OliviaJane

Діаграма у венах, Мозок у крипті

OliviaJane

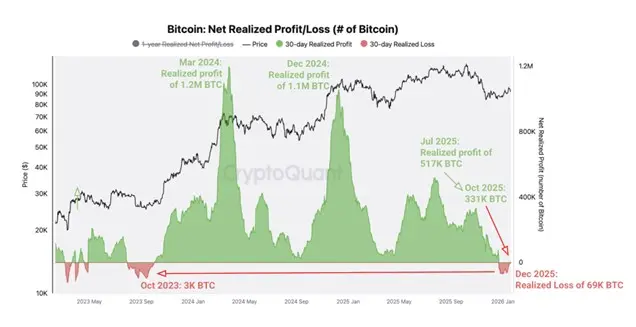

$BTC реалізовані прибутки швидко висихають.

Раніше піки показували понад 1М BTC у вигляді прибутків, що були заблоковані.

Зараз ми спостерігаємо реалізовані збитки.

Зазвичай це означає, що слабкі руки виходять, а довгострокові тримачі залишаються спокійними.

Поведінка наприкінці циклу, а не паніка.

#GoldandSilverHitNewHighs

#TrumpWithdrawsEUTariffThreats

Раніше піки показували понад 1М BTC у вигляді прибутків, що були заблоковані.

Зараз ми спостерігаємо реалізовані збитки.

Зазвичай це означає, що слабкі руки виходять, а довгострокові тримачі залишаються спокійними.

Поведінка наприкінці циклу, а не паніка.

#GoldandSilverHitNewHighs

#TrumpWithdrawsEUTariffThreats

BTC0,49%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$DOGE DOGE вже продемонстрував силу, прорвавшись вище за свій попередній діапазон, і тепер ціна повертається до знайомої зони підтримки.

Такий тип поведінки зазвичай сприяє продовженню руху, а не розвороту.

Поки DOGE залишається вище цієї зони, широка бичача структура залишається цілісною.

Такий тип поведінки зазвичай сприяє продовженню руху, а не розвороту.

Поки DOGE залишається вище цієї зони, широка бичача структура залишається цілісною.

DOGE1,35%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$ASTER бачив сильний зростання, піднявшись на 10% перед типовим відкатом у 5%.

Імпульс посилився після бичачих рухів MYX Finance та партнерства з Binance. Активність зросла, виведення з бірж перевищило $3.1М, а кількість власників зросла з 200К до 206К.

Технічно, ASTER прорвався з падаючого клина, і недавнє повторне тестування близько $0.67 здається завершеним. Дані на блокчейні показують подальші притоки, тоді як аналітики рекомендують підтримувати рівень підтримки вище за рівень прориву, що може підштовхнути токен понад $1, потенційний приріст у 120%.

Обережність рекомендується, оскільки н

Імпульс посилився після бичачих рухів MYX Finance та партнерства з Binance. Активність зросла, виведення з бірж перевищило $3.1М, а кількість власників зросла з 200К до 206К.

Технічно, ASTER прорвався з падаючого клина, і недавнє повторне тестування близько $0.67 здається завершеним. Дані на блокчейні показують подальші притоки, тоді як аналітики рекомендують підтримувати рівень підтримки вище за рівень прориву, що може підштовхнути токен понад $1, потенційний приріст у 120%.

Обережність рекомендується, оскільки н

ASTER6,14%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$POL Polygon тихо демонструє, чому він залишається одним із провідних рішень для масштабування Ethereum. Початок 2026 року став цікавим періодом для мережі, з рівнями активності, що свідчать про більше, ніж просто хайп. Користувачі не лише торгують для швидких перепродажів, вони фактично використовують платформу.

