Asiftahsin

暗号資産に関連する市場分析を共有し、フォロワー(兄弟と姉妹)に暗号資産に関連する知識を共有する

asiftahsin

XRP テクニカル展望:サイクルベース付近で価格安定、下落トレンドの勢い喪失

XRPは、0.5–0.618フィボナッチリトレースメント領域に対応する$2.39–$2.69の抵抗クラスターを取り戻せず、その後もより広範な修正構造内に留まっています。下降トレンドラインからの繰り返しの拒否と主要なEMAを維持できないことが、引き続き中期的な弱気構造を強化しています。

最近の価格は、$1.30–$1.20のマクロ需要ゾーンに向かって下落し、サイクルベースを示す$1.12付近のFib 0レベルと密接に一致しています。現在、XRPは$1.34–$1.37の範囲で調整中であり、急激な下落後の早期安定化を示唆していますが、強い強気の確信はまだ現れていません。

EMA構造 (弱気バイアス)

20 EMA:$1.409

50 EMA:$1.551

100 EMA:$1.766

200 EMA:$2.014

XRPはすべての主要EMAの下で取引を続けており、$1.41–$1.55の20–50 EMAクラスターが即時の動的抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された下落トレンドを反映しています。価格が$1.76–$2.01の領域を取り戻さない限り、上昇局面は修正的な動きにとどまる可能性が高いです。

フィボナッチ&価格構造

0.786 Fib:$3.117

XRPは、0.5–0.618フィボナッチリトレースメント領域に対応する$2.39–$2.69の抵抗クラスターを取り戻せず、その後もより広範な修正構造内に留まっています。下降トレンドラインからの繰り返しの拒否と主要なEMAを維持できないことが、引き続き中期的な弱気構造を強化しています。

最近の価格は、$1.30–$1.20のマクロ需要ゾーンに向かって下落し、サイクルベースを示す$1.12付近のFib 0レベルと密接に一致しています。現在、XRPは$1.34–$1.37の範囲で調整中であり、急激な下落後の早期安定化を示唆していますが、強い強気の確信はまだ現れていません。

EMA構造 (弱気バイアス)

20 EMA:$1.409

50 EMA:$1.551

100 EMA:$1.766

200 EMA:$2.014

XRPはすべての主要EMAの下で取引を続けており、$1.41–$1.55の20–50 EMAクラスターが即時の動的抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された下落トレンドを反映しています。価格が$1.76–$2.01の領域を取り戻さない限り、上昇局面は修正的な動きにとどまる可能性が高いです。

フィボナッチ&価格構造

0.786 Fib:$3.117

XRP-0.29%

- 報酬

- 1

- 3

- リポスト

- 共有

Ryakpanda :

:

2026年ラッシュ 👊もっと見る

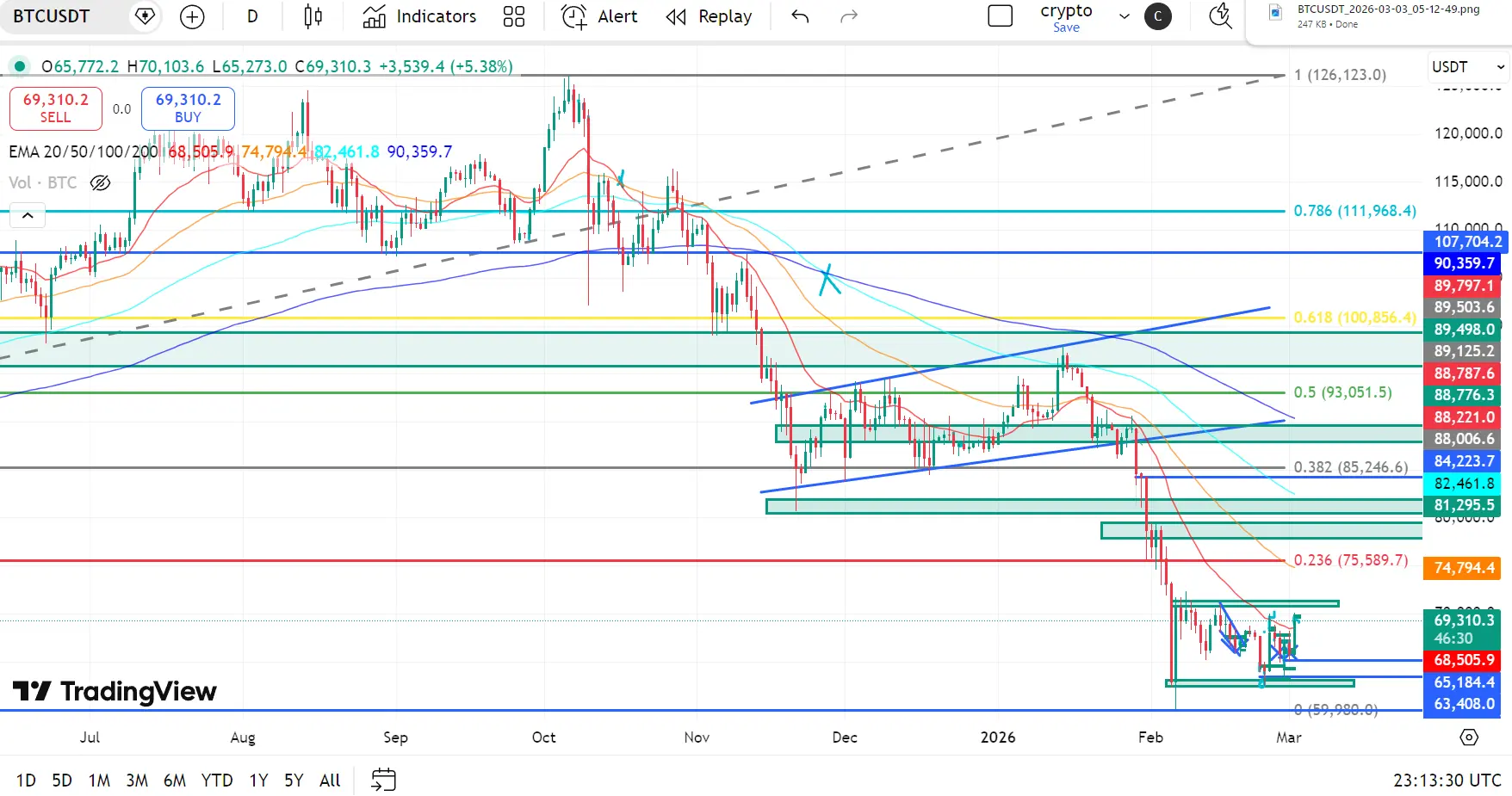

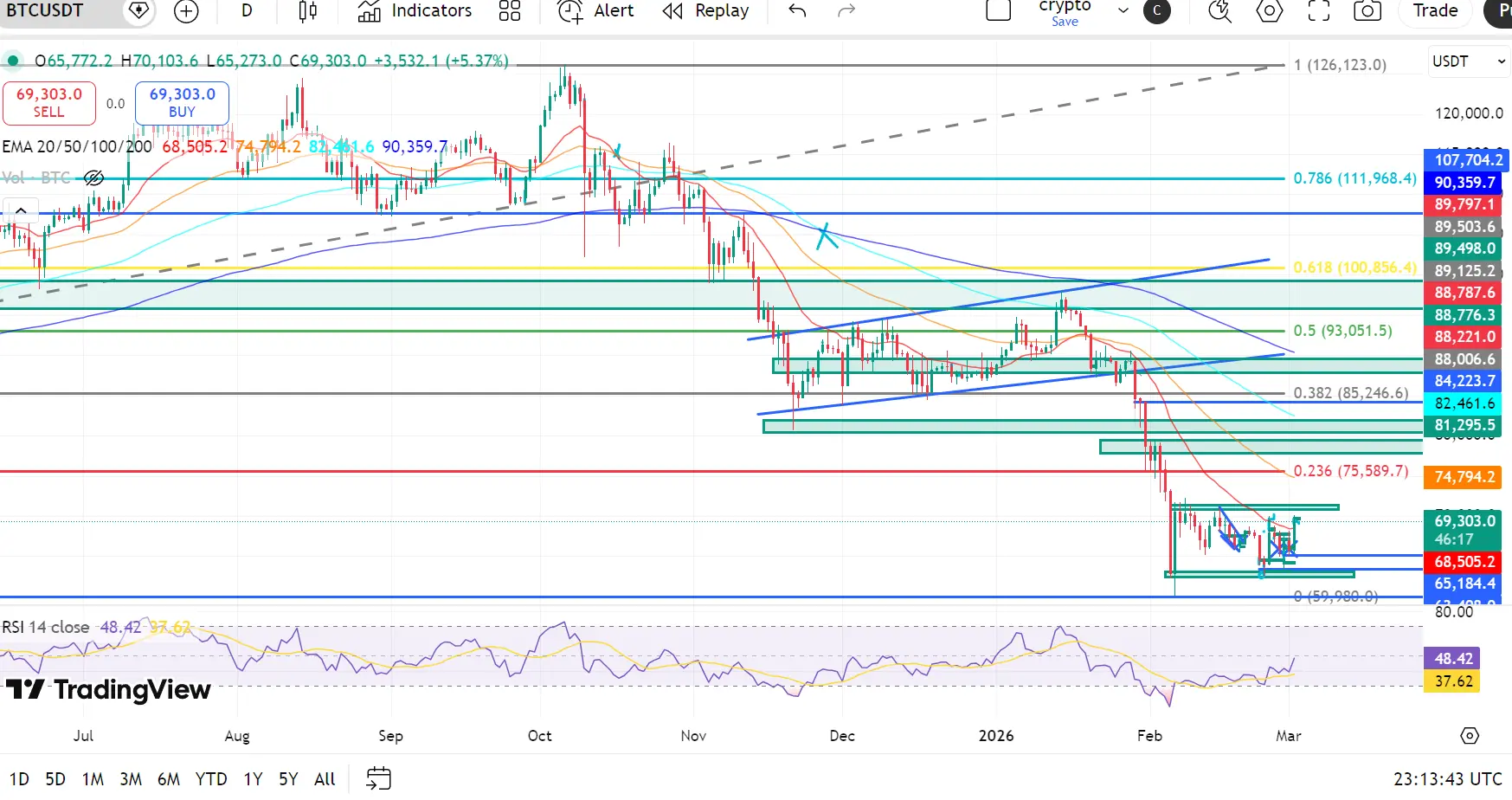

BTCテクニカル展望:ビットコイン、急落後にサイクルサポート付近で安定

ビットコインは、$100K–$112K 抵抗帯の上で勢いを維持できず、0.618–0.786フィボナッチリトレースメント領域に対応する広範な修正構造内に留まっています。このゾーンからの拒否により、下降トレンドラインと主要EMAレベルでの繰り返し失敗によって、長期の下落フェーズが引き起こされました。

価格は最近、$60K–$65K マクロ需要ゾーンに向かって下落し、重要なサイクルサポートエリアを示しています。BTCは現在、$67K–$69K付近での安定化を示唆しており、売り圧力が薄れ始めているものの、全体の構造は慎重なままです。

EMA構造 (弱気バイアス)

20 EMA:$68,971

50 EMA:$74,074

100 EMA:$81,497

200 EMA:$89,558

ビットコインはすべての主要EMAの下で取引されており、20–50 EMAのクラスターは$69K–$74K 付近で即時のダイナミック抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された修正トレンドを反映しています。価格が$81K–$89K の領域を回復しない限り、上昇は修正的な動きにとどまる可能性が高いです。ここで100EMAと200EMAが収束しています。

フィボナッチ&価格構造

0.786 Fib:$111,

ビットコインは、$100K–$112K 抵抗帯の上で勢いを維持できず、0.618–0.786フィボナッチリトレースメント領域に対応する広範な修正構造内に留まっています。このゾーンからの拒否により、下降トレンドラインと主要EMAレベルでの繰り返し失敗によって、長期の下落フェーズが引き起こされました。

価格は最近、$60K–$65K マクロ需要ゾーンに向かって下落し、重要なサイクルサポートエリアを示しています。BTCは現在、$67K–$69K付近での安定化を示唆しており、売り圧力が薄れ始めているものの、全体の構造は慎重なままです。

EMA構造 (弱気バイアス)

20 EMA:$68,971

50 EMA:$74,074

100 EMA:$81,497

200 EMA:$89,558

ビットコインはすべての主要EMAの下で取引されており、20–50 EMAのクラスターは$69K–$74K 付近で即時のダイナミック抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された修正トレンドを反映しています。価格が$81K–$89K の領域を回復しない限り、上昇は修正的な動きにとどまる可能性が高いです。ここで100EMAと200EMAが収束しています。

フィボナッチ&価格構造

0.786 Fib:$111,

BTC-1.14%

- 報酬

- 12

- 12

- リポスト

- 共有

XSEAM :

:

あなたは同意しますか? ⚜️ BTCから金へ。

過去のサイクルを振り返ると、繰り返されるパターンがあります:BTC/ゴールドの局所的なピークから底値形成まで

もっと見る

SOL 技術的見通し:ソラナ、長期下落トレンド後の安定化を試みる

ソラナは、0.618–0.786 Fibonacciリトレースメント領域に対応する$182–$213 抵抗クラスターを超える勢いを維持できず、長期の修正構造内に留まっています。このゾーンからの拒否により、下降トレンドが持続し、下降トレンドラインと主要なEMAレベルでの繰り返しの失敗によって強化されました。

価格は最近、$67 サイクルの底(Fib 0)に向かって下落した後、控えめな反発を見せました。SOLは現在、$86–$90 の範囲で調整中であり、急激な下落後の短期的な安定化を示唆していますが、より広範なトレンド構造は依然として慎重です。

EMA構造 (弱気バイアス)

20 EMA:$87

50 EMA:$97

100 EMA:$115

200 EMA:$135

ソラナはすべての主要EMAの下で取引を続けており、20–50 EMAクラスターは$87–$97 付近で即時のダイナミック抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された下降トレンドを強調しています。価格が$115–$135 の領域を回復しない限り、上昇は修正的な動きにとどまります。そこでは100EMAと200EMAが収束しています。

フィボナッチ&価格構造

0.786 Fib:$213.60

0.618 Fib:$182.29

ソラナは、0.618–0.786 Fibonacciリトレースメント領域に対応する$182–$213 抵抗クラスターを超える勢いを維持できず、長期の修正構造内に留まっています。このゾーンからの拒否により、下降トレンドが持続し、下降トレンドラインと主要なEMAレベルでの繰り返しの失敗によって強化されました。

価格は最近、$67 サイクルの底(Fib 0)に向かって下落した後、控えめな反発を見せました。SOLは現在、$86–$90 の範囲で調整中であり、急激な下落後の短期的な安定化を示唆していますが、より広範なトレンド構造は依然として慎重です。

EMA構造 (弱気バイアス)

20 EMA:$87

50 EMA:$97

100 EMA:$115

200 EMA:$135

ソラナはすべての主要EMAの下で取引を続けており、20–50 EMAクラスターは$87–$97 付近で即時のダイナミック抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、確立された下降トレンドを強調しています。価格が$115–$135 の領域を回復しない限り、上昇は修正的な動きにとどまります。そこでは100EMAと200EMAが収束しています。

フィボナッチ&価格構造

0.786 Fib:$213.60

0.618 Fib:$182.29

SOL-1.88%

- 報酬

- 6

- 4

- リポスト

- 共有

ybaser :

:

2026年ゴゴゴ 👊もっと見る

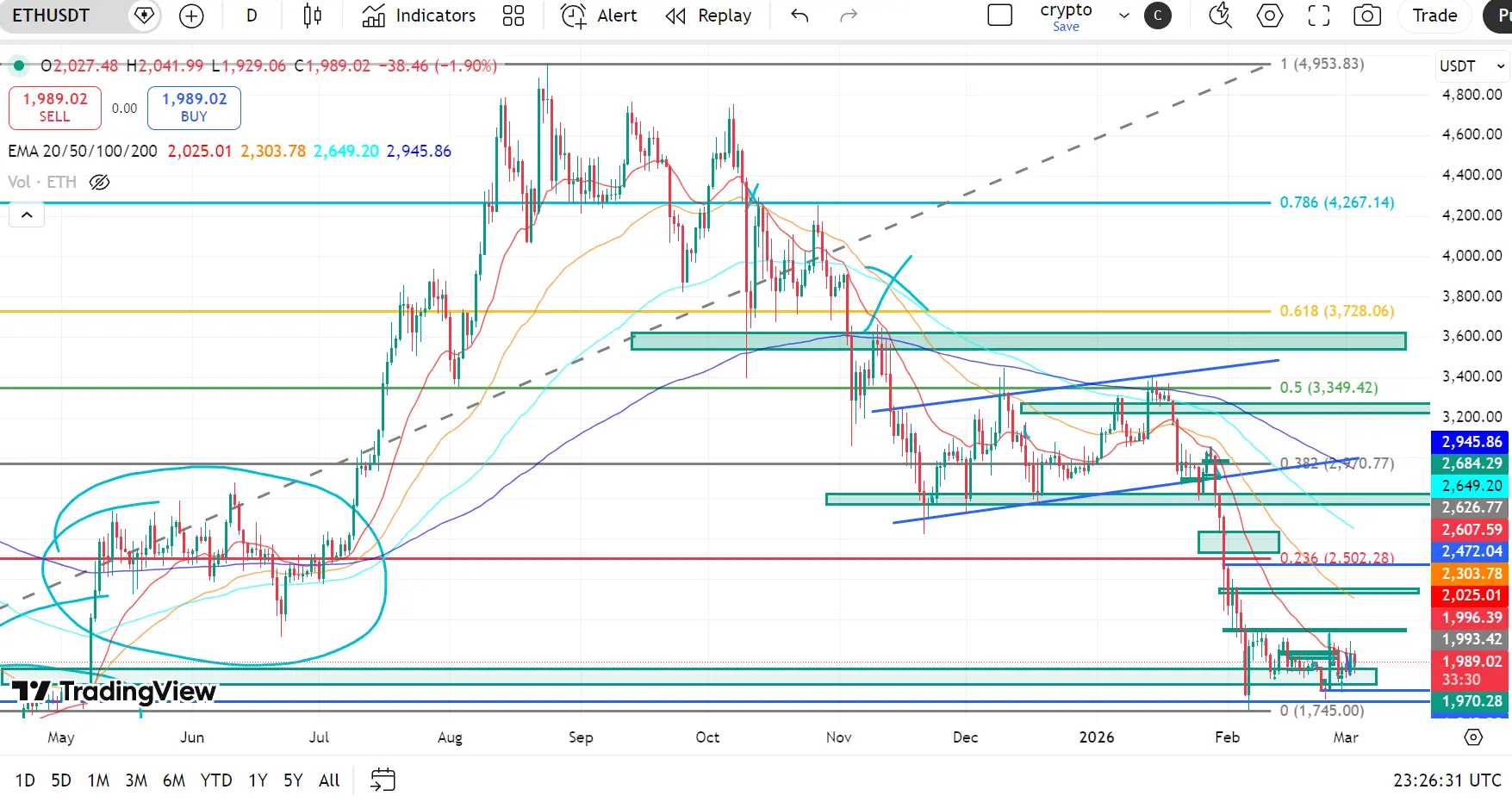

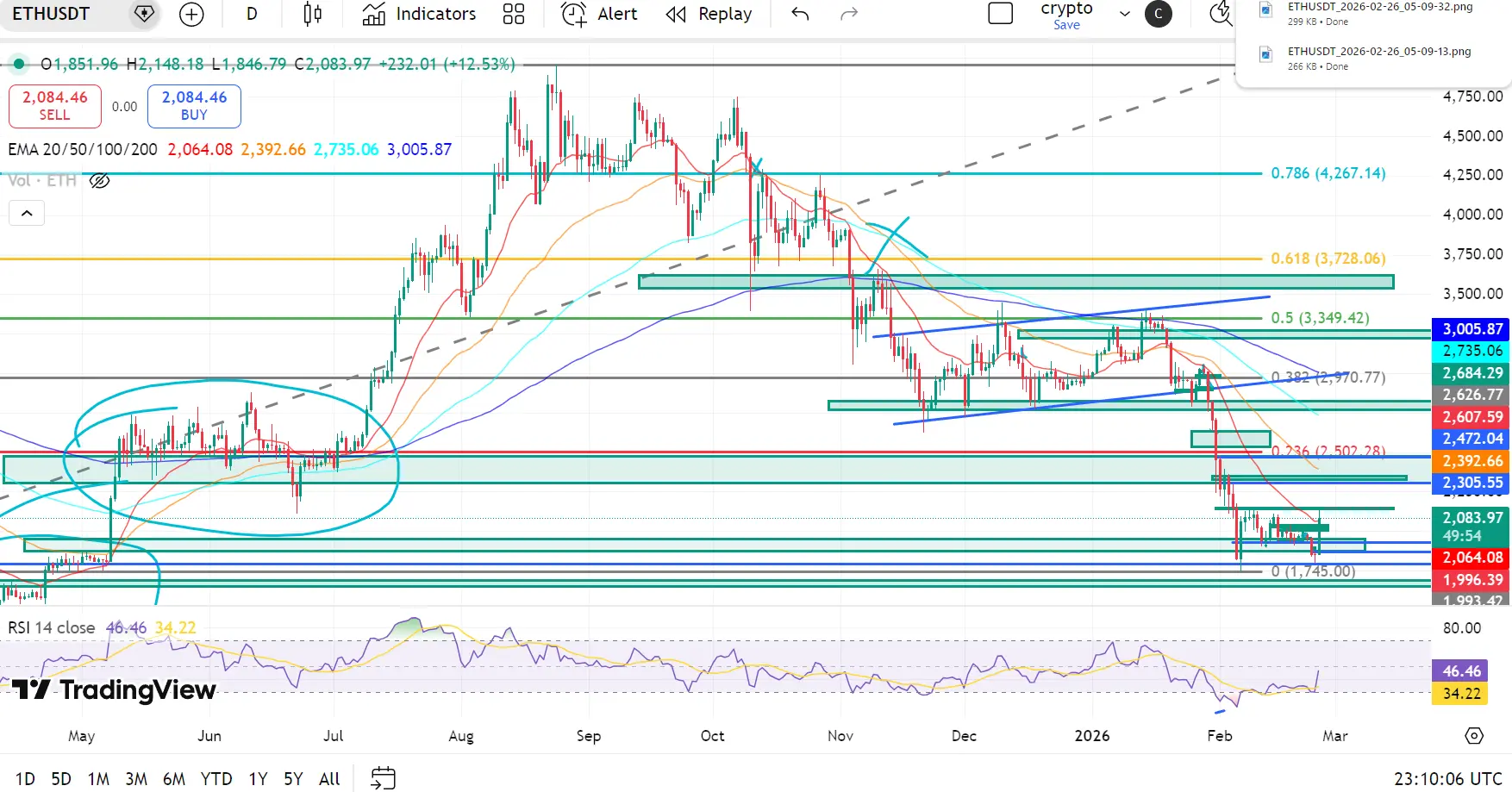

ETH テクニカル見通し:長期調整後にサイクル底付近で安定

Ethereumは、0.618–0.786 Fibonacciリトレースメントゾーンに一致する$3,728–$4,267の抵抗クラスターを超えられず、広範な調整構造内に留まっています。この地域からの拒否は、主要なEMAレベルでの繰り返し失敗と複数の構造的サポートの喪失によって強化された持続的な下落トレンドを引き起こしました。

価格は最近、サイクル底の$1,745 (Fib 0)に向かって下落し、その後わずかな回復を見せました。ETHは現在、$2,050–$2,150のゾーン周辺で安定化し始めており、衝撃的な下落後の早期安定を示唆していますが、より広範なトレンド状況は依然として慎重です。

EMA構造 (弱気バイアス)

20 EMA:$2,038

50 EMA:$2,288

100 EMA:$2,627

200 EMA:$2,929

Ethereumはすべての主要EMAの下で取引されており、20–50 EMAクラスターは$2,040–$2,290付近に位置し、即時の動的抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、成熟した調整段階を確認しています。上昇局面は現在、価格が$2,627–$2,929の領域を取り戻さない限り、リリーフラリーと見なされます。

フィボナッチ&価格構造

1.0 Fib (サイクル高)

Ethereumは、0.618–0.786 Fibonacciリトレースメントゾーンに一致する$3,728–$4,267の抵抗クラスターを超えられず、広範な調整構造内に留まっています。この地域からの拒否は、主要なEMAレベルでの繰り返し失敗と複数の構造的サポートの喪失によって強化された持続的な下落トレンドを引き起こしました。

価格は最近、サイクル底の$1,745 (Fib 0)に向かって下落し、その後わずかな回復を見せました。ETHは現在、$2,050–$2,150のゾーン周辺で安定化し始めており、衝撃的な下落後の早期安定を示唆していますが、より広範なトレンド状況は依然として慎重です。

EMA構造 (弱気バイアス)

20 EMA:$2,038

50 EMA:$2,288

100 EMA:$2,627

200 EMA:$2,929

Ethereumはすべての主要EMAの下で取引されており、20–50 EMAクラスターは$2,040–$2,290付近に位置し、即時の動的抵抗として機能しています。

