Akonuche_m

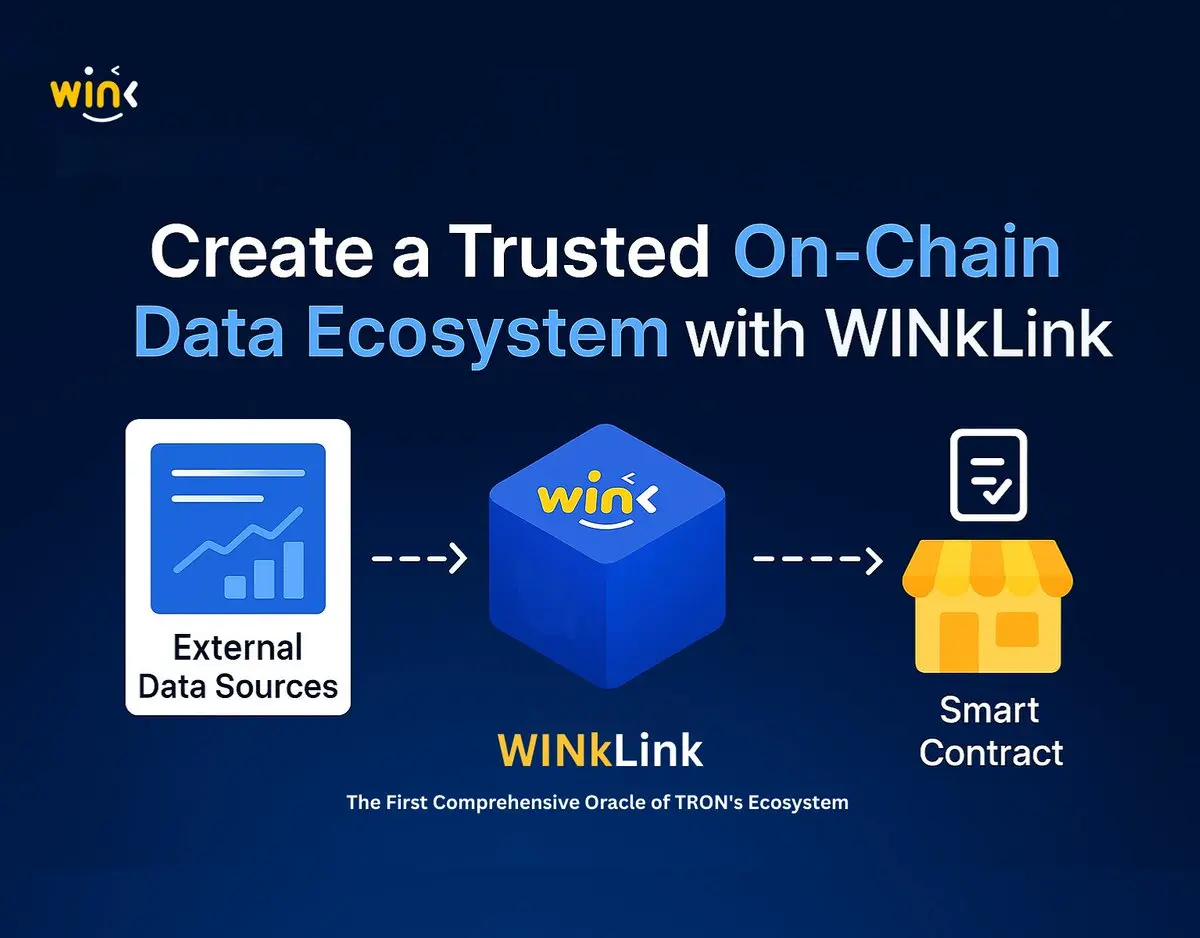

🌟 WINkLink: Первый комплексный оракул TRON

В экосистеме TRON данные движут всем. Умные контракты, DeFi-приложения, игры и рынки все зависят от точной и своевременной информации. Вот где появляется WINkLink, первый комплексный оракул, разработанный для TRON.

Это больше, чем просто ценовые данные. Это мост между данными из реального мира и действиями в цепочке. Разработчики могут получать рыночные цены, данные о погоде, спортивные результаты или любую внешнюю информацию, все проверено, надежно и готово для их dApps.

Для разработчиков это означает создание более умных и динамичных приложений без

Посмотреть ОригиналВ экосистеме TRON данные движут всем. Умные контракты, DeFi-приложения, игры и рынки все зависят от точной и своевременной информации. Вот где появляется WINkLink, первый комплексный оракул, разработанный для TRON.

Это больше, чем просто ценовые данные. Это мост между данными из реального мира и действиями в цепочке. Разработчики могут получать рыночные цены, данные о погоде, спортивные результаты или любую внешнюю информацию, все проверено, надежно и готово для их dApps.

Для разработчиков это означает создание более умных и динамичных приложений без