Кількість транзакцій зросла до 3,9 мільярдів у січні, переважно завдяки мікроплатежам, що склали 67,7 мільйонів доларів. Це чіткий знак того, що менші користувачі приймають Polygon для щоденних транзакцій. Коли малі платежі накопичуються, вони створюють великий ефект, і саме це ми бач

Кількість транзакцій зросла до 3,9 мільярдів у січні, переважно завдяки мікроплатежам, що склали 67,7 мільйонів доларів. Це чіткий знак того, що менші користувачі приймають Polygon для щоденних транзакцій. Коли малі платежі накопичуються, вони створюють великий ефект, і саме це ми бач

POL-0,05%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$XLM починає демонструвати чіткі зміни у структурі після тривалого руху вбік у вузькому консолідаційному діапазоні. Ціна наразі прорвалася вище важливого рівня $0.25 із помітною силою, що сигналізує про відновлений інтерес з боку покупців. Ця зона раніше виступала як сильна зона опору, і успішне повернення вказує на значущий перехід від опору до підтримки.

Цей рух відбувся після того, як XLM встановила вищі мінімуми від недавнього дна біля $0.20, що свідчить про покращення попиту та поступове змінення ринкового настрою. Поки ціна залишається вище за діапазон $0.24–$0.25, ширша структура підтри

Цей рух відбувся після того, як XLM встановила вищі мінімуми від недавнього дна біля $0.20, що свідчить про покращення попиту та поступове змінення ринкового настрою. Поки ціна залишається вище за діапазон $0.24–$0.25, ширша структура підтри

XLM-0,28%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$SOL знову піднімається після створення міцної бази.

Ціна поважала нижню зону, відновила ключові рівні і тепер демонструє чисту висхідну структуру. Покупці повертаються з контролем, без паніки.

Це більше схоже на повернення сили, ніж на випадковий відскок.

Я тримаю SOL у полі зору.

Ви вже зайняли позицію чи чекаєте на більш ясний рух?

Ціна поважала нижню зону, відновила ключові рівні і тепер демонструє чисту висхідну структуру. Покупці повертаються з контролем, без паніки.

Це більше схоже на повернення сили, ніж на випадковий відскок.

Я тримаю SOL у полі зору.

Ви вже зайняли позицію чи чекаєте на більш ясний рух?

SOL1,53%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Спостерігаючи за тим, як @blocksquare_io тихо готує сцену для 2026 року.

✓ Більше об'єктів нерухомості на Oceanpoint.

✓ Більше доступу.

✓ Більше реального DeFi для нерухомості.

Переглянути оригінал✓ Більше об'єктів нерухомості на Oceanpoint.

✓ Більше доступу.

✓ Більше реального DeFi для нерухомості.

