# Cryptoanalysis

18.09K

AngelEye

#BitcoinUpdate 🚀

O Bitcoin está a comprimir-se em prazos mais longos — e o gráfico de 3 dias está a começar a contar uma história. A ação do preço está a formar uma potencial base de reversão, do tipo que normalmente se forma antes de o momentum regressar, não depois.

Isto não é volatilidade aleatória. É a estrutura a fazer o seu trabalho.

🔹 Referência principal de baixa: $80.600

Um fecho sustentado abaixo deste nível enfraqueceria a configuração e obrigaria a uma reavaliação. A estrutura vem sempre em primeiro lugar.

🔹 Cenário alternativo:

Uma varredura breve na área $78K seguida de uma r

O Bitcoin está a comprimir-se em prazos mais longos — e o gráfico de 3 dias está a começar a contar uma história. A ação do preço está a formar uma potencial base de reversão, do tipo que normalmente se forma antes de o momentum regressar, não depois.

Isto não é volatilidade aleatória. É a estrutura a fazer o seu trabalho.

🔹 Referência principal de baixa: $80.600

Um fecho sustentado abaixo deste nível enfraqueceria a configuração e obrigaria a uma reavaliação. A estrutura vem sempre em primeiro lugar.

🔹 Cenário alternativo:

Uma varredura breve na área $78K seguida de uma r

BTC1,57%

- Recompensa

- 8

- 7

- Republicar

- Partilhar

EagleEye :

:

"Post verdadeiramente inspirador! Obrigado por partilhar as suas opiniões connosco."Ver mais

📊 Peter Brandt’s Crypto Market Insight – 30 de janeiro de 2026

O renomado trader Peter Brandt, famoso por prever a queda do Bitcoin em 2018, partilhou hoje uma nova análise de gráfico:

ETH mostra uma formação de triângulo simétrico.

A capitalização total do mercado de criptomoedas está formando um padrão de ângulo direito em expansão.

⚡ Conclusão principal: Os touros precisam de uma quebra clara para dominar, enquanto a história sugere que esses padrões podem desencadear volatilidade ou pressão de baixa.

💡 Previsão do Bitcoin de Brandt:

“O Bitcoin vai estabilizar-se e recuperar entre agosto

Ver originalO renomado trader Peter Brandt, famoso por prever a queda do Bitcoin em 2018, partilhou hoje uma nova análise de gráfico:

ETH mostra uma formação de triângulo simétrico.

A capitalização total do mercado de criptomoedas está formando um padrão de ângulo direito em expansão.

⚡ Conclusão principal: Os touros precisam de uma quebra clara para dominar, enquanto a história sugere que esses padrões podem desencadear volatilidade ou pressão de baixa.

💡 Previsão do Bitcoin de Brandt:

“O Bitcoin vai estabilizar-se e recuperar entre agosto

- Recompensa

- 18

- 22

- Republicar

- Partilhar

EagleEye :

:

