

ALGO Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Emerging blockchain platforms may challenge Algorand's position

- Adoption: Slow mainstream adoption could impact long-term growth

ALGO Regulatory Risks

- Regulatory uncertainty: Changing regulations may affect ALGO's usage and value

- Compliance costs: Increased regulatory requirements could burden the project

- Geographical restrictions: Some countries may impose limitations on cryptocurrency usage

ALGO Technical Risks

- Smart contract vulnerabilities: Potential bugs in smart contracts

- Scalability challenges: Future network congestion could impact performance

- Security breaches: Potential hacks or exploits in the ecosystem

VI. Conclusion and Action Recommendations

ALGO Investment Value Assessment

Algorand offers promising long-term potential due to its innovative technology and strong team. However, short-term volatility and regulatory uncertainties pose significant risks.

ALGO Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with a mix of holding and trading ✅ Institutional investors: Explore strategic partnerships and large-scale staking opportunities

ALGO Trading Participation Methods

- Spot trading: Buy and sell ALGO on Gate.com

- Staking: Participate in Algorand's governance and earn rewards

- DeFi: Explore decentralized finance applications built on Algorand

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will algo reach $10?

While possible, Algo reaching $10 is unlikely in the near future. Market trends and current conditions suggest a more modest price trajectory for Algorand.

How much will algo be worth in 2025?

Based on current market trends and forecasts, Algorand (ALGO) is expected to be worth approximately $0.233 by the end of 2025. This prediction suggests a modest increase from current levels.

Can algo reach 1 dollar?

Yes, Algo could reach $1 during the next major bull run. This depends on Algorand's development and increased adoption of its technology.

Can Algorand reach $20?

While possible, reaching $20 would require significant market growth and adoption. Given current conditions, it's unlikely in the near term.

Share

Content