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

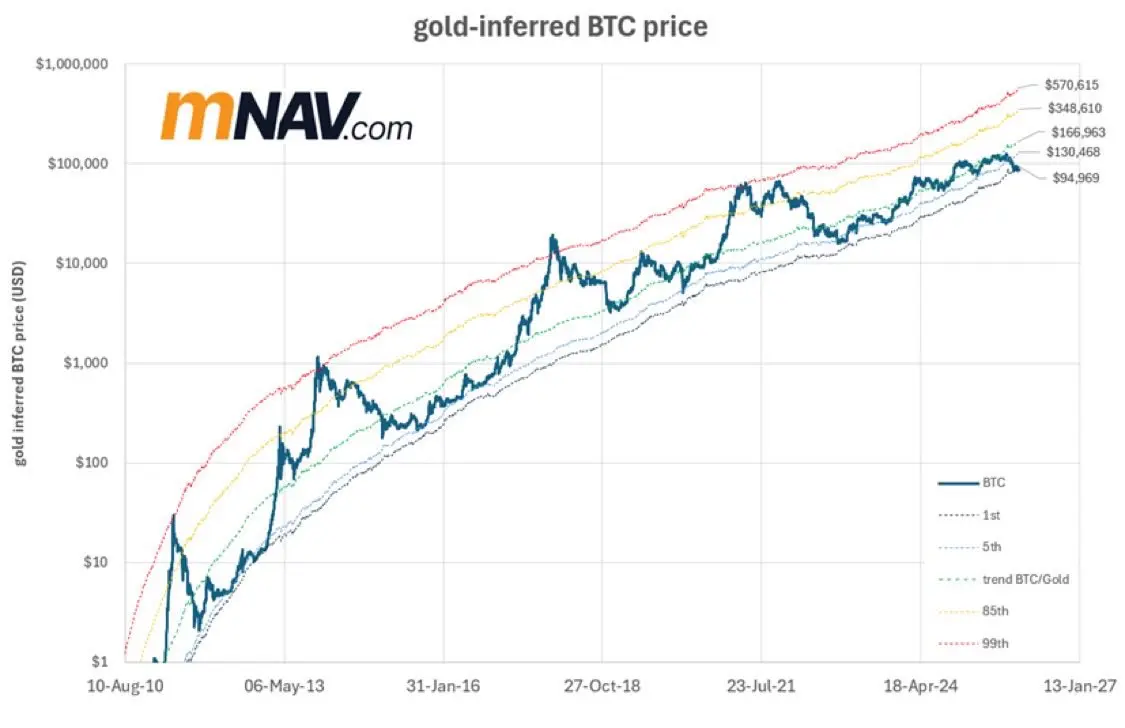

Глобальна ліквідність друкує нові історичні максимуми.

Зазвичай це паливо для ризикових активів.

Біткоїн ще не відреагував, але рідко залишається відключеним надовго.

Ліквідність веде. Ціна слідує.

Питання не в тому, чи… а коли.

Зазвичай це паливо для ризикових активів.

Біткоїн ще не відреагував, але рідко залишається відключеним надовго.

Ліквідність веде. Ціна слідує.

Питання не в тому, чи… а коли.

BTC0,49%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

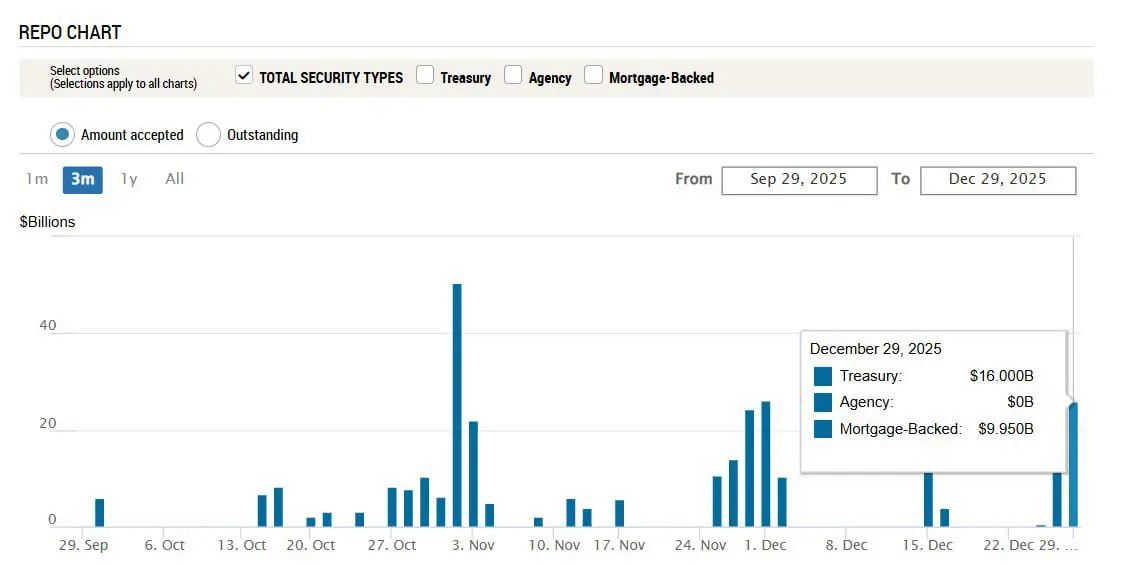

Федеральна резервна система щойно додала до економіки $25.95 млрд.

Це хороші новини для ринків. Ціни можуть підвищитися.

Переглянути оригіналЦе хороші новини для ринків. Ціни можуть підвищитися.