Obrigado por partilhar esta informaçãoVer mais

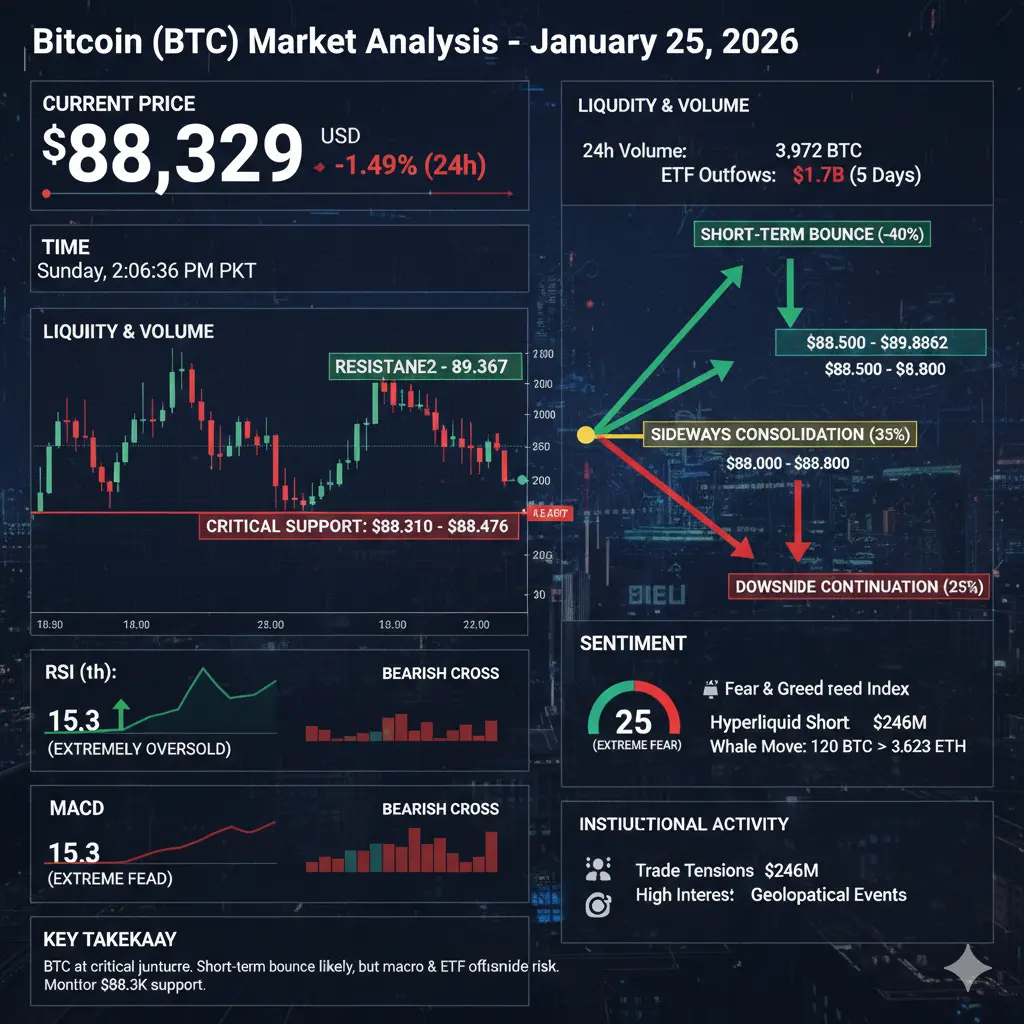

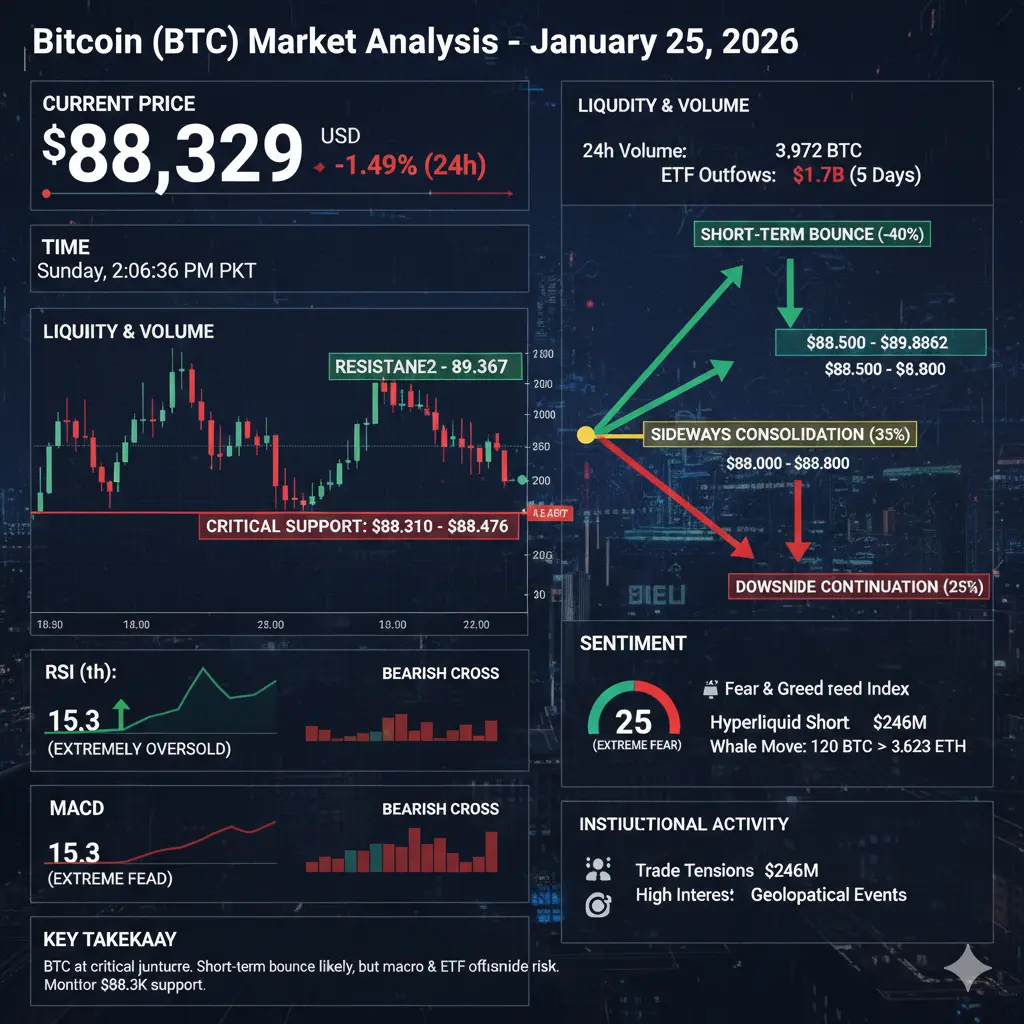

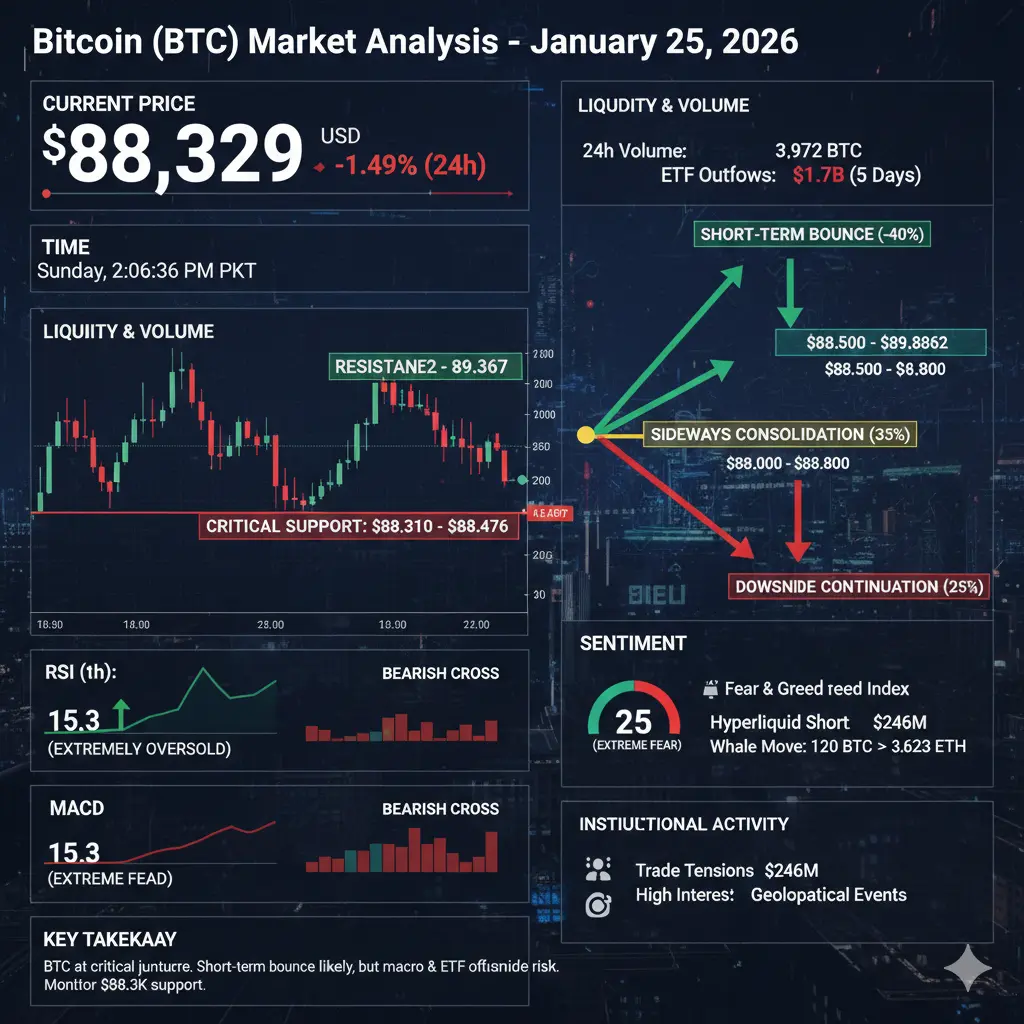

🚨 #BTCMarketAnalysis – Atualização do Bitcoin

Preço Atual: $88.329 (↓1,49% 24h)

Variação nas 24h: $88.128 – $89.673 (~1,75% de volatilidade)

Suporte / Resistência: $88.310–$88.476 | $88.862–$89.367

🔹 Destaques Principais:

Medo Extremo: Índice de Medo & Ganância 25 → venda de pânico visível

Venda com Alto Volume: volume de 24h de 3.972 BTC ($354M), saídas de ETF de $1,7B em 5 dias

Sobrevendido Técnico: RSI (1h) 15,3, Bandas de Bollinger abaixo da banda inferior → possível rebound de curto prazo

Ajuste de Liquidez: spreads de compra e venda ampliados, shorts institucionais em aumento

📊 Perspe

Preço Atual: $88.329 (↓1,49% 24h)

Variação nas 24h: $88.128 – $89.673 (~1,75% de volatilidade)

Suporte / Resistência: $88.310–$88.476 | $88.862–$89.367

