2025 年 BCH 价格预测:全方位解读比特币现金的潜在增长动力与市场发展趋势

深入解析 Bitcoin Cash(BCH)在 2025 年的投资价值与价格预测,全面阐述其增长潜力、市场动态以及可行的投资策略。基于 BCH 在数字支付领域的关键地位及历史表现,本报告将呈现专业且权威的分析。引言:BCH 的市场地位与投资价值

Bitcoin Cash(BCH)作为比特币的重要分叉币,自 2017 年诞生以来已经取得了诸多行业里程碑。截至 2025 年,BCH 市值已达 116.4 亿美元,流通供应量约为 1992 万枚,价格约为 584.45 美元。作为被称为“点对点电子现金系统”的代表性数字资产,BCH 在数字支付与去中心化金融(DeFi)领域中的作用日益凸显。

本文将从历史价格走势、市场供需关系、生态系统发展及宏观经济因素等角度,系统分析 BCH 2025–2030 年的价格变动趋势,旨在为投资者提供权威的价格预测及实用的投资策略建议。

一、BCH 价格历史回顾与当前市场状况

BCH 历史价格走势

- 2017 年:BCH 由比特币硬分叉诞生,初始价格为 555.89 美元

- 2017 年:12 月 20 日创下历史新高 3785.82 美元

- 2018 年:市场进入下行周期,12 月 16 日跌至历史低点 76.93 美元

BCH 当前市场状况

截至 2025 年 9 月 9 日,Bitcoin Cash(BCH)报价为 584.45 美元,在加密市场市值中位列第 20,当前市值 116.4 亿美元。BCH 近 24 小时下跌 2.17%,成交量为 385 万美元。当前价格较去年同期上涨 91.42%,呈现出强劲回升。尽管如此,价格仍明显低于历史高点,后市仍有进一步上行空间。流通量为 19,922,974 枚,占最大供应量 2100 万的 94.87%,流通高度成熟。

查看最新 BCH 市场价格

BCH 市场情绪指标

2025 年 9 月 9 日恐惧与贪婪指数为 48(中性)

查看 BCH 恐惧与贪婪指数详情

BCH 加密市场整体情绪处于中性区间,恐惧与贪婪指数为 48,表明投资者情绪未现极端。建议交易者持续关注行情变化,谨慎决策并做好充分调研。Gate.com 提供丰富的数据工具,助力投资者高效应对市场波动。

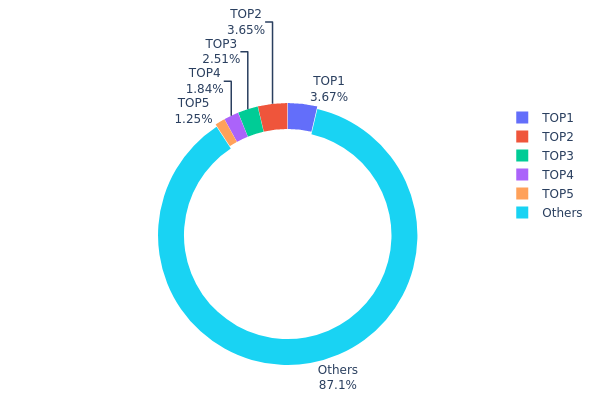

BCH 持仓分布情况

地址持仓分布反映了 Bitcoin Cash(BCH)在各地址间的资产集中度。数据显示,前 5 个地址共持有约 12.88% 的 BCH 总供应量,单个地址持仓比例介于 1.24% 至 3.66% 之间,最大地址持有 730,940 枚 BCH,占比 3.66%。

整体来看,主力持仓占比适中,未出现明显集中风险。其余 87.12% 的 BCH 分布于“其他”,去中心化特征明显,有助于市场稳定,降低大户操纵风险。但需关注头部地址的协调操作可能带来的影响。

当前地址分布情况表明 BCH 生态结构均衡,大额持有者与广泛散户共同构成网络基础,有助于增强系统韧性,符合去中心化理念。建议持续关注持仓结构变化,以便及时评估长期稳定性和潜在风险。

查看 BCH 持仓分布详情

| 排名 | 地址 | 持仓数量 | 占比 (%) |

|---|---|---|---|

| 1 | qrmfke...wse7ve | 730,940 | 3.66% |

| 2 | qre24q...28z85p | 726,230 | 3.64% |

| 3 | qrwcmu...e0z839 | 500,550 | 2.51% |

| 4 | qqwj7g...yyk82r | 365,990 | 1.83% |

| 5 | qpz8uc...mwzsl9 | 248,950 | 1.24% |

| - | 其他 | 17,350,190 | 87.12% |

二、影响 BCH 未来价格的核心因素

供应机制

- 减半:BCH 遵循与比特币相同的减半周期,下次减半预计将于 2024 年到来。

- 历史规律:以往减半通常因供应减少推动价格上涨。

- 当下影响:2024 年减半有望因供给减少进一步刺激 BCH 价格上行。

机构及大户行为

- 企业采纳:部分公司已支持 BCH 支付,有望提升实际应用与市场需求。

- 政策影响:监管政策,特别是明确 BCH 非证券属性的规定,将极大影响其应用拓展与估值表现。

宏观经济环境

- 货币政策:各国央行,尤其美联储的政策变动,仍是加密市场关键变量。

- 抗通胀特性:BCH 具备一定抗通胀特性,受关注度持续上升。

- 地缘政治:国际局势与经济不确定性将推动加密资产避险需求。

技术进展与生态建设

- CashTokens:2023 年 5 月上线,赋予 BCH 代币发行能力。

- 智能合约:BCH 已实现智能合约,开发者可基于其链构建 DApp。

- 生态应用:新技术推动 DApp 增多,持续丰富 BCH 生态场景与实际用例。

三、BCH 2025-2030 价格预测

2025 年展望

- 保守预测:409.22 – 584.60 美元

- 中性预测:584.60 – 710.29 美元

- 乐观预测:710.29 – 835.98 美元(前提为市场复苏明显、应用加速扩展)