短期EMAと長期EMAの間の広い乖離は、成熟した調整段階を確認しています。上昇局面は現在、価格が$2,627–$2,929の領域を取り戻さない限り、リリーフラリーと見なされます。

フィボナッチ&価格構造

1.0 Fib (サイクル高)

ETH-0.58%

- 報酬

- 15

- 13

- 1

- 共有

Surrealist5N1K :

:

情報と共有をありがとうございます 💜🌼🌼🌼🌼💜情報と共有をありがとうございます 💜🌼🌼🌼🌼💜情報と共有をありがとうございます 💜🌼🌼🌼🌼💜情報と共有をありがとうございます 💜🌼🌼🌼🌼💜情報と共有をありがとうございます 💜🌼🌼🌼🌼💜情報と共有をありがとうございます 💜🌼🌼🌼🌼💜もっと見る

XRP テクニカル見通し:マクロサポート反応後に価格が$1.42付近で圧縮

XRPは、$3.66 (Fib 1.0)付近のサイクル高から反発した後、より広範な下降チャネル構造内で取引を続けています。市場は、中央値のフィボナッチレベルを失って以来、持続的な売り圧力の下にあります。

$1.71 (0.236 Fib)を下回ると、マクロリトレースメントの基準付近の$1.11 (Fib 0)に向かう長期的な修正動きが引き起こされました。

この需要ゾーンから強い反応があり、価格は$1.40–$1.50の範囲に押し戻されました。ここで、XRPは衝動的な下落後にタイトな統合範囲を形成しています。

短期的な安定化は見られるものの、主要な抵抗レベルを回復しない限り、より広範な市場構造は修正的なままです。

EMA構造 (弱気の整列維持)

20 EMA:$1.420

50 EMA:$1.573

100 EMA:$1.790

200 EMA:$2.033

価格はすべての主要EMAの下に留まり、明確な弱気のスタックを維持しています (20 < 50 < 100 < 200)。

$1.42–$1.57のゾーンは、即時の動的抵抗として機能しています。

50 EMAを回復できない場合、ラリーは引き続き全体的な下降トレンド内で修正的なものとなります。

フィボナッチ&市場構造

1.0 Fib (サイクル高): $3.

XRPは、$3.66 (Fib 1.0)付近のサイクル高から反発した後、より広範な下降チャネル構造内で取引を続けています。市場は、中央値のフィボナッチレベルを失って以来、持続的な売り圧力の下にあります。

$1.71 (0.236 Fib)を下回ると、マクロリトレースメントの基準付近の$1.11 (Fib 0)に向かう長期的な修正動きが引き起こされました。

この需要ゾーンから強い反応があり、価格は$1.40–$1.50の範囲に押し戻されました。ここで、XRPは衝動的な下落後にタイトな統合範囲を形成しています。

短期的な安定化は見られるものの、主要な抵抗レベルを回復しない限り、より広範な市場構造は修正的なままです。

EMA構造 (弱気の整列維持)

20 EMA:$1.420

50 EMA:$1.573

100 EMA:$1.790

200 EMA:$2.033

価格はすべての主要EMAの下に留まり、明確な弱気のスタックを維持しています (20 < 50 < 100 < 200)。

$1.42–$1.57のゾーンは、即時の動的抵抗として機能しています。

50 EMAを回復できない場合、ラリーは引き続き全体的な下降トレンド内で修正的なものとなります。

フィボナッチ&市場構造

1.0 Fib (サイクル高): $3.

XRP-0.29%

- 報酬

- 3

- 2

- リポスト

- 共有

LittleGodOfWealthPlutus :

:

馬年大吉,发财发财😘もっと見る

BTCテクニカル見通し:ビットコイン、衝動的な下落後に$68,000以上で圧縮

ビットコインは、0.786フィボ( $111,968)からの反発とマクロ中間レンジレベルを維持できなかったことを受けて、より広範な修正構造内に留まっています。

$85,246 (0.382フィボ)とその後の$75,589 (0.236フィボ)を下回るブレイクダウンは、マクロリトレースメントの基点付近の$59,980 (Fib 0)に向かう衝動的な売りを引き起こしました。

その後、$60K 地域から強い反応があり、ビットコインは現在、急落後のタイトな圧縮範囲を形成しながら$68,000–$72,500の間で統合しています。

短期的な安定化は見られるものの、主要な抵抗レベルを取り戻さない限り、支配的な構造は修正的なままです。

EMA構造 (弱気な整列は維持)

20 EMA:$68,859

50 EMA:$74,454

100 EMA:$81,986

200 EMA:$89,963

価格はすべての主要EMA以下に留まり、クリーンな弱気スタックを維持 (20 < 50 < 100 < 200)。

$68,800–$74,400のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを取り戻せない場合、ラリーは引き続き広範な下降トレンド内で修正的なものとなることを示唆します。

フィボナッチ&マーケッ

ビットコインは、0.786フィボ( $111,968)からの反発とマクロ中間レンジレベルを維持できなかったことを受けて、より広範な修正構造内に留まっています。

$85,246 (0.382フィボ)とその後の$75,589 (0.236フィボ)を下回るブレイクダウンは、マクロリトレースメントの基点付近の$59,980 (Fib 0)に向かう衝動的な売りを引き起こしました。

その後、$60K 地域から強い反応があり、ビットコインは現在、急落後のタイトな圧縮範囲を形成しながら$68,000–$72,500の間で統合しています。

短期的な安定化は見られるものの、主要な抵抗レベルを取り戻さない限り、支配的な構造は修正的なままです。

EMA構造 (弱気な整列は維持)

20 EMA:$68,859

50 EMA:$74,454

100 EMA:$81,986

200 EMA:$89,963

価格はすべての主要EMA以下に留まり、クリーンな弱気スタックを維持 (20 < 50 < 100 < 200)。

$68,800–$74,400のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを取り戻せない場合、ラリーは引き続き広範な下降トレンド内で修正的なものとなることを示唆します。

フィボナッチ&マーケッ

BTC-1.14%

- 報酬

- 1

- コメント

- リポスト

- 共有

XRP テクニカル見通し:下降構造が持続する中、XRPは1.34ドル以上で安定

XRPは、0.786フィボ(3.117ドル)からの反発後、明確な下降チャネル内で高値を切り下げながら、主要な修正サイクル内に留まっています。

1.719ドル(0.236フィボ)を下回ると、売り圧力が加速し、価格はマクロリトレースメントの基準点である1.119ドル(フィボ0)に向かって動きました。その後鋭い反応があり、XRPは現在、1.34ドル〜1.40ドルの間でタイトに統合されており、主要なサポートのすぐ上に圧縮範囲を形成しています。

下落の勢いは鈍化していますが、主要な抵抗レベルを回復しない限り、全体の構造は依然として弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:1.420ドル

50 EMA:1.579ドル

100 EMA:1.797ドル

200 EMA:2.039ドル

価格はすべての主要EMAの下で取引を続けており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

1.42ドル〜1.58ドルのゾーンは、即時の動的抵抗として機能しています。

50 EMAを回復できない場合、修正トレンドは維持されます。

フィボナッチ&マーケット構造

1.0フィボ(サイクル高):3.661ドル

0.786フィボ:3.117ドル

0.618フィボ:2.690ドル

0.5フ

XRPは、0.786フィボ(3.117ドル)からの反発後、明確な下降チャネル内で高値を切り下げながら、主要な修正サイクル内に留まっています。

1.719ドル(0.236フィボ)を下回ると、売り圧力が加速し、価格はマクロリトレースメントの基準点である1.119ドル(フィボ0)に向かって動きました。その後鋭い反応があり、XRPは現在、1.34ドル〜1.40ドルの間でタイトに統合されており、主要なサポートのすぐ上に圧縮範囲を形成しています。

下落の勢いは鈍化していますが、主要な抵抗レベルを回復しない限り、全体の構造は依然として弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:1.420ドル

50 EMA:1.579ドル

100 EMA:1.797ドル

200 EMA:2.039ドル

価格はすべての主要EMAの下で取引を続けており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

1.42ドル〜1.58ドルのゾーンは、即時の動的抵抗として機能しています。

50 EMAを回復できない場合、修正トレンドは維持されます。

フィボナッチ&マーケット構造

1.0フィボ(サイクル高):3.661ドル

0.786フィボ:3.117ドル

0.618フィボ:2.690ドル

0.5フ

XRP-0.29%

- 報酬

- 3

- 2

- 1

- 共有

ybaser :

