# RiskManagement

10.23K

SheenCrypto

#CryptoSurvivalGuide 🧭📊

Криптовалютный рынок — выживание здесь не только в прибыли — это проверка мышления, контроля риска и дисциплины. Бычиные ралли все наслаждаются… но настоящие трейдеры строятся в медвежьих рынках.

Если вы хотите выжить в долгосрочной перспективе, это Руководство по выживанию в крипте для вас обязательно. 👇

🛡️ 1️⃣ Управление рисками В первую очередь никогда не вкладывайте весь капитал в одну сделку.

Золотое правило:

• риск 1–5% на сделку

• обязательный стоп-лосс

• избегайте эмоциональной мести за убытки

📉 2️⃣ Не каждый спад — это возможность для покупки Различайте в

Посмотреть ОригиналКриптовалютный рынок — выживание здесь не только в прибыли — это проверка мышления, контроля риска и дисциплины. Бычиные ралли все наслаждаются… но настоящие трейдеры строятся в медвежьих рынках.

Если вы хотите выжить в долгосрочной перспективе, это Руководство по выживанию в крипте для вас обязательно. 👇

🛡️ 1️⃣ Управление рисками В первую очередь никогда не вкладывайте весь капитал в одну сделку.

Золотое правило:

• риск 1–5% на сделку

• обязательный стоп-лосс

• избегайте эмоциональной мести за убытки

📉 2️⃣ Не каждый спад — это возможность для покупки Различайте в

- Награда

- 4

- 7

- Репост

- Поделиться

MoonGirl :

:

GOGOGO 2026 👊Подробнее

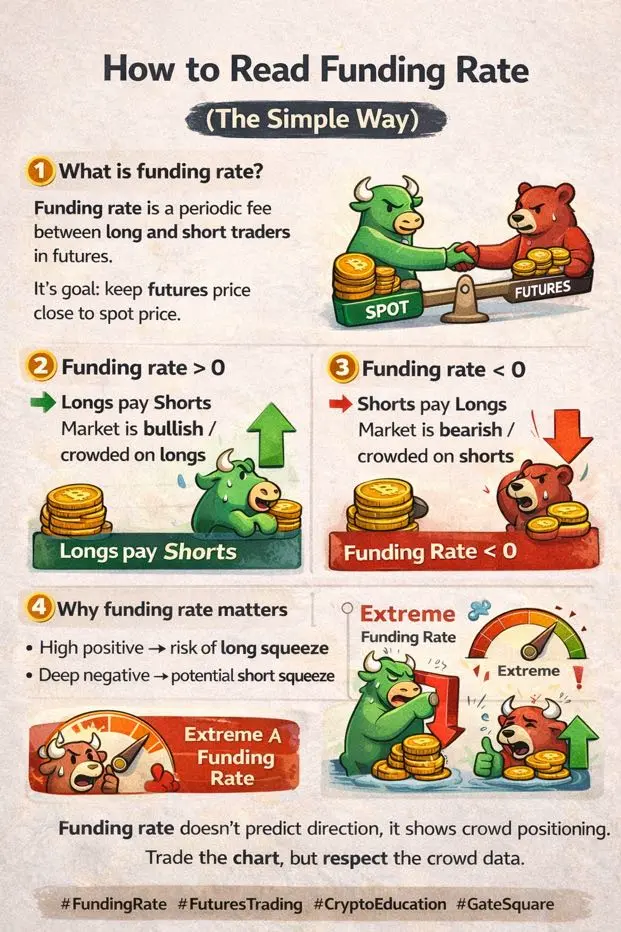

Как читать ставку финансирования (Простым способом)

1️⃣ Что такое ставка финансирования?

Ставка финансирования — это периодическая плата между трейдерами, открывающими длинные и короткие позиции, на фьючерсах.

Её цель: держать цену фьючерса близкой к спотовой цене.

2️⃣ Ставка финансирования > 0

👉 Длинные платят коротким

👉 Рынок бычий / переполнен длинными позициями

3️⃣ Ставка финансирования < 0

👉 Короткие платят длинным

👉 Рынок медвежий / переполнен короткими позициями

4️⃣ Почему ставка финансирования важна

• Высокая положительная → риск сжатия длинных

• Глубоко отрицательная → возможное

Посмотреть Оригинал1️⃣ Что такое ставка финансирования?