2027-2028 年展望

- 预计市场阶段:可能迈入新一轮牛市周期

- 价格区间预测:

- 2027 年:715.55 – 1042.21 美元

- 2028 年:591.49 – 1219.38 美元

- 主要催化剂:机构进场、技术创新及整体加密市场扩容

2029-2030 年长期展望

- 基础情景:862.39 – 1208.42 美元(对应稳中有进及主流应用稳步提升)

- 乐观情景:1208.42 – 1607.19 美元(对应大规模采纳及市场环境利好)

- 变革性情景:1607.19 美元以上(如 BCH 生态取得突破性进展及主流普及)

- 2030-12-31 预测高点:1607.19 美元(基于乐观发展假设)

| 年份 | 预测最高价 | 预测均价 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 835.98 | 584.6 | 409.22 | 0 |

| 2026 | 845.24 | 710.29 | 497.2 | 21 |

| 2027 | 1042.21 | 777.77 | 715.55 | 33 |

| 2028 | 1219.38 | 909.99 | 591.49 | 55 |

| 2029 | 1352.15 | 1064.68 | 862.39 | 82 |

| 2030 | 1607.19 | 1208.42 | 628.38 | 106 |

四、BCH 专业投资策略与风险管理

BCH 投资方法论

(1)长期持有策略

- 适用对象:保守型投资者,寻求加密货币稳健配置

- 操作建议:

- 采用定投方式,平滑市场波动

- 建议持有周期 3-5 年以上,以覆盖主流牛熊周期

- 建议将 BCH 资产存储于硬件钱包,以保障资金安全

(2)主动交易策略

- 推荐工具:

- 均线(Moving Average):分析趋势、把握反转时机

- 相对强弱指数(RSI):评估超买与超卖风险

- 波段操作要点:

- 密切关注支撑位和阻力位变化

- 科学设置止损线,有效控制风险敞口

BCH 风险管理框架

(1)资产配置建议

- 保守型投资人:1%-3% 加密货币占比

- 稳健型投资人:3%-5% 加密货币占比

- 激进型投资人:5%-10% 加密货币占比

(2)风险对冲策略

- 多元资产配置:投资多种加密货币分散市场风险

- 期权策略:通过购买认沽期权对冲下行风险

(3)安全存储措施

- 硬件钱包建议选择 Gate Web3 钱包

- 冷存储方案:长期持有建议启用纸钱包

- 安全要点:设置强密码、开启双重认证(2FA)、定期备份钱包信息

五、BCH 潜在风险与挑战

BCH 市场风险

- 高波动性:价格大幅波动,带来较高盈亏不确定性

- 同业竞争:其他加密货币或抢占 BCH 市场份额

- 流动性风险:流动性较低时,大额交易对价格影响显著

BCH 监管风险

- 监管不确定性:政策变化或导致潜在不利影响

- 税收政策调整:加密货币税收制度不断变化

- 反洗钱/实名制(AML/KYC)要求趋严,或影响市场采纳

BCH 技术风险

- 51% 攻击风险:理论上网络易受控制威胁

- 代码安全问题:潜在漏洞或致重大损失

- 扩展性瓶颈:未来大规模应用或对网络性能形成挑战

六、结论与行动建议

BCH 投资价值评估

BCH 主要应用于支付场景,具备长期成长空间,但短期内仍面临较高波动和激烈竞争。其网络规模和品牌影响力为其赋予一定的抗风险能力,但投资者需充分考虑价格的不确定性。

BCH 投资建议

✅ 新手投资者:建议采用小额定投策略,逐步积累经验并适度参与

✅ 熟练投资者:可建立核心持仓,结合市场周期主动管理

✅ 机构投资者:建议纳入加密资产多元化组合,注重风险隔离与动态调整

BCH 参与方式

- 现货交易:于 Gate.com 平台直接买卖 BCH

- 合约交易:通过 BCH 永续合约/期货产品提升资金使用效率

- 质押(Staking):参与 BCH 质押计划,在可用时获取被动收益

加密货币投资风险极高,本文内容不构成任何投资建议。请投资者结合自身风险偏好谨慎决策,并建议向专业金融顾问寻求咨询。请勿投入超出自身承受能力范围的资金。

常见问题解答

2025 年 BCH 预计价格区间是多少?

按照当前市场情况,2025 年 BCH 预计交易区间在 587.52–823.37 美元之间,均价约为 734 美元。

BCH 有机会涨至 1000 美元吗?

BCH 按照现有市场发展趋势和应用预期,有望在 2030 年突破 1000 美元大关,但达成该目标仍需多重行业及市场利好配合。

2030 年 BCH 价格预测是多少?

根据当前市场分析,2030 年 BCH 价格预测区间为 1572–2196 美元,显示出长期增值空间。

BCH 有未来吗?

BCH 具备较强技术扩展性及低手续费等优势,随着持续开发和应用普及,有望继续作为主流加密货币长期存在并发展。

分享

目录