:

月へ 🌕もっと見る

ETH テクニカル見通し:構造的崩壊後も$1,970のマクロサポートを維持

イーサリアムは、0.786フィボ( $4,267)からの反発と、下降トレンドラインの下で形成されたローアー・ハイ構造の後、より広範な修正サイクル内に留まっています。

$2,502 (0.236フィボ)を下回ると、下落の勢いが加速し、価格はマクロリトレースメントの基準付近の$1,745 (フィボ0)に直接押し込まれました。これに続き鋭い反応が見られ、ETHは現在$1,970–$2,020の間で安定し、重要なサポートの上にタイトな圧縮レンジを形成しています。

売り圧力は和らいできていますが、主要な抵抗ゾーンを回復しない限り、支配的な構造は依然として弱気のままです。

EMA構造 (弱気の整列を維持)

20 EMA:$2,024

50 EMA:$2,303

100 EMA:$2,649

200 EMA:$2,945

価格はすべての主要EMAの下に留まり、クリーンな弱気のスタックを維持しています (20 < 50 < 100 < 200)。

$2,020–$2,300のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを回復できない場合、ラリーは修正的なままとなります。

フィボナッチ&マーケット構造

1.0フィボ (サイクル高):$4,953

0.786フィボ:$4,267

0.618フィボ:$3,

イーサリアムは、0.786フィボ( $4,267)からの反発と、下降トレンドラインの下で形成されたローアー・ハイ構造の後、より広範な修正サイクル内に留まっています。

$2,502 (0.236フィボ)を下回ると、下落の勢いが加速し、価格はマクロリトレースメントの基準付近の$1,745 (フィボ0)に直接押し込まれました。これに続き鋭い反応が見られ、ETHは現在$1,970–$2,020の間で安定し、重要なサポートの上にタイトな圧縮レンジを形成しています。

売り圧力は和らいできていますが、主要な抵抗ゾーンを回復しない限り、支配的な構造は依然として弱気のままです。

EMA構造 (弱気の整列を維持)

20 EMA:$2,024

50 EMA:$2,303

100 EMA:$2,649

200 EMA:$2,945

価格はすべての主要EMAの下に留まり、クリーンな弱気のスタックを維持しています (20 < 50 < 100 < 200)。

$2,020–$2,300のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを回復できない場合、ラリーは修正的なままとなります。

フィボナッチ&マーケット構造

1.0フィボ (サイクル高):$4,953

0.786フィボ:$4,267

0.618フィボ:$3,

ETH-0.58%

- 報酬

- 11

- 7

- 3

- 共有

KatyPaty :

:

2026年ゴゴゴ 👊もっと見る

SOL テクニカル見通し:0.236割れ後にマクロベースを上回り安定化

Solanaは、$253.47付近のサイクル高から反発した後、より広範な調整下落トレンドに留まっています。重要な0.236フィボナッチレベル($111.11)を下回ると、売り圧力が加速し、価格はマクロリトレースメントのベースに向かって推移しています。

SOLは現在、$85–$90の範囲で調整中であり、$67.14のフィボナッチ0レベルを上回っており、激しい売りの後に短期的な安定化を試みています。

EMA構造 (弱気の整列は維持)

20 EMA:$86.38

50 EMA:$99.15

100 EMA:$116.89

200 EMA:$137.25

価格はすべての主要EMAの下に位置し、明確な弱気の積み重ねが見られます:

20 < 50 < 100 < 200

$86–$99 ゾーンは即時のダイナミックな抵抗線として機能します。

$116–$137 地域(100 & 200 EMAクラスター)は強力なマクロ上部供給を示しています。

SOLが勢いを持って50 EMAを取り戻さない限り、上昇はより広範な下落トレンド内の修正にとどまります。

フィボナッチ構造

1.0 Fib (サイクル高): $253.47

0.786 Fib:$213.60

0.618 Fib:$182.29

0.5 Fib:$160.31

0.38

Solanaは、$253.47付近のサイクル高から反発した後、より広範な調整下落トレンドに留まっています。重要な0.236フィボナッチレベル($111.11)を下回ると、売り圧力が加速し、価格はマクロリトレースメントのベースに向かって推移しています。

SOLは現在、$85–$90の範囲で調整中であり、$67.14のフィボナッチ0レベルを上回っており、激しい売りの後に短期的な安定化を試みています。

EMA構造 (弱気の整列は維持)

20 EMA:$86.38

50 EMA:$99.15

100 EMA:$116.89

200 EMA:$137.25

価格はすべての主要EMAの下に位置し、明確な弱気の積み重ねが見られます:

20 < 50 < 100 < 200

$86–$99 ゾーンは即時のダイナミックな抵抗線として機能します。

$116–$137 地域(100 & 200 EMAクラスター)は強力なマクロ上部供給を示しています。

SOLが勢いを持って50 EMAを取り戻さない限り、上昇はより広範な下落トレンド内の修正にとどまります。

フィボナッチ構造

1.0 Fib (サイクル高): $253.47

0.786 Fib:$213.60

0.618 Fib:$182.29

0.5 Fib:$160.31

0.38

SOL-1.88%

- 報酬

- 4

- 13

- リポスト

- 共有

Satosh陌Nakamato :

:

申し訳ありませんが、提供されたソーステキストは意味のある内容を含んでいないため、翻訳できません。もっと見る

BTCのテクニカル見通し:急激な調整後、0.236以下での推移を継続

ビットコインは、$126,123付近のサイクル高からのリジェクト後、構造的な圧力の下にあります。主要な中間範囲のフィボナッチレベルを失った後、BTCは0.382 ($85,246)と0.5 ($93,051)のサポートを下回り、下落ゾーンに加速しています。

価格は現在、$65,000–$69,000付近で安定しつつあり、マクロリトレースメントの基準点である$59,980 (Fib 0)の少し上で短期的な安定化を試みています。

EMA構造 (弱気の整列)

20 EMA:$68,505

50 EMA:$74,794

100 EMA:$82,461

200 EMA:$90,359

BTCはすべての主要EMAの下で取引されており、明確な弱気の積み重ねが見られます:

20 < 50 < 100 < 200

$68,500–$74,800のゾーンは即時のダイナミックな抵抗線として機能しています。

$82,000–$90,000のクラスター (100 & 200 EMA)は、強力なマクロの上値供給を示しています。

ビットコインが50 EMAを力強く取り戻さない限り、上昇は修正的な動きにとどまるでしょう。

フィボナッチ構造

1.0 Fib (サイクル高): $126,123

0.786 Fib: $111,968

0.618 F

ビットコインは、$126,123付近のサイクル高からのリジェクト後、構造的な圧力の下にあります。主要な中間範囲のフィボナッチレベルを失った後、BTCは0.382 ($85,246)と0.5 ($93,051)のサポートを下回り、下落ゾーンに加速しています。

価格は現在、$65,000–$69,000付近で安定しつつあり、マクロリトレースメントの基準点である$59,980 (Fib 0)の少し上で短期的な安定化を試みています。

EMA構造 (弱気の整列)

20 EMA:$68,505

50 EMA:$74,794

100 EMA:$82,461

200 EMA:$90,359

BTCはすべての主要EMAの下で取引されており、明確な弱気の積み重ねが見られます:

20 < 50 < 100 < 200

$68,500–$74,800のゾーンは即時のダイナミックな抵抗線として機能しています。

$82,000–$90,000のクラスター (100 & 200 EMA)は、強力なマクロの上値供給を示しています。

ビットコインが50 EMAを力強く取り戻さない限り、上昇は修正的な動きにとどまるでしょう。

フィボナッチ構造

1.0 Fib (サイクル高): $126,123

0.786 Fib: $111,968

0.618 F

BTC-1.14%

- 報酬

- 3

- 2

- リポスト

- 共有

ybaser :

:

月へ 🌕もっと見る

XRP テクニカル見通し:下降チャネル内でマクロサポートに圧縮

XRPは、$3.11(0.786フィボ)付近の上部リトレースメントゾーンからの反発後も、下落トレンドを維持し、下降チャネル構造内で明確な安値の連続を形成しています。

$2.09(0.382フィボ)および$1.72(0.236フィボ)を下回ると、下落の勢いが加速し、マクロベースの$1.12(フィボ)に向かって価格が押し下げられました。現在、価格は$1.34–$1.40の間で調整中で、より広範な需要ゾーンのやや上に位置しています。

売り圧力は緩和していますが、XRPが重要な抵抗レベルを回復しない限り、全体の構造は弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:$1.429