Ставка финансирования — это периодическая плата между трейдерами, открывающими длинные и короткие позиции, на фьючерсах.

Её цель: держать цену фьючерса близкой к спотовой цене.

2️⃣ Ставка финансирования > 0

👉 Длинные платят коротким

👉 Рынок бычий / переполнен длинными позициями

3️⃣ Ставка финансирования < 0

👉 Короткие платят длинным

👉 Рынок медвежий / переполнен короткими позициями

4️⃣ Почему ставка финансирования важна

• Высокая положительная → риск сжатия длинных

• Глубоко отрицательная → возможное

- Награда

- 2

- комментарий

- Репост

- Поделиться

Я был ликвидирован на сумму 2000 долларов прошлой ночью, потому что не установил стоп-лосс. 🤕

Рынок волатилен, и волатильность "отчета по рабочим местам" застала меня врасплох. Не будь как я. Используйте инструменты управления рисками Gate.io.

Мое новое правило: никогда не рискуйте более 1% портфеля в одной сделке.

CTA: Какой самый дорогой урок вы усвоили в криптовалюте? Поделитесь, чтобы спасти новичка! 🛡️

#TradingTips #RiskManagement #CryptoLessons #GateIO ⚠️

$GT

Рынок волатилен, и волатильность "отчета по рабочим местам" застала меня врасплох. Не будь как я. Используйте инструменты управления рисками Gate.io.

Мое новое правило: никогда не рискуйте более 1% портфеля в одной сделке.

CTA: Какой самый дорогой урок вы усвоили в криптовалюте? Поделитесь, чтобы спасти новичка! 🛡️

#TradingTips #RiskManagement #CryptoLessons #GateIO ⚠️

$GT

GT1,74%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

#КупитьПадениеИлиПодождатьСейчас?

Рынки снова находятся на критическом этапе принятия решений, заставляя инвесторов выбирать между покупкой на дне или ожиданием более ясных подтверждений. Недавние откаты цен на криптовалюты и традиционные рынки привлекли оппортунистических покупателей, которые рассматривают эти падения как здоровые коррекции в рамках более широкого долгосрочного восходящего тренда. Исторически, дисциплинированная покупка на дне во времена страха вознаграждала терпеливых инвесторов, особенно при поддержке сильных фундаментальных показателей, данных on-chain и улучшающихся макро

Посмотреть ОригиналРынки снова находятся на критическом этапе принятия решений, заставляя инвесторов выбирать между покупкой на дне или ожиданием более ясных подтверждений. Недавние откаты цен на криптовалюты и традиционные рынки привлекли оппортунистических покупателей, которые рассматривают эти падения как здоровые коррекции в рамках более широкого долгосрочного восходящего тренда. Исторически, дисциплинированная покупка на дне во времена страха вознаграждала терпеливых инвесторов, особенно при поддержке сильных фундаментальных показателей, данных on-chain и улучшающихся макро

- Награда

- лайк

- комментарий

- Репост

- Поделиться

#КупитьПадениеИлиПодождатьСейчас?

Рынки снова находятся на критическом этапе принятия решений, заставляя инвесторов выбирать между покупкой на дне или ожиданием более ясных подтверждений. Недавние откаты цен на криптовалюты и традиционные рынки привлекли оппортунистических покупателей, которые рассматривают эти падения как здоровые коррекции в рамках более широкого долгосрочного восходящего тренда. Исторически, дисциплинированная покупка на дне во времена страха вознаграждала терпеливых инвесторов, особенно при поддержке сильных фундаментальных показателей, данных on-chain и улучшающихся макро

Посмотреть ОригиналРынки снова находятся на критическом этапе принятия решений, заставляя инвесторов выбирать между покупкой на дне или ожиданием более ясных подтверждений. Недавние откаты цен на криптовалюты и традиционные рынки привлекли оппортунистических покупателей, которые рассматривают эти падения как здоровые коррекции в рамках более широкого долгосрочного восходящего тренда. Исторически, дисциплинированная покупка на дне во времена страха вознаграждала терпеливых инвесторов, особенно при поддержке сильных фундаментальных показателей, данных on-chain и улучшающихся макро

- Награда

- 4

- 7

- Репост

- Поделиться

CryptoEye :

:

Купить, чтобы заработать 💎Подробнее

#BuyTheDipOrWaitNow?