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

BitMine щойно зробила ставку ще на $780M вартістю $ETH , підвищивши загальну кількість Ethereum, що поставлені на стейкінг, понад $1 МІЛЬЯРДИ за всього 48 годин.

Зараз заблоковано 342 560 ETH.

Подібні кроки не відбуваються тихо.

Великі гравці явно орієнтуються на довгострокову перспективу, зменшуючи ліквідний запас і демонструючи сильну впевненість у майбутньому Ethereum.

Варто стежити.

Зараз заблоковано 342 560 ETH.

Подібні кроки не відбуваються тихо.

Великі гравці явно орієнтуються на довгострокову перспективу, зменшуючи ліквідний запас і демонструючи сильну впевненість у майбутньому Ethereum.

Варто стежити.

ETH2,15%

- Нагородити

- 1

- 1

- Репост

- Поділіться

Noaa_Grace :

:

Великий капітал, що блокують ETH, говорить голосніше за наративи. Довгострокова впевненість явно зростає.Словенія щойно увійшла в історію у сфері нерухомості. 🇸🇮

З @blocksquare_io вони завершили створення свого першого повністю нотаріалізованого токена нерухомості. Кожен токен юридично пов’язаний з іпотеками та земельним кадастром → права на нерухомість в блокчейні.

Маленька країна, великий крок для реальних активів. $BST

З @blocksquare_io вони завершили створення свого першого повністю нотаріалізованого токена нерухомості. Кожен токен юридично пов’язаний з іпотеками та земельним кадастром → права на нерухомість в блокчейні.

Маленька країна, великий крок для реальних активів. $BST

BST4,43%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

$NIGHT продовжує дотримуватися своєї структури вищої-нижчої після різкого розширення знизу. Відкат був контрольованим, а не агресивним, що свідчить про те, що продавці втрачають тиск, а не домінують.

Ціна зараз рухається вгору повільно, а не стрімко, і це зазвичай більш здорово для стабільності. Це поведінка в межах діапазону вище колишньої підтримки натякає, що ринок комфортно приймає вищі ціни.

Якщо покупці залишаться активними і захищатимуть цю зону, NIGHT може налаштовуватися на ще один підйом. Терпіння тут ключове — повільна сила часто триває довше, ніж швидкий ажіотаж.

Ціна зараз рухається вгору повільно, а не стрімко, і це зазвичай більш здорово для стабільності. Це поведінка в межах діапазону вище колишньої підтримки натякає, що ринок комфортно приймає вищі ціни.

Якщо покупці залишаться активними і захищатимуть цю зону, NIGHT може налаштовуватися на ще один підйом. Терпіння тут ключове — повільна сила часто триває довше, ніж швидкий ажіотаж.

NIGHT-2,18%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

$ZEC демонструє сильний зсув у структурі після тривалого періоду коливань. Ціна чітко прорвала попередній рівень опору та розширилася з переконанням, що зазвичай сигналізує про реальний попит, а не випадковий сплеск.

Що виділяється, так це те, наскільки швидко покупці втрутилися після консолідації. Такий рух часто відображає накопичення, яке нарешті розв’язується в бік зростання. Поки ціна тримається вище недавньої зони прориву, імпульс залишається на боці продовження.

Якщо ZEC зможе підтримувати ці вищі рівні, ринок може почати сприймати попередній рівень опору як нову підтримку. Це той тип

Що виділяється, так це те, наскільки швидко покупці втрутилися після консолідації. Такий рух часто відображає накопичення, яке нарешті розв’язується в бік зростання. Поки ціна тримається вище недавньої зони прориву, імпульс залишається на боці продовження.