🔹 Destaques Principais:

Medo Extremo: Índice de Medo & Ganância 25 → venda de pânico visível

Venda com Alto Volume: volume de 24h de 3.972 BTC ($354M), saídas de ETF de $1,7B em 5 dias

Sobrevendido Técnico: RSI (1h) 15,3, Bandas de Bollinger abaixo da banda inferior → possível rebound de curto prazo

Ajuste de Liquidez: spreads de compra e venda ampliados, shorts institucionais em aumento

📊 Perspe

BTC1,57%

- Recompensa

- 2

- 1

- Republicar

- Partilhar

Karik254 :

:

GOGOGO 2026 👊🚨 #BTCMarketAnalysis – Atualização do Bitcoin

Preço Atual: $88.329 (↓1,49% 24h)

Variação nas 24h: $88.128 – $89.673 (~1,75% de volatilidade)

Suporte / Resistência: $88.310–$88.476 | $88.862–$89.367

🔹 Destaques Principais:

Medo Extremo: Índice de Medo & Ganância 25 → venda de pânico visível

Venda com Alto Volume: volume de 24h de 3.972 BTC ($354M), saídas de ETF de $1,7B em 5 dias

Sobrevendido Técnico: RSI (1h) 15,3, Bandas de Bollinger abaixo da banda inferior → possível rebound de curto prazo

Ajuste de Liquidez: spreads de compra e venda ampliados, shorts institucionais em aumento

📊 Perspe

Preço Atual: $88.329 (↓1,49% 24h)

Variação nas 24h: $88.128 – $89.673 (~1,75% de volatilidade)

Suporte / Resistência: $88.310–$88.476 | $88.862–$89.367

🔹 Destaques Principais:

Medo Extremo: Índice de Medo & Ganância 25 → venda de pânico visível

Venda com Alto Volume: volume de 24h de 3.972 BTC ($354M), saídas de ETF de $1,7B em 5 dias

Sobrevendido Técnico: RSI (1h) 15,3, Bandas de Bollinger abaixo da banda inferior → possível rebound de curto prazo

Ajuste de Liquidez: spreads de compra e venda ampliados, shorts institucionais em aumento

📊 Perspe

BTC1,57%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

🚀 $CYBER Análise Spot: Identificação do Piso de Reversão para um Movimento de Longo Prazo

Contexto de Mercado:

À medida que avançamos para o segundo trimestre de 2026, a narrativa da camada social descentralizada está a ganhar novamente tração۔ CyberConnect ($CYBER), um líder no espaço social Web3, está atualmente a exibir um padrão clássico de "Bottoming Out" após uma fase de correção prolongada۔

A Zona de Reversão:

Indicadores técnicos sugerem que $CYBER está a entrar numa "Zona de Reversão" de alta probabilidade entre $0.60 e $0.82۔

• Base de Apoio: Este intervalo tem atuado como um pi

Contexto de Mercado:

À medida que avançamos para o segundo trimestre de 2026, a narrativa da camada social descentralizada está a ganhar novamente tração۔ CyberConnect ($CYBER), um líder no espaço social Web3, está atualmente a exibir um padrão clássico de "Bottoming Out" após uma fase de correção prolongada۔

A Zona de Reversão:

Indicadores técnicos sugerem que $CYBER está a entrar numa "Zona de Reversão" de alta probabilidade entre $0.60 e $0.82۔

• Base de Apoio: Este intervalo tem atuado como um pi

CYBER-2,74%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Perspectiva Técnica do ETH | Recuperação Estruturada Dentro de uma Correção Mais Ampla

Ethereum ($ETH) está a mostrar sinais de estabilização após um movimento corretivo profundo que seguiu uma forte rejeição na zona de oferta macro de $4.450–$4.950 (0.786–1 Fib). Essa rejeição confirmou um topo de distribuição e empurrou o preço para a zona de procura macro de $2.620, onde os compradores intervieram de forma decisiva.

A partir desta procura de longo prazo, o ETH está agora a tentar uma recuperação arredondada e estruturada, formando mínimos mais altos — mais consistente com acumulação inicial

Ethereum ($ETH) está a mostrar sinais de estabilização após um movimento corretivo profundo que seguiu uma forte rejeição na zona de oferta macro de $4.450–$4.950 (0.786–1 Fib). Essa rejeição confirmou um topo de distribuição e empurrou o preço para a zona de procura macro de $2.620, onde os compradores intervieram de forma decisiva.

A partir desta procura de longo prazo, o ETH está agora a tentar uma recuperação arredondada e estruturada, formando mínimos mais altos — mais consistente com acumulação inicial

ETH-1,3%

- Recompensa

- 1

- 2

- Republicar

- Partilhar

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats – O que isto Significa para os Mercados e Cripto no Futuro

Numa evolução que surpreendeu muitos investidores, o ex-Presidente Trump retirou oficialmente as tarifas planeadas sobre várias nações europeias, que estavam previstas para entrar em vigor a 1 de fevereiro. Esta decisão surge após meses de incerteza em torno do comércio global, que tem vindo a criar volatilidade nos mercados de ações, commodities e ativos sensíveis ao risco, incluindo criptomoedas.

Implicações Imediatas no Mercado:

A retirada das tarifas da UE proporciona um

Numa evolução que surpreendeu muitos investidores, o ex-Presidente Trump retirou oficialmente as tarifas planeadas sobre várias nações europeias, que estavam previstas para entrar em vigor a 1 de fevereiro. Esta decisão surge após meses de incerteza em torno do comércio global, que tem vindo a criar volatilidade nos mercados de ações, commodities e ativos sensíveis ao risco, incluindo criptomoedas.

Implicações Imediatas no Mercado:

A retirada das tarifas da UE proporciona um

BTC1,57%

- Recompensa

- 4

- 3

- Republicar

- Partilhar

MrFlower_ :

:

GOGOGO 2026 👊Ver mais

🔒 #PrivacyCoinsDiverge — Uma Mudança Clara no Mercado de Privacidade

Nas últimas semanas, o setor das moedas de privacidade tem mostrado uma divergência acentuada. Enquanto os projetos líderes continuam a aumentar a adoção e a força da rede, as moedas de privacidade menores estão a perder volume, liquidez e relevância.

🔹 Visão Geral do Mercado

Monero (XMR):

• Base de utilizadores forte e leal

• Tecnologia de privacidade testada em combate (RingCT, Kovri)

• Atualizações recentes melhoraram a segurança e o anonimato

• Integrações contínuas e suporte de trocas

Zcash (ZEC):

• Privacidade comprov

Ver originalNas últimas semanas, o setor das moedas de privacidade tem mostrado uma divergência acentuada. Enquanto os projetos líderes continuam a aumentar a adoção e a força da rede, as moedas de privacidade menores estão a perder volume, liquidez e relevância.