50 EMA:$1.596

100 EMA:$1.814

200 EMA:$2.053

XRPは、すべての主要EMAの下で取引を続けており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

$1.43–$1.60のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを下回る回復は、より広範な下降トレンド内で修正的とみなすべきです。

フィボナッチ&マーケット構造

1.0フィボ(サイクル高): $3.661

0.786フィボ:$3.117

0.618フィボ:$2.690

0.5フィボ:$2.3

XRPは、$3.11(0.786フィボ)付近の上部リトレースメントゾーンからの反発後も、下落トレンドを維持し、下降チャネル構造内で明確な安値の連続を形成しています。

$2.09(0.382フィボ)および$1.72(0.236フィボ)を下回ると、下落の勢いが加速し、マクロベースの$1.12(フィボ)に向かって価格が押し下げられました。現在、価格は$1.34–$1.40の間で調整中で、より広範な需要ゾーンのやや上に位置しています。

売り圧力は緩和していますが、XRPが重要な抵抗レベルを回復しない限り、全体の構造は弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:$1.429

50 EMA:$1.596

100 EMA:$1.814

200 EMA:$2.053

XRPは、すべての主要EMAの下で取引を続けており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

$1.43–$1.60のゾーンは、即時のダイナミック抵抗として機能しています。

50 EMAを下回る回復は、より広範な下降トレンド内で修正的とみなすべきです。

フィボナッチ&マーケット構造

1.0フィボ(サイクル高): $3.661

0.786フィボ:$3.117

0.618フィボ:$2.690

0.5フィボ:$2.3

XRP-0.29%

- 報酬

- 3

- 3

- リポスト

- 共有

Xavi1 :

:

2026 ゴーゴーゴー 👊2026 ゴーゴーゴー 👊 2026 ゴーゴーゴー 👊 2026 ゴーゴー 👊 2026 ゴーゴーゴー 👊 2026 ゴーゴーゴー 👊 2026 ゴーゴーゴー 👊 2026 ゴーゴーゴー 👊もっと見る

ETH テクニカル見通し:インパルス的な下落後にマクロ基準線の上で安定

イーサリアムは、$4,267(0.786フィボナッチ)付近の上部リトレースメントゾーンからの拒否と、重要な0.5($3,349)および0.382($2,976)のサポートを下回ったことで、持続的な修正構造の中に留まっています。

最近の売りは、マクロリトレースメント基準線付近の$1,745(フィボナッチ0)まで拡大し、その後、価格は強い反応を示し、$1,900–$1,970の間で狭いレンジの中に入っています。

下落の勢いは鈍化していますが、主要な抵抗レベルを回復しない限り、より広範な構造は依然として弱気のままです。

EMA構造 (弱気の整列維持)

20 EMA:$2,028

50 EMA:$2,328

100 EMA:$2,675

200 EMA:$2,964

ETHはすべての主要EMAの下で取引されており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

$2,030–$2,330のゾーンは、即時の動的抵抗として機能しています。

50 EMAを下回る回復は、より広範な下降トレンド内の修正と見なされるべきです。

フィボナッチ&マーケット構造

1.0フィボナッチ(サイクル高): $4,953

0.786フィボナッチ:$4,267

0.618フィボナッチ:$3,728

0.5フィボナッ

イーサリアムは、$4,267(0.786フィボナッチ)付近の上部リトレースメントゾーンからの拒否と、重要な0.5($3,349)および0.382($2,976)のサポートを下回ったことで、持続的な修正構造の中に留まっています。

最近の売りは、マクロリトレースメント基準線付近の$1,745(フィボナッチ0)まで拡大し、その後、価格は強い反応を示し、$1,900–$1,970の間で狭いレンジの中に入っています。

下落の勢いは鈍化していますが、主要な抵抗レベルを回復しない限り、より広範な構造は依然として弱気のままです。

EMA構造 (弱気の整列維持)

20 EMA:$2,028

50 EMA:$2,328

100 EMA:$2,675

200 EMA:$2,964

ETHはすべての主要EMAの下で取引されており、明確な弱気のスタックを維持しています(20 < 50 < 100 < 200)。

$2,030–$2,330のゾーンは、即時の動的抵抗として機能しています。

50 EMAを下回る回復は、より広範な下降トレンド内の修正と見なされるべきです。

フィボナッチ&マーケット構造

1.0フィボナッチ(サイクル高): $4,953

0.786フィボナッチ:$4,267

0.618フィボナッチ:$3,728

0.5フィボナッ

ETH-0.58%

- 報酬

- 4

- 2

- リポスト

- 共有

Ryakpanda :

:

ボラティリティはチャンス 📊もっと見る

SOL テクニカル見通し:マクロベースで圧縮するソラナ、数ヶ月の下落トレンド後

ソラナは、$253付近のサイクル高からのリジェクト後、持続的な弱気構造のまま推移しています。0.382フィボ ($138.32) と 0.236フィボ ($111.11) のレベルを失った後、価格はマクロリトレースメントの基準点である $67.14 (Fib 0) へと下落を拡大しました。

現在、価格は$81–$86の間でタイトに統合されており、マクロサポートのすぐ上に短期的な圧縮レンジを形成しています。下落の勢いは鈍化していますが、より広範な構造は高抵抗レベルを回復しない限り、依然として弱気のままです。

EMA構造 (弱気スタック維持)

20 EMA:$86.61

50 EMA:$100.31

100 EMA:$118.18

200 EMA:$138.30

ソラナは、すべての主要EMAの下で取引を続けており、明確な弱気の整列を維持しています (20 < 50 < 100 < 200)。

$86–$100 ゾーンは、即時のダイナミック抵抗として機能しています。

50 EMA以下の回復は、より広範な下落トレンド内の修正とみなすべきです。

フィボナッチ&マーケット構造

1.0 フィボ (サイクル高): $253.47

0.786 フィボ:$213.60

0.618 フィボ:$182.29

0.5 フィボ:$

ソラナは、$253付近のサイクル高からのリジェクト後、持続的な弱気構造のまま推移しています。0.382フィボ ($138.32) と 0.236フィボ ($111.11) のレベルを失った後、価格はマクロリトレースメントの基準点である $67.14 (Fib 0) へと下落を拡大しました。

現在、価格は$81–$86の間でタイトに統合されており、マクロサポートのすぐ上に短期的な圧縮レンジを形成しています。下落の勢いは鈍化していますが、より広範な構造は高抵抗レベルを回復しない限り、依然として弱気のままです。

EMA構造 (弱気スタック維持)

20 EMA:$86.61

50 EMA:$100.31

100 EMA:$118.18

200 EMA:$138.30

ソラナは、すべての主要EMAの下で取引を続けており、明確な弱気の整列を維持しています (20 < 50 < 100 < 200)。

$86–$100 ゾーンは、即時のダイナミック抵抗として機能しています。

50 EMA以下の回復は、より広範な下落トレンド内の修正とみなすべきです。

フィボナッチ&マーケット構造

1.0 フィボ (サイクル高): $253.47

0.786 フィボ:$213.60

0.618 フィボ:$182.29

0.5 フィボ:$

SOL-1.88%

- 報酬

- 3

- 1

- リポスト

- 共有

ybaser :

:

月へ 🌕BTC テクニカル見通し:キャピチュレーション後にマクロサポートの上で統合を続けるビットコイン

ビットコインは急激なインパルス下降を完了し、上昇構造を下抜けて0.382フィボ ($85,246) と0.236フィボ ($75,589) のサポートを順次失いました。売りは$59,980 (フィボ 0)付近のマクロリトレースメント基準点まで拡大し、そこで強い反応の安値を記録しました。

マクロ基準点に到達して以来、BTCは$63,000–$69,000の狭い統合レンジに入り、短期的な安定化を示唆しています。ただし、主要な抵抗レベルを回復しない限り、より広範なトレンド構造は依然として弱気のままです。

EMA構造 (弱気の整列維持)

20 EMA:$68,709

50 EMA:$75,399

100 EMA:$83,071

200 EMA:$90,821

価格はすべての主要EMAの下に位置し、明確な弱気のスタック (20 < 50 < 100 < 200)を形成しています。

$68K–$75K ゾーンは現在、即時のダイナミック抵抗として機能しています。

BTCが50 EMAを強い勢いで回復しない限り、上昇は修正的な動きである可能性が高いです。

フィボナッチ & マーケット構造

1.0 フィボ (サイクル高): $126,123

0.786 フィボ:$111,968

0.618 フィボ:$10

ビットコインは急激なインパルス下降を完了し、上昇構造を下抜けて0.382フィボ ($85,246) と0.236フィボ ($75,589) のサポートを順次失いました。売りは$59,980 (フィボ 0)付近のマクロリトレースメント基準点まで拡大し、そこで強い反応の安値を記録しました。