Рынок снова испытывает терпение.

Цены падают… страх растет… и все начинают спрашивать — «Это дно?»

Но вот правда:

Не каждый спад — это скидка. Некоторые падения — это предупреждения.

Настоящая возможность показывает признаки: ✔️ Цена реагирует в ключевой зоне поддержки

✔️ Продавцы теряют импульс

✔️ Объем увеличивается на бычьих свечах

✔️ Структура начинает меняться

Если график все еще показывает более низкие минимумы при сильном продавательском давлении, слепая покупка — это не уверенность, а надежда. А надежда — не стратегия торговли.

Профессиональные трейдеры не гоняются

Посмотреть ОригиналРынок снова испытывает терпение.

Цены падают… страх растет… и все начинают спрашивать — «Это дно?»

Но вот правда:

Не каждый спад — это скидка. Некоторые падения — это предупреждения.

Настоящая возможность показывает признаки: ✔️ Цена реагирует в ключевой зоне поддержки

✔️ Продавцы теряют импульс

✔️ Объем увеличивается на бычьих свечах

✔️ Структура начинает меняться

Если график все еще показывает более низкие минимумы при сильном продавательском давлении, слепая покупка — это не уверенность, а надежда. А надежда — не стратегия торговли.

Профессиональные трейдеры не гоняются

- Награда

- 6

- 8

- Репост

- Поделиться

Ryakpanda :

:

Пик 2026 года 👊Подробнее

🚀 ПРИВЫЧКИ КРИПТО-ТРЕЙДЕРА | GATE.IO

Большинство трейдеров терпят неудачу не потому, что не умеют читать графики…

Они терпят неудачу, потому что им не хватает последовательных привычек.

🔹 1️⃣ ПЛАНИРУЙТЕ КАЖДУЮ СДЕЛКУ

✏️ Устанавливайте вход / выход / стоп-лосс перед торговлей

⚡ Избегайте погонь за интуицией

📅 Ежедневно пересматривайте свой план

🔹 2️⃣ КОНТРОЛИРУЙТЕ РИСК

💵 Макс 1% на сделку

🎯 Контролируйте кредитное плечо

🛡️ Оставайтесь спокойными во время рыночных колебаний

🔹 3️⃣ ПРОДОЛЖАЙТЕ УЧИТЬСЯ

📚 Отслеживайте свои победы и поражения

🔍 Ежедневно изучайте графики, новости, анализ

🧪

Посмотреть ОригиналБольшинство трейдеров терпят неудачу не потому, что не умеют читать графики…

Они терпят неудачу, потому что им не хватает последовательных привычек.

🔹 1️⃣ ПЛАНИРУЙТЕ КАЖДУЮ СДЕЛКУ

✏️ Устанавливайте вход / выход / стоп-лосс перед торговлей

⚡ Избегайте погонь за интуицией

📅 Ежедневно пересматривайте свой план

🔹 2️⃣ КОНТРОЛИРУЙТЕ РИСК

💵 Макс 1% на сделку

🎯 Контролируйте кредитное плечо

🛡️ Оставайтесь спокойными во время рыночных колебаний

🔹 3️⃣ ПРОДОЛЖАЙТЕ УЧИТЬСЯ

📚 Отслеживайте свои победы и поражения

🔍 Ежедневно изучайте графики, новости, анализ

🧪

- Награда

- лайк

- комментарий

- Репост

- Поделиться

#YiLihuaExitsPositions

На сегодняшний день решение И Лихуа выйти из позиций сигнализирует о осторожном сдвиге среди некоторых участников рынка, подчеркивая, как быстро может измениться настроение даже после периодов стабильности. Масштабные выходы часто отражают переоценку рисков, и в данном случае это может указывать на то, что некоторые инвесторы ставят приоритет на сохранение капитала, а не на погоню за краткосрочной прибылью.

Что выделяется, так это время. Выходы из позиций часто происходят в периоды неопределенности, будь то вызванные макроэкономическими сигналами, техническими уровнями

Посмотреть ОригиналНа сегодняшний день решение И Лихуа выйти из позиций сигнализирует о осторожном сдвиге среди некоторых участников рынка, подчеркивая, как быстро может измениться настроение даже после периодов стабильности. Масштабные выходы часто отражают переоценку рисков, и в данном случае это может указывать на то, что некоторые инвесторы ставят приоритет на сохранение капитала, а не на погоню за краткосрочной прибылью.