🔹 Visão Geral do Mercado

Monero (XMR):

• Base de utilizadores forte e leal

• Tecnologia de privacidade testada em combate (RingCT, Kovri)

• Atualizações recentes melhoraram a segurança e o anonimato

• Integrações contínuas e suporte de trocas

Zcash (ZEC):

• Privacidade comprov

- Recompensa

- 1

- 1

- Republicar

- Partilhar

Stuart_Crown :

:

Vibrações otimistas 🔥🔥🔥#CryptoMarketWatch

Uma Análise Sólida dos Preços de Criptomoedas, Psicologia de Mercado e a Minha Visão Atual

O mercado de criptomoedas encontra-se atualmente numa fase em que a clareza é limitada, mas a estrutura ainda existe. O Bitcoin está a negociar perto de $91.600, enquanto o Ethereum oscila em torno de $3.170. Estes preços refletem pressão, mas não sinalizam pânico. A capitalização total do mercado de criptomoedas permanece próxima de $3,10 trilhões, e o domínio do Bitcoin em cerca de 59% indica que o capital está a consolidar-se em ativos mais fortes, em vez de sair do mercado.

Psicolo

Ver originalUma Análise Sólida dos Preços de Criptomoedas, Psicologia de Mercado e a Minha Visão Atual

O mercado de criptomoedas encontra-se atualmente numa fase em que a clareza é limitada, mas a estrutura ainda existe. O Bitcoin está a negociar perto de $91.600, enquanto o Ethereum oscila em torno de $3.170. Estes preços refletem pressão, mas não sinalizam pânico. A capitalização total do mercado de criptomoedas permanece próxima de $3,10 trilhões, e o domínio do Bitcoin em cerca de 59% indica que o capital está a consolidar-se em ativos mais fortes, em vez de sair do mercado.

Psicolo

- Recompensa

- 4

- 4

- Republicar

- Partilhar

ybaser :

:

GOGOGO 2026 👊Ver mais

$BNB /Gráfico USDT mostra níveis-chave de suporte e resistência. O suporte está em $864.5, onde o preço recentemente rebotou após uma queda acentuada. A resistência está em $959.3, marcada pela máxima anterior. Atualmente, o preço está em torno de $880.5. Uma quebra acima de $911.0 pode indicar um movimento em direção à resistência em $940.3. Por outro lado, uma queda abaixo de $864.5 pode sugerir uma continuação da tendência de baixa. Fique atento a esses níveis para possíveis movimentos de preço! #CryptoAnalysis

BNB0,99%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Carregar mais

Junte-se a 40M utilizadores na nossa comunidade em crescimento

⚡️ Junte-se a 40M utilizadores na discussão sobre a tendência das criptomoedas

💬 Interaja com os seus criadores favoritos

👍 Descubra o que lhe interessa

Tópicos em destaque

29.74K Popularidade

41.39K Popularidade

359.04K Popularidade

36.5K Popularidade

57.84K Popularidade

8.64K Popularidade

21.7K Popularidade

12.95K Popularidade

86.56K Popularidade

32.84K Popularidade

27.18K Popularidade

27.96K Popularidade

12.67K Popularidade

18.75K Popularidade

190.68K Popularidade

Notícias

Ver maisHuatai Macroeconomics: Wosh may impulsionar a combinação de políticas de "redução de juros + redução de ativos"

7 m

Santiment: A contínua extrema de medo no mercado de criptomoedas é um sinal de "forte alta"

9 m

O nomeado para presidente do Federal Reserve, Waller, foi implicado no caso Epstein, envolvendo-se em controvérsias relacionadas ao escândalo de Jeffrey Epstein.

52 m

「百胜战神」40x short em 136.15 BTC, preço médio de entrada de 83.469,3 dólares

55 m

Jupiter lança o mercado de empréstimos P2P sem necessidade de licença, chamado Jupiter Offerbook, permitindo que os utilizadores acedam a uma plataforma descentralizada para empréstimos peer-to-peer, facilitando transações mais rápidas e acessíveis.

1 h

Fixar