マクロ基準点に到達して以来、BTCは$63,000–$69,000の狭い統合レンジに入り、短期的な安定化を示唆しています。ただし、主要な抵抗レベルを回復しない限り、より広範なトレンド構造は依然として弱気のままです。

EMA構造 (弱気の整列維持)

20 EMA:$68,709

50 EMA:$75,399

100 EMA:$83,071

200 EMA:$90,821

価格はすべての主要EMAの下に位置し、明確な弱気のスタック (20 < 50 < 100 < 200)を形成しています。

$68K–$75K ゾーンは現在、即時のダイナミック抵抗として機能しています。

BTCが50 EMAを強い勢いで回復しない限り、上昇は修正的な動きである可能性が高いです。

フィボナッチ & マーケット構造

1.0 フィボ (サイクル高): $126,123

0.786 フィボ:$111,968

0.618 フィボ:$10

BTC-1.14%

- 報酬

- 3

- 4

- リポスト

- 共有

AYATTAC :

:

Ape In 🚀もっと見る

XRP テクニカル展望:下降チャネル内でマクロサポートを圧迫

XRPは、$3.66付近のサイクル高値からの反発後、持続的な弱気圧力の下にあります。価格はその後、明確な下降チャネル構造を形成し、一貫して安値と高値を更新しています。

0.236フィボナッチレベル ( $1.71) を失った後、XRPは下落を加速し、現在はマクロベースのサポート付近の$1.11 ( Fib 0) の少し上で調整中です。

短期的には$1.35–$1.45の範囲で安定化が見られますが、主要な抵抗レベルを回復しない限り、より広範なトレンドは依然として明確な弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:$1.44

50 EMA:$1.61

100 EMA:$1.83

200 EMA:$2.06

XRPはすべての主要EMAの下で取引されており、クリーンな弱気スタックを維持しています:

20 < 50 < 100 < 200

$1.44–$1.61のゾーンは現在、即時のダイナミック抵抗として機能し、100 & 200 EMAのクラスターは$1.83–$2.06付近にあり、強力なマクロの上値供給を示しています。

価格が50 EMAを力強く回復しない限り、ラリーはより広範な下降トレンド内で修正的な動きにとどまります。

フィボナッチ & マーケット構造

1.0フィボ (サイクル高値): $3.661

0

XRPは、$3.66付近のサイクル高値からの反発後、持続的な弱気圧力の下にあります。価格はその後、明確な下降チャネル構造を形成し、一貫して安値と高値を更新しています。

0.236フィボナッチレベル ( $1.71) を失った後、XRPは下落を加速し、現在はマクロベースのサポート付近の$1.11 ( Fib 0) の少し上で調整中です。

短期的には$1.35–$1.45の範囲で安定化が見られますが、主要な抵抗レベルを回復しない限り、より広範なトレンドは依然として明確な弱気のままです。

EMA構造 (弱気の整列は維持)

20 EMA:$1.44

50 EMA:$1.61

100 EMA:$1.83

200 EMA:$2.06

XRPはすべての主要EMAの下で取引されており、クリーンな弱気スタックを維持しています:

20 < 50 < 100 < 200

$1.44–$1.61のゾーンは現在、即時のダイナミック抵抗として機能し、100 & 200 EMAのクラスターは$1.83–$2.06付近にあり、強力なマクロの上値供給を示しています。

価格が50 EMAを力強く回復しない限り、ラリーはより広範な下降トレンド内で修正的な動きにとどまります。

フィボナッチ & マーケット構造

1.0フィボ (サイクル高値): $3.661

0

XRP-0.29%

- 報酬

- 4

- 2

- 1

- 共有

KevinLeee :

:

私はビジネスをしています。取引を行います。良い取引があれば私に教えてください。気に入ればあなたの取引を買います。あなたがお金を持っていて私のものを買えるなら、私の取引を差し上げます。あなたが支払えば、それがビジネスです 😂もっと見る

ETH テクニカル見通し:マクロベース付近で安定化、数ヶ月の下落後

イーサリアムは、$4,900–$4,300のマクロ供給ゾーンからの反発後、持続的な調整下落トレンドにあります。0.236フィボナッチレベル ( $2,502 ) を失った後、価格は急激に下落し、最近は$1,745付近のマクロベースに到達しました ( Fib 0 )。

ETHは現在、$1,900–$2,000の範囲で調整中で、短期的な安定化を試みていますが、重要な抵抗レベルを回復しない限り、長期的な構造は依然として弱気のままです。

EMA構造 (弱気の整列が継続)

20 EMA:$2,046

50 EMA:$2,359

100 EMA:$2,704

200 EMA:$2,985

イーサリアムはすべての主要EMAの下で取引されており、短期、中期、長期の構造にわたって強い弱気の整列を確認しています。

$2,050–$2,360のゾーン (20 & 50 EMAクラスター) は、即時のダイナミック抵抗として機能しています。

ETHが$2,700–$3,000付近の100 & 200 EMAクラスターの下に留まる限り、上昇は制限され、反発は修正的である可能性が高いです。

フィボナッチ & マーケット構造

1.0フィボナッチ (サイクル高値): $4,953

0.786フィボナッチ:$4,267

0.618フィボナッチ:$3,

イーサリアムは、$4,900–$4,300のマクロ供給ゾーンからの反発後、持続的な調整下落トレンドにあります。0.236フィボナッチレベル ( $2,502 ) を失った後、価格は急激に下落し、最近は$1,745付近のマクロベースに到達しました ( Fib 0 )。

ETHは現在、$1,900–$2,000の範囲で調整中で、短期的な安定化を試みていますが、重要な抵抗レベルを回復しない限り、長期的な構造は依然として弱気のままです。

EMA構造 (弱気の整列が継続)

20 EMA:$2,046

50 EMA:$2,359

100 EMA:$2,704

200 EMA:$2,985

イーサリアムはすべての主要EMAの下で取引されており、短期、中期、長期の構造にわたって強い弱気の整列を確認しています。

$2,050–$2,360のゾーン (20 & 50 EMAクラスター) は、即時のダイナミック抵抗として機能しています。

ETHが$2,700–$3,000付近の100 & 200 EMAクラスターの下に留まる限り、上昇は制限され、反発は修正的である可能性が高いです。

フィボナッチ & マーケット構造

1.0フィボナッチ (サイクル高値): $4,953

0.786フィボナッチ:$4,267

0.618フィボナッチ:$3,

ETH-0.58%

- 報酬

- 5

- 5

- 1

- 共有

MasterChuTheOldDemonMasterChu :

:

2026年ラッシュ 👊もっと見る

SOLテクニカル見通し:インパルス的な下落後、サラナはサイクル安値での調整を続ける

サラナは、$253付近のサイクル高値からの長期下落トレンドにより、持続的な弱気圧力の下にあります。0.236フィボナッチレベルの($111)を失った後、価格は加速して下落し、最近はマクロベース付近の$67 (Fib 0)にタッチし、その後やや反発しています。

現在の構造は$85–$90の短期的な調整範囲内にありますが、主要な抵抗レベルを回復しない限り、全体的なトレンドは依然として明確な弱気のままです。

EMA構造 (弱気の整列は維持されています

20 EMA:$87.41

50 EMA:$101.75

100 EMA:$119.61

200 EMA:$139.42

SOLはすべての主要EMAの下で取引されており、クリーンな弱気スタック)20 < 50 < 100 < 200(を形成しています。

$87–)ゾーンは即時のダイナミック抵抗として機能し、下落圧力を強化しています。

価格が50 EMAを明確に回復しない限り、上昇は修正的な動きにとどまる可能性が高いです。

フィボナッチ&マーケット構造

1.0フィボナッチ $102 サイクル高値:$253.47

0.786フィボナッチ:$213.60

0.618フィボナッチ:$182.29

0.5フィボナッチ:$160.31

0.382フィボナッチ:$138.