Что выделяется, так это время. Выходы из позиций часто происходят в периоды неопределенности, будь то вызванные макроэкономическими сигналами, техническими уровнями

- Награда

- 2

- 2

- Репост

- Поделиться

HighAmbition :

:

Внимательно следим 🔍️Подробнее

#CryptoMarketPullback | Официальный канал Dragon Fly

Криптовалютный рынок только что пережил резкую волну дезлевериджа. Падение BTC ниже $76K вызвало синхронную распродажу ETH, SOL и крупных альткоинов. Когда волатильность растет так быстро, настоящая игра уже не в погоне за быстрыми прибылью — а в **защите капитала и умном позиционировании для следующего шага**.

Сейчас структура выглядит как классический сброс ликвидности. Принудительные ликвидации очистили перегретое кредитное плечо, и исторически такие фазы часто создают **сильные зоны реакции**, а не мгновенные развороты тренда. Ключевой

Посмотреть ОригиналКриптовалютный рынок только что пережил резкую волну дезлевериджа. Падение BTC ниже $76K вызвало синхронную распродажу ETH, SOL и крупных альткоинов. Когда волатильность растет так быстро, настоящая игра уже не в погоне за быстрыми прибылью — а в **защите капитала и умном позиционировании для следующего шага**.

Сейчас структура выглядит как классический сброс ликвидности. Принудительные ликвидации очистили перегретое кредитное плечо, и исторически такие фазы часто создают **сильные зоны реакции**, а не мгновенные развороты тренда. Ключевой

- Награда

- 11

- 9

- Репост

- Поделиться

Vortex_King :

:

Купить, чтобы заработать 💎Подробнее

#CryptoSurvivalGuide

Криптовалютный рынок сейчас не просто волатилен — он избирательно жесток. Эта фаза предназначена для выбивания нетерпеливых, чрезмерно заимствованных и слабых по убеждению участников. Понимание, где мы находимся, важнее, чем предсказание следующего движения на 5%.

1️⃣ Структура рынка: Распределение, а не капитуляция (Еще)

Несмотря на резкие откаты, мы не наблюдаем классические сигналы паники:

Ставки финансирования охлаждаются, а не рушатся

Открытый интерес уменьшается в упорядоченной манере

Нет экстремального всплеска объема, который обычно свидетельствует о полном капиту

Криптовалютный рынок сейчас не просто волатилен — он избирательно жесток. Эта фаза предназначена для выбивания нетерпеливых, чрезмерно заимствованных и слабых по убеждению участников. Понимание, где мы находимся, важнее, чем предсказание следующего движения на 5%.

1️⃣ Структура рынка: Распределение, а не капитуляция (Еще)

Несмотря на резкие откаты, мы не наблюдаем классические сигналы паники:

Ставки финансирования охлаждаются, а не рушатся

Открытый интерес уменьшается в упорядоченной манере

Нет экстремального всплеска объема, который обычно свидетельствует о полном капиту

BTC0,35%

- Награда

- 1

- комментарий

- Репост

- Поделиться

Загрузить больше

Присоединяйтесь к 40M пользователям в нашем растущем сообществе

⚡️ Присоединяйтесь к 40M пользователям в обсуждении криптовалют

💬 Общайтесь с любимыми авторами

👍 Посмотрите, что вас интересует

Популярные темы

4.24K Популярность

2.14K Популярность

803 Популярность

31.61K Популярность

246.38K Популярность

131.61K Популярность

201 Популярность

569 Популярность

177 Популярность

96 Популярность

119.84K Популярность

23.91K Популярность

20.74K Популярность

14.21K Популярность

1.58K Популярность

Новости

ПодробнееНекотая китовая снова открыла длинную позицию по ETH, текущий объем составляет 9366 ETH

2 м

Мицубиси Банк: Банк Японии в этом году может повысить ставку до 3 раз

3 м

Центральный банк ОАЭ и Управление по финансовому регулированию Гонконга углубляют финансовое сотрудничество и взаимосвязь рынков

5 м

QCP Capital:Этот медвежий рынок больше похож на перезагрузку ликвидности, а не на структурный крах

11 м

ZK(ZKsync)24 часа вырос на 7.23%

15 м

Закрепить