Якщо ZEC зможе підтримувати ці вищі рівні, ринок може почати сприймати попередній рівень опору як нову підтримку. Це той тип

ZEC5,52%

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

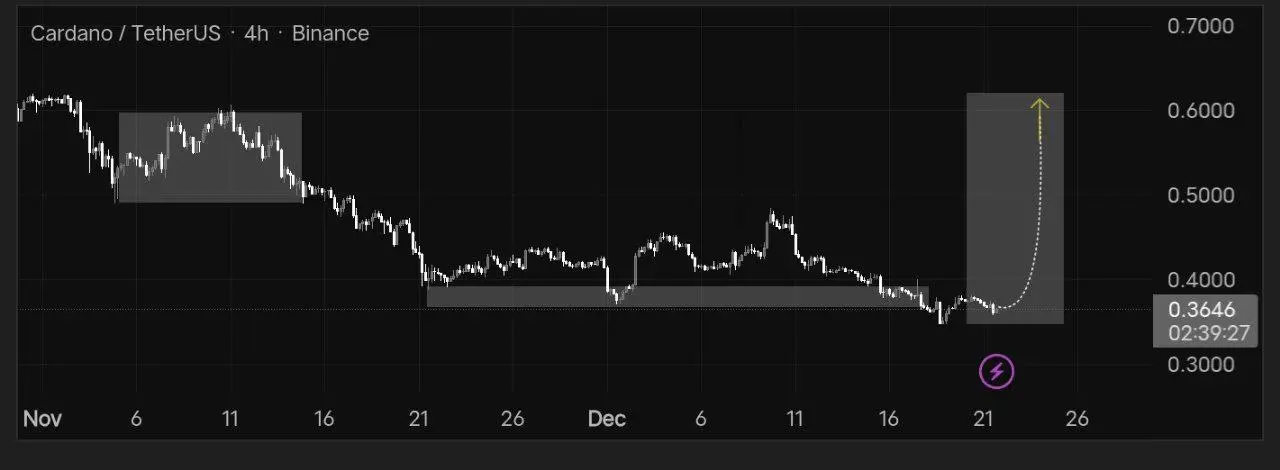

$ADA намагається відновитися після тривалої низхідної тенденції, і недавнє відскоку показує, що покупці нарешті реагують на нижчих рівнях. Реакція від підтримки була різкою, що свідчить про те, що попит все ще присутній.

Однак структура залишається крихкою, поки ADA не зможе повернутися до ключових зон опору. Цей рух більше схожий на полегшення, ніж на підтверджену зміну тренду наразі.

Якщо ціна зможе побудувати базу замість того, щоб знову знизитися, ADA може почати формувати структуру вищої низької точки. Це сигнал, за яким багато хто буде стежити, перш ніж довіра повністю відновиться.

Однак структура залишається крихкою, поки ADA не зможе повернутися до ключових зон опору. Цей рух більше схожий на полегшення, ніж на підтверджену зміну тренду наразі.

Якщо ціна зможе побудувати базу замість того, щоб знову знизитися, ADA може почати формувати структуру вищої низької точки. Це сигнал, за яким багато хто буде стежити, перш ніж довіра повністю відновиться.

ADA0,78%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

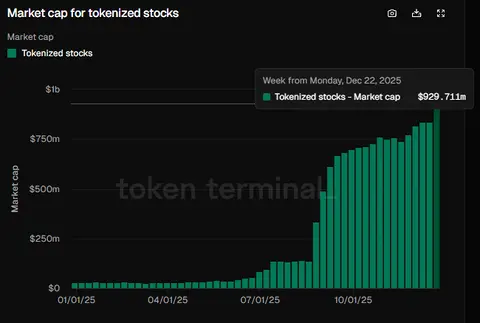

Щойно: Токенізовані акції досягають нового історичного максимуму, наближаючись до $1B ринкової капіталізації.

Зростання на 2 695% з початку року, це чіткий знак того, що традиційні цінні папери швидше переходять в блокчейн, ніж багато очікували.

#2025GateYearEndSummary #CryptoMarketMildlyRebounds

Переглянути оригіналЗростання на 2 695% з початку року, це чіткий знак того, що традиційні цінні папери швидше переходять в блокчейн, ніж багато очікували.