サラナは、$253付近のサイクル高値からの長期下落トレンドにより、持続的な弱気圧力の下にあります。0.236フィボナッチレベルの($111)を失った後、価格は加速して下落し、最近はマクロベース付近の$67 (Fib 0)にタッチし、その後やや反発しています。

現在の構造は$85–$90の短期的な調整範囲内にありますが、主要な抵抗レベルを回復しない限り、全体的なトレンドは依然として明確な弱気のままです。

EMA構造 (弱気の整列は維持されています

20 EMA:$87.41

50 EMA:$101.75

100 EMA:$119.61

200 EMA:$139.42

SOLはすべての主要EMAの下で取引されており、クリーンな弱気スタック)20 < 50 < 100 < 200(を形成しています。

$87–)ゾーンは即時のダイナミック抵抗として機能し、下落圧力を強化しています。

価格が50 EMAを明確に回復しない限り、上昇は修正的な動きにとどまる可能性が高いです。

フィボナッチ&マーケット構造

1.0フィボナッチ $102 サイクル高値:$253.47

0.786フィボナッチ:$213.60

0.618フィボナッチ:$182.29

0.5フィボナッチ:$160.31

0.382フィボナッチ:$138.

SOL-1.88%

- 報酬

- 6

- 5

- 1

- 共有

HuanyuDigitalHuanyuDigitalIsA :

:

馬年に大儲け 🐴もっと見る

BTCのテクニカル見通し:0.236の下落後にマクロベースのすぐ上での統合

ビットコインは、$93K–$100K 抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、強い調整下落トレンドに留まっています。

0.382($85,246)を下回り、その後0.236($75,589)を失ったことで、加速した下落圧力が引き起こされました。

現在の価格は$65,000–$69,000の範囲で統合しており、マクロフィボナッチの0レベルである$59,980のすぐ上に浮いています。

これは重要な高時間軸のサポート領域です。

EMA構造 (弱気の整列)

20 EMA:$69,193

50 EMA:$76,140

100 EMA:$83,748

200 EMA:$91,312

BTCはすべての主要EMAの下で取引されており、短期、中期、長期の構造全体にわたって強い弱気の整列を確認しています。

$69K–$76K ゾーン(20 & 50 EMAクラスター)は、現在即時の動的抵抗として機能しています。

より広範な構造的抵抗は$83K–$91Kの間に残っています。

これらのレベルへの上昇は、強い勢いと持続的な日次クローズで取り戻されない限り、修正的な動きとなる可能性が高いです。

フィボナッチ&価格構造

0.786 Fib:$111,968

0.618 Fib:$100,856

0.5 Fib

ビットコインは、$93K–$100K 抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、強い調整下落トレンドに留まっています。

0.382($85,246)を下回り、その後0.236($75,589)を失ったことで、加速した下落圧力が引き起こされました。

現在の価格は$65,000–$69,000の範囲で統合しており、マクロフィボナッチの0レベルである$59,980のすぐ上に浮いています。

これは重要な高時間軸のサポート領域です。

EMA構造 (弱気の整列)

20 EMA:$69,193

50 EMA:$76,140

100 EMA:$83,748

200 EMA:$91,312

BTCはすべての主要EMAの下で取引されており、短期、中期、長期の構造全体にわたって強い弱気の整列を確認しています。

$69K–$76K ゾーン(20 & 50 EMAクラスター)は、現在即時の動的抵抗として機能しています。

より広範な構造的抵抗は$83K–$91Kの間に残っています。

これらのレベルへの上昇は、強い勢いと持続的な日次クローズで取り戻されない限り、修正的な動きとなる可能性が高いです。

フィボナッチ&価格構造

0.786 Fib:$111,968

0.618 Fib:$100,856

0.5 Fib

BTC-1.14%

- 報酬

- 4

- 2

- リポスト

- 共有

Ryakpanda :

:

2026年ラッシュ 👊もっと見る

XRP テクニカル見通し:下降チャネル内のマクロベース上での統合

XRPは、$2.39–$2.69の抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、より広範な修正下落トレンドに留まっています。

0.382($2.09)を維持できず、その後0.236($1.719)を下回る明確な下落が起き、強い下落継続を引き起こしました。

現在の価格は$1.34–$1.46の範囲で統合しており、マクロフィボナッチの0レベル($1.119)のすぐ上に位置しています。

これは重要な高時間軸のサポート領域です。

EMA構造 (弱気の整列)

20EMA:$1.460

50EMA:$1.635

100EMA:$1.851

200EMA:$2.081

XRPはすべての主要EMAの下で取引されており、時間軸全体で弱気の整列を確認しています。

$1.46–$1.63のゾーン(20 & 50EMAクラスター)は、現在即時のダイナミック抵抗として機能しています。

より広範な構造的抵抗は$1.85–$2.08の間に残っています。

これらのレベルへの上昇は、強い出来高と持続的な日次クローズによる回復がなければ、修正的な動きと見なされる可能性が高いです。

フィボナッチ&価格構造

0.786フィブ:$3.117

0.618フィブ:$2.690

0.5フィブ:$2.390

0.382フィブ:$2.090

0.

XRPは、$2.39–$2.69の抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、より広範な修正下落トレンドに留まっています。

0.382($2.09)を維持できず、その後0.236($1.719)を下回る明確な下落が起き、強い下落継続を引き起こしました。

現在の価格は$1.34–$1.46の範囲で統合しており、マクロフィボナッチの0レベル($1.119)のすぐ上に位置しています。

これは重要な高時間軸のサポート領域です。

EMA構造 (弱気の整列)

20EMA:$1.460

50EMA:$1.635

100EMA:$1.851

200EMA:$2.081

XRPはすべての主要EMAの下で取引されており、時間軸全体で弱気の整列を確認しています。

$1.46–$1.63のゾーン(20 & 50EMAクラスター)は、現在即時のダイナミック抵抗として機能しています。

より広範な構造的抵抗は$1.85–$2.08の間に残っています。

これらのレベルへの上昇は、強い出来高と持続的な日次クローズによる回復がなければ、修正的な動きと見なされる可能性が高いです。

フィボナッチ&価格構造

0.786フィブ:$3.117

0.618フィブ:$2.690

0.5フィブ:$2.390

0.382フィブ:$2.090

0.

XRP-0.29%

- 報酬

- 5

- 9

- リポスト

- 共有

GateUser-f0a66e66 :

:

月へ 🌕もっと見る

ETH テクニカル見通し:大きな下落後にマクロベースのすぐ上で取引

イーサリアムは、$3,349–$3,728の抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、強い修正下落トレンドに留まっています。

0.382($2,970)を超えて維持できず、その後0.236($2,502)を下回る決定的な下落により、積極的な下落継続が引き起こされました。

価格は現在、$1,990–$2,080の範囲で調整中であり、マクロフィボナッチの0レベル($1,745)のすぐ上に位置しています。

これは主要な高時間枠のサポートゾーンです。

EMA構造 (強い弱気の整列)

20 EMA:$2,064

50 EMA:$2,392

100 EMA:$2,735

200 EMA:$3,005

ETHはすべての主要EMAの下で取引されており、短期、中期、長期の構造にわたる強い弱気の整列を確認しています。

$2,060–$2,390のゾーン(20 & 50 EMAクラスター)は、即時の動的抵抗として機能しています。

より広範な構造的抵抗は$2,735–$3,005の間に残っています。

これらのレベルへの上昇は、強い勢いと持続的な日次クローズで取り戻されない限り、修正的な動きと見なされる可能性が高いです。

フィボナッチ&価格構造

0.786 フィボナッチ:$4,267

0.618 フィボナッチ:$3

イーサリアムは、$3,349–$3,728の抵抗クラスター(0.5–0.618フィボナッチゾーン)からの反発後、強い修正下落トレンドに留まっています。

0.382($2,970)を超えて維持できず、その後0.236($2,502)を下回る決定的な下落により、積極的な下落継続が引き起こされました。

価格は現在、$1,990–$2,080の範囲で調整中であり、マクロフィボナッチの0レベル($1,745)のすぐ上に位置しています。

これは主要な高時間枠のサポートゾーンです。

EMA構造 (強い弱気の整列)

20 EMA:$2,064

50 EMA:$2,392

100 EMA:$2,735

200 EMA:$3,005

ETHはすべての主要EMAの下で取引されており、短期、中期、長期の構造にわたる強い弱気の整列を確認しています。

$2,060–$2,390のゾーン(20 & 50 EMAクラスター)は、即時の動的抵抗として機能しています。

より広範な構造的抵抗は$2,735–$3,005の間に残っています。

これらのレベルへの上昇は、強い勢いと持続的な日次クローズで取り戻されない限り、修正的な動きと見なされる可能性が高いです。

フィボナッチ&価格構造

0.786 フィボナッチ:$4,267

0.618 フィボナッチ:$3

ETH-0.58%

- 報酬

- 2

- コメント

- リポスト

- 共有