#2025GateYearEndSummary #CryptoMarketMildlyRebounds

- Нагородити

- 1

- 1

- Репост

- Поділіться

GateUser-68291371 :

:

Держіть міцно 💪- Нагородити

- 3

- 3

- Репост

- Поділіться

HighAmbition :

:

Різдвяний бичий ринок! 🐂Дізнатися більше

- Нагородити

- 1

- 3

- Репост

- Поділіться

HighAmbition :

:

Різдвяний бичий ринок! 🐂Дізнатися більше

Чарльз Хоскінсон пояснює: NIGHT ≠ заміна ADA.

Токен Night підтримує мережу конфіденційності Cardano під назвою Midnight, але його мета — розширити екосистему ADA, а не конкурувати з нею. Продаж ADA за NIGHT ігнорує більшу картину, ADA залишається ядром мережі Cardano.

$ADA $NIGHT #Cardano

Переглянути оригіналТокен Night підтримує мережу конфіденційності Cardano під назвою Midnight, але його мета — розширити екосистему ADA, а не конкурувати з нею. Продаж ADA за NIGHT ігнорує більшу картину, ADA залишається ядром мережі Cardano.

$ADA $NIGHT #Cardano

- Нагородити

- 1

- 3

- Репост

- Поділіться

HighAmbition :

:

Різдвяний бичий ринок! 🐂Дізнатися більше

$BNB BNB будує бичачу структуру після прориву вгору з попереднього низхідного тренду та утримується міцно вище підтримки. З моменту прориву ціна консолідується в здоровому діапазоні, що свідчить про сильний попит та покращення настроїв.

Покупці, здається, комфортно захищають поточні рівні, що часто передує продовженню вгору. Ця цінова поведінка свідчить про накопичення, а не про розподіл.

Якщо BNB зберігає цю структуру, рух у бік регіону $900–$930 стає все більш імовірним. Поза цим, стійка сила може дозволити BNB знову увійти в більш широкий прорив вгору.

В цілому, ринкова структура залишаєть

Покупці, здається, комфортно захищають поточні рівні, що часто передує продовженню вгору. Ця цінова поведінка свідчить про накопичення, а не про розподіл.

Якщо BNB зберігає цю структуру, рух у бік регіону $900–$930 стає все більш імовірним. Поза цим, стійка сила може дозволити BNB знову увійти в більш широкий прорив вгору.

В цілому, ринкова структура залишаєть

BNB1,32%

- Нагородити

- 2

- 3

- Репост

- Поділіться

HighAmbition :

:

Різдвяний бичий ринок! 🐂Дізнатися більше

$ADA витратив тижні на зниження, повільно опускаючись у чітко визначену зону попиту, яка трималася кілька разів у минулому.

Нещодавня реакція вказує на те, що тиск продажу зменшується, а не посилюється. Якщо покупці продовжать захищати цю зону, ADA може почати формувати базу перед спробою відновлення до вищих рівнів опору.

Обсяг торгівлі та ширше ринкове сприйняття будуть ключовими для підтвердження будь-якого подальшого зростання.

#ADA #Cardano

Нещодавня реакція вказує на те, що тиск продажу зменшується, а не посилюється. Якщо покупці продовжать захищати цю зону, ADA може почати формувати базу перед спробою відновлення до вищих рівнів опору.

Обсяг торгівлі та ширше ринкове сприйняття будуть ключовими для підтвердження будь-якого подальшого зростання.

#ADA #Cardano

ADA0,78%

- Нагородити

- 1

- 2

- Репост

- Поділіться

HighAmbition :

:

З Різдвом Христовим ⛄Дізнатися більше

Популярні теми

Дізнатися більше60.89K Популярність

21.66K Популярність

16.69K Популярність

7.48K Популярність

6.12K Популярність

Популярні активності Gate Fun

Дізнатися більше- Рин. кап.:$3.47KХолдери:20.09%

- Рин. кап.:$3.61KХолдери:20.80%

- Рин. кап.:$3.44KХолдери:20.00%

- Рин. кап.:$3.42KХолдери:10.00%

- Рин. кап.:$3.44KХолдери:20.00%